Answered step by step

Verified Expert Solution

Question

1 Approved Answer

design services had the following unadjusted balances at december 31, 2018. salaries payable $0, and salaries expense, $800. the following transactions have taken place during

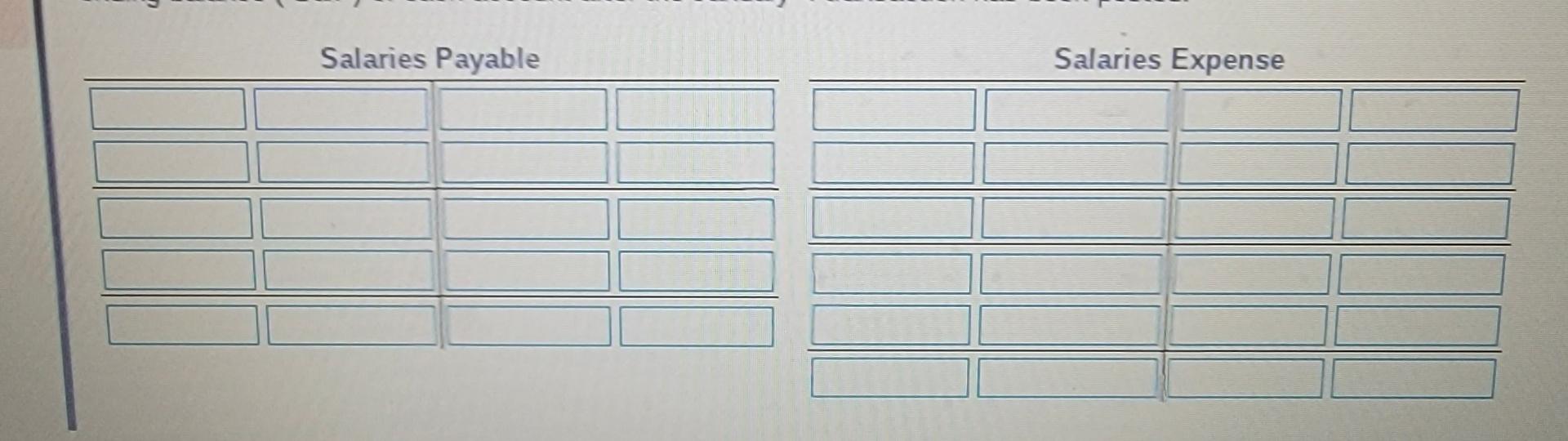

design services had the following unadjusted balances at december 31, 2018. salaries payable $0, and salaries expense, $800. the following transactions have taken place during the end of 2018 and beginning of 2019. journalize the entries assuming design services does not use reversing entries. do not record the reversing entry on Jan. 1. the t-accounts have been opened for you. enter the salaries payable and salaries expense unadjusted balances at december 31, 2018. post the journal entries to the accounts

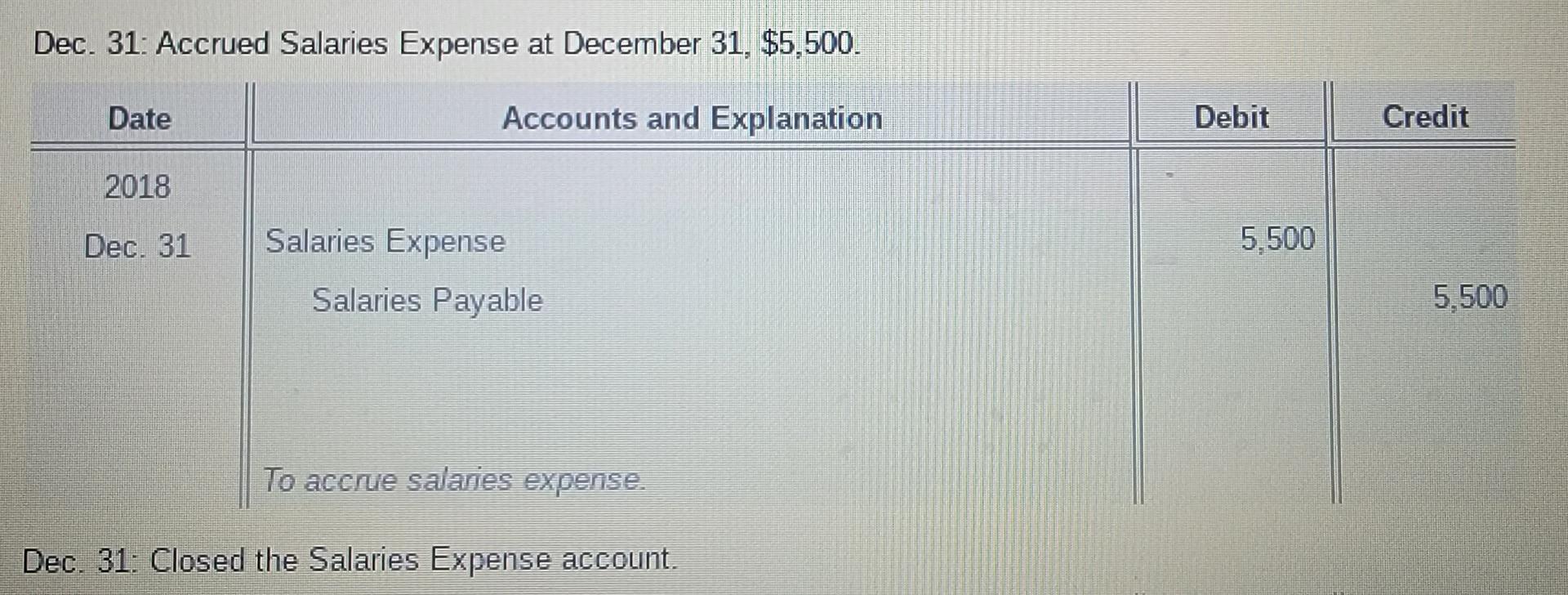

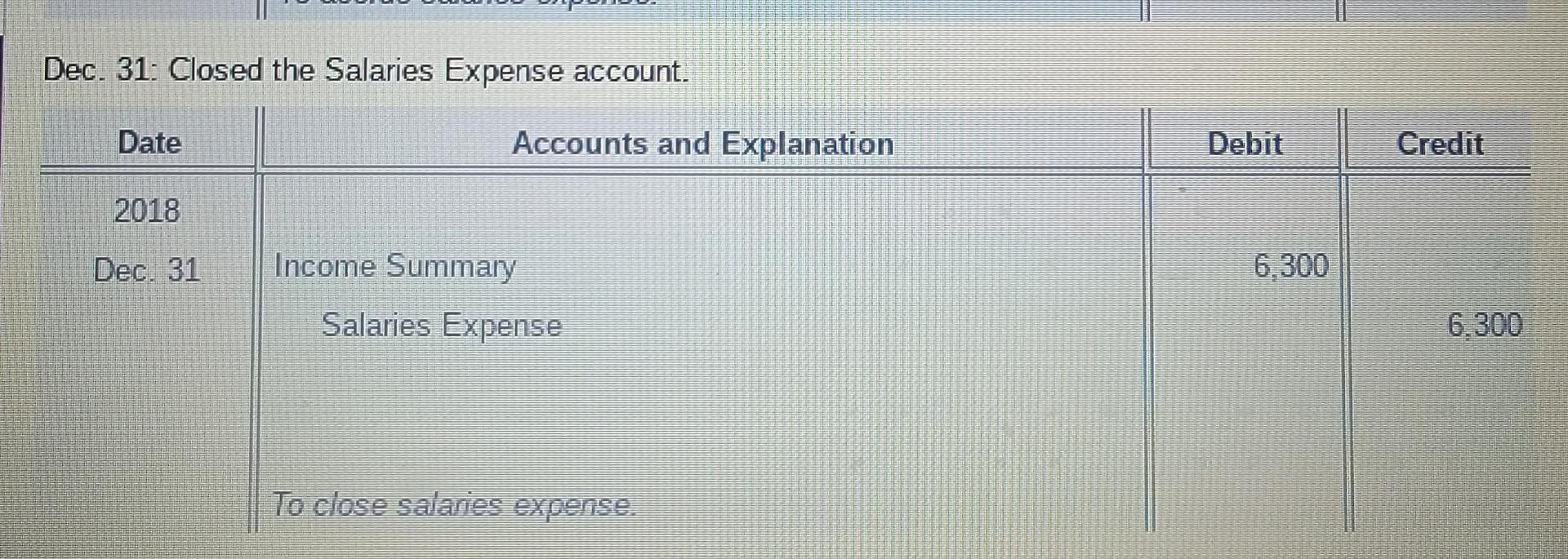

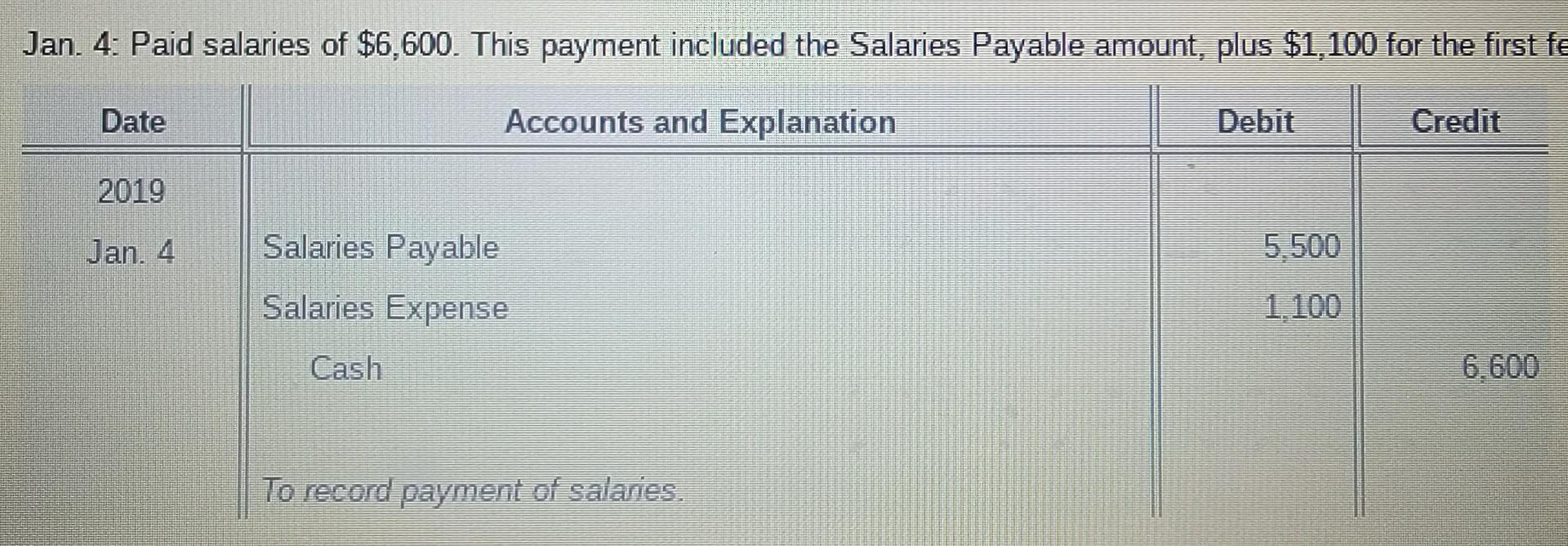

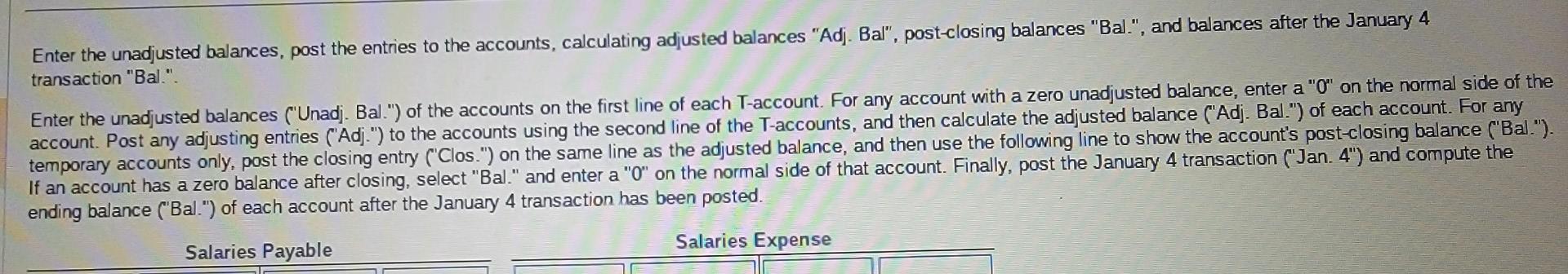

Dec. 31: Accrued Salaries Expense at December 31,$5,500. Dec. 31: Closed the Salaries Expense account. Jan. 4: Paid salaries of $6,600. This payment included the Salaries Payable amount, plus $1,100 for the first fs Enter the unadjusted balances, post the entries to the accounts, calculating adjusted balances "Adj. Bal", post-closing balances "Bal.", and balances after the January 4 transaction "Bal.". Enter the unadjusted balances ("Unadj. Bal.") of the accounts on the first line of each T-account. For any account with a zero unadjusted balance, enter a "0" on the normal side of the account. Post any adjusting entries ("Adj.") to the accounts using the second line of the T-accounts, and then calculate the adjusted balance ("Adj. Bal.") of each account. For any temporary accounts only, post the closing entry ("Clos.") on the same line as the adjusted balance, and then use the following line to show the account's post-closing balance ("Bal."). If an account has a zero balance after closing, select "Bal." and enter a "0" on the normal side of that account. Finally, post the January 4 transaction ("Jan. 4 ") and compute the endina balance ("Bal.") of each account after the January 4 transaction has been posted. Salaries Payable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started