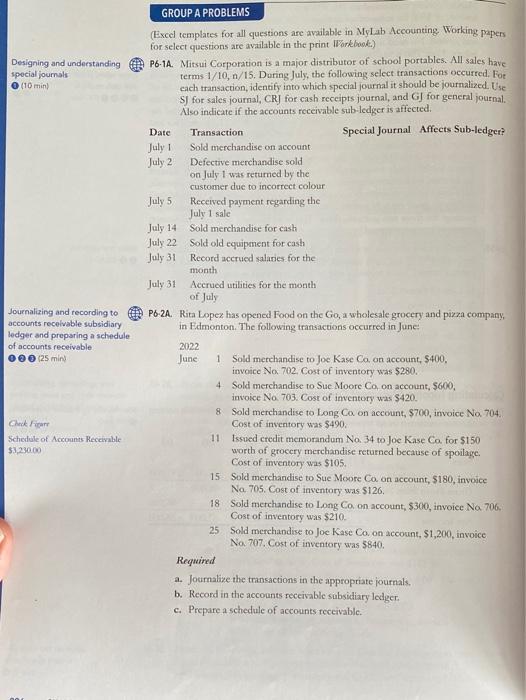

Designing and understanding special journals (10 min) GROUP A PROBLEMS (Excel templates for all questions are available in Mylab Accounting Working papers for select questions are available in the print Porkbook) PG-1A. Mitsui Corporation is a major distributor of school portables. All sales have terms 1/10,n/15. During July, the following select transactions occurred. For each transaction, identify into which special journal it should be journalized. Use SJ for sales journal, CRJ for cash receipts journal, and GJ for general journal. Also indicate if the accounts receivable sub-ledger is affected. Date Transaction Special Journal Affects Sub-ledgere July 1 Sold merchandise on account July 2 Defective merchandise sold on July 1 was returned by the customer due to incorrect colour July 5 Received payment regarding the July 1 sale July 14 Sold merchandise for cash July 22 Sold old equipment for cash July 31 Record accrued alates for the month July 31 Accrued utilities for the month of July Journalizing and recording to PG2A. Rita Lopez has opened Food on the Go, a wholesale grocery and pizza company, accounts receivable subsidiary in Edmonton. The following transactions occurred in June ledger and preparing a schedule of accounts receivable 2022 00 (25 min June 1 Sold merchandise to Joe Kase Co on account, $400, invoice No. 702. Cost of inventory was $280. 4 Sold merchandise to Sue Moore Co, on account, $600, invoice No 703. Cost of inventory was $420. 8 Sold merchandise to Long Ca on account, 8700, invoice No 704 Check Figure Cost of inventory was $490. Schedale of Accounts Receivable 11 Issued credit memorandum No. 34 to Joe Kase Co. for $150 $3.230.00 worth of grocery merchandise returned because of spoilage. Cost of inventory was $105. 15 Sold merchandise to Sue Moore Co. on account, $180, invoice No 705. Cost of inventory was $126. 18 Sold merchandise to Long Co on account, $300, invoice No 706, Cost of inventory was $210. 25 Sold merchandise to Joe Kase Co. on account, $1,200, invoice Na 707. Cost of inventory was 5840. Required a. Journalize the transactions in the appropriate journals. b. Record in the accounts receivable subsidiary ledger c. Prepare a schedule of accounts receivable