Answered step by step

Verified Expert Solution

Question

1 Approved Answer

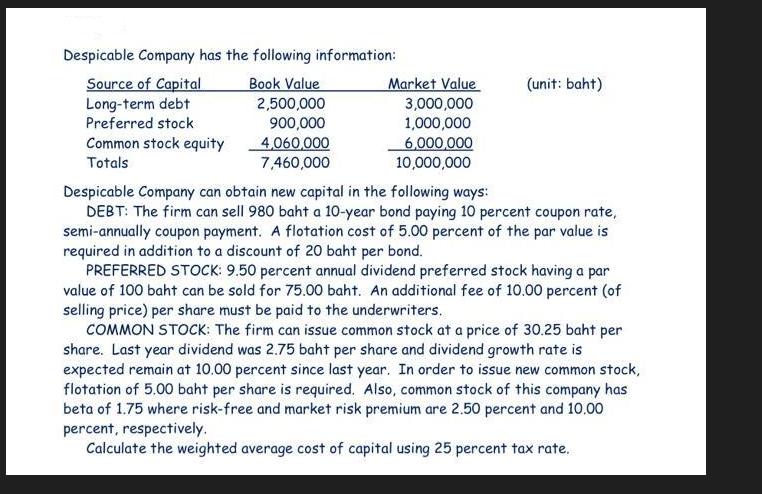

Despicable Company has the following information: Source of Capital Long-term debt Preferred stock Common stock equity Totals Book Value 2,500,000 900,000 4,060,000 7,460,000 Market

Despicable Company has the following information: Source of Capital Long-term debt Preferred stock Common stock equity Totals Book Value 2,500,000 900,000 4,060,000 7,460,000 Market Value 3,000,000 1,000,000 6,000,000 10,000,000 (unit: baht) Despicable Company can obtain new capital in the following ways: DEBT: The firm can sell 980 baht a 10-year bond paying 10 percent coupon rate, semi-annually coupon payment. A flotation cost of 5.00 percent of the par value is required in addition to a discount of 20 baht per bond. PREFERRED STOCK: 9.50 percent annual dividend preferred stock having a par value of 100 baht can be sold for 75.00 baht. An additional fee of 10.00 percent (of selling price) per share must be paid to the underwriters. COMMON STOCK: The firm can issue common stock at a price of 30.25 baht per share. Last year dividend was 2.75 baht per share and dividend growth rate is expected remain at 10.00 percent since last year. In order to issue new common stock, flotation of 5.00 baht per share is required. Also, common stock of this company has beta of 1.75 where risk-free and market risk premium are 2.50 percent and 10.00 percent, respectively. Calculate the weighted average cost of capital using 25 percent tax rate.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the weighted average cost of capital WACC we need to find the cost of each sourc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started