Question

Desire Streetcars (Streetcars) is considering a change of its capital structure. Currently, the companys stock is selling for USD 100 per share and the firm

Desire Streetcars (Streetcars) is considering a change of its capital structure. Currently, the companys stock is selling for USD 100 per share and the firm has

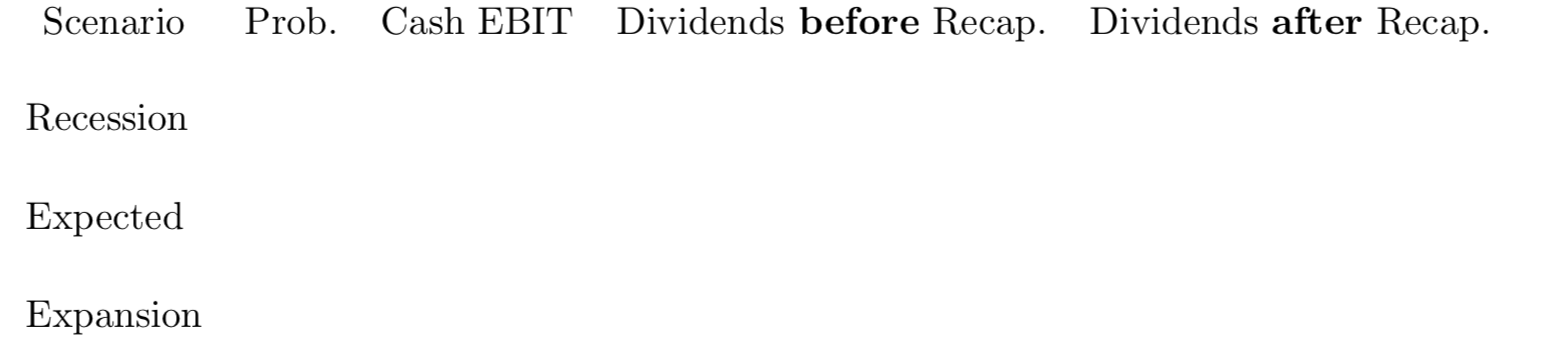

1 million shares outstanding. It has also a zero-coupon bond outstanding with a maturity of one year and a current market value of USD 10m (million). The yield on Streetcars debt is 6.50% and the company expects to earn with equal probability 1/3 USD 200m, 300m or 400m3 before interest and taxes next year. In keeping with a long-honored company tradition, all net income is being distributed to shareholders as dividends.

Streetcars major shareholder, renowned investor and philanthropist Stanley Kowalski, cur- rently owns 10% of Streetcars stock. Expressing high regard for its management, he found Streetcars recent stock price performance very disappointing as the firms shares had been falling for most of the preceding year. Indeed, Kowalski was quoted as saying that [i]t is essential that the company take positive steps to enhance shareholder value (The Times- Picayune, December 21, 1947).

As a result of shareholder activism, Streetcars management has now decided to repurchase 500,000 shares and will finance the repurchase by issuing USD 50m in zero-coupon bonds yielding 6.5%. Assume that cash reserves are sufficient to cover any debt service obligations by Desire Streetcars. Also, ignore bankruptcy, taxes and transaction costs in your analysis unless otherwise stated and assume that payout choices do not affect Streetcars investment, financing and operating policies.

(a) Calculate Stans dividends from his Streetcars investment before and after the proposed recapitalization. Which capital structure offers the riskier investment? Explain the difference.

(b) What is the return on equity in each scenario before and after the recapitalization? Compare the riskiness for shareholders and compute the expected ROE under each capital structure.

(c) In fact, Stan Kowalski likes the current capital structure and wishes to maintain a 10% stake in the company. What should he do? Propose an investment strategy that keeps his stake constant and calculate Stans return in this case.

(d) The preceding is an application of which celebrated result? Which of its underlying assumptions are most likely to be violated in practice?

(e) Suppose that, instead of issuing zero-coupon bonds, Streetcars is currently financed with a USD 10m perpetual bond (called a console) and considers issuing another one to finance the share repurchase program. The bonds both have a coupon rate of 11% qualifying for tax-deductability and currently yield 6.5%. Also assume that Streetcars pays corporate tax at 34%.

What is the price of the bonds? What are Stans after-tax cash flows before and after the recapitalization with

coupon paying bond finance (same coupon rate) and corporate taxes? What are Stans after-tax cash flows if he keeps his stake constant at 10%?

Scenario Prob. Cash EBIT Dividends before Recap. Dividends after Recap. Recession Expected Expansion Scenario Prob. Cash EBIT Dividends before Recap. Dividends after Recap. Recession Expected ExpansionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started