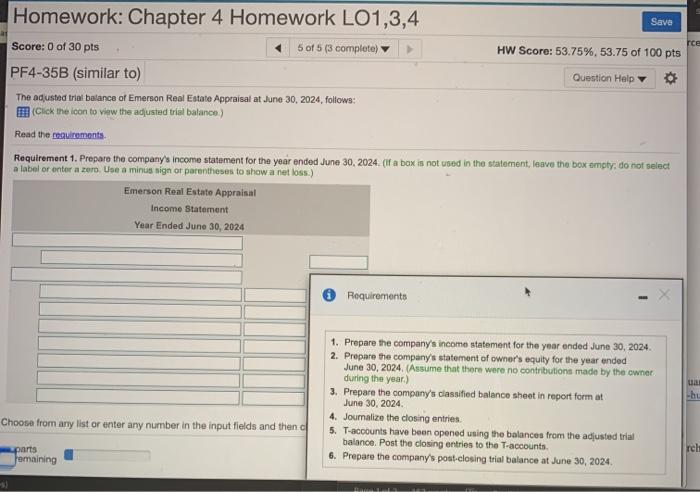

Save kce Homework: Chapter 4 Homework LO1,3,4 Score: 0 of 30 pts 5 of 5 (3 complete) HW Score: 53.75%, 53.75 of 100 pts PF4-35B (similar to) Question Help The adusted trial balance of Emerson Real Estate Appraisal at June 30, 2024, follows: Click the icon to view the adjusted trial balance) Read the requirements Requirement 1. Prepare the company's income statement for the year ended June 30, 2024. (If a box is not used in the statement, leave the box empty, do not select a label or enter a zero. Use a minus nign or parentheses to show a net loss.) Emerson Real Estate Appraisal Income Statement Year Ended June 30, 2024 Requirements 1. Prepare the company's income statement for the year ended June 30, 2024 2. Prepare the company's statement of owner's equity for the year ended June 30, 2024. Assume that there were no contributions made by the owner during the year) 3. Prepare the company's classified balance sheet in report form at June 30, 2024 4. Joumalize the closing entries 5. T-accounts have been opened using the balances from the adjusted trial balance. Post the closing entries to the T-accounts 6. Prepare the company's post.closing trial balance at June 30, 2024 ua hu Choose from any list or enter any number in the input fields and then rel parts emaining Save kce Homework: Chapter 4 Homework LO1,3,4 Score: 0 of 30 pts 5 of 5 (3 complete) HW Score: 53.75%, 53.75 of 100 pts PF4-35B (similar to) Question Help The adusted trial balance of Emerson Real Estate Appraisal at June 30, 2024, follows: Click the icon to view the adjusted trial balance) Read the requirements Requirement 1. Prepare the company's income statement for the year ended June 30, 2024. (If a box is not used in the statement, leave the box empty, do not select a label or enter a zero. Use a minus nign or parentheses to show a net loss.) Emerson Real Estate Appraisal Income Statement Year Ended June 30, 2024 Requirements 1. Prepare the company's income statement for the year ended June 30, 2024 2. Prepare the company's statement of owner's equity for the year ended June 30, 2024. Assume that there were no contributions made by the owner during the year) 3. Prepare the company's classified balance sheet in report form at June 30, 2024 4. Joumalize the closing entries 5. T-accounts have been opened using the balances from the adjusted trial balance. Post the closing entries to the T-accounts 6. Prepare the company's post.closing trial balance at June 30, 2024 ua hu Choose from any list or enter any number in the input fields and then rel parts emaining