Answered step by step

Verified Expert Solution

Question

1 Approved Answer

detailed information: ( Click the icon to view the information. ) Read the requirements. Data table Requirement 2 . Compute the manufacturing overhead allocated to

detailed information:

Click the icon to view the information.

Read the requirements.

Data table

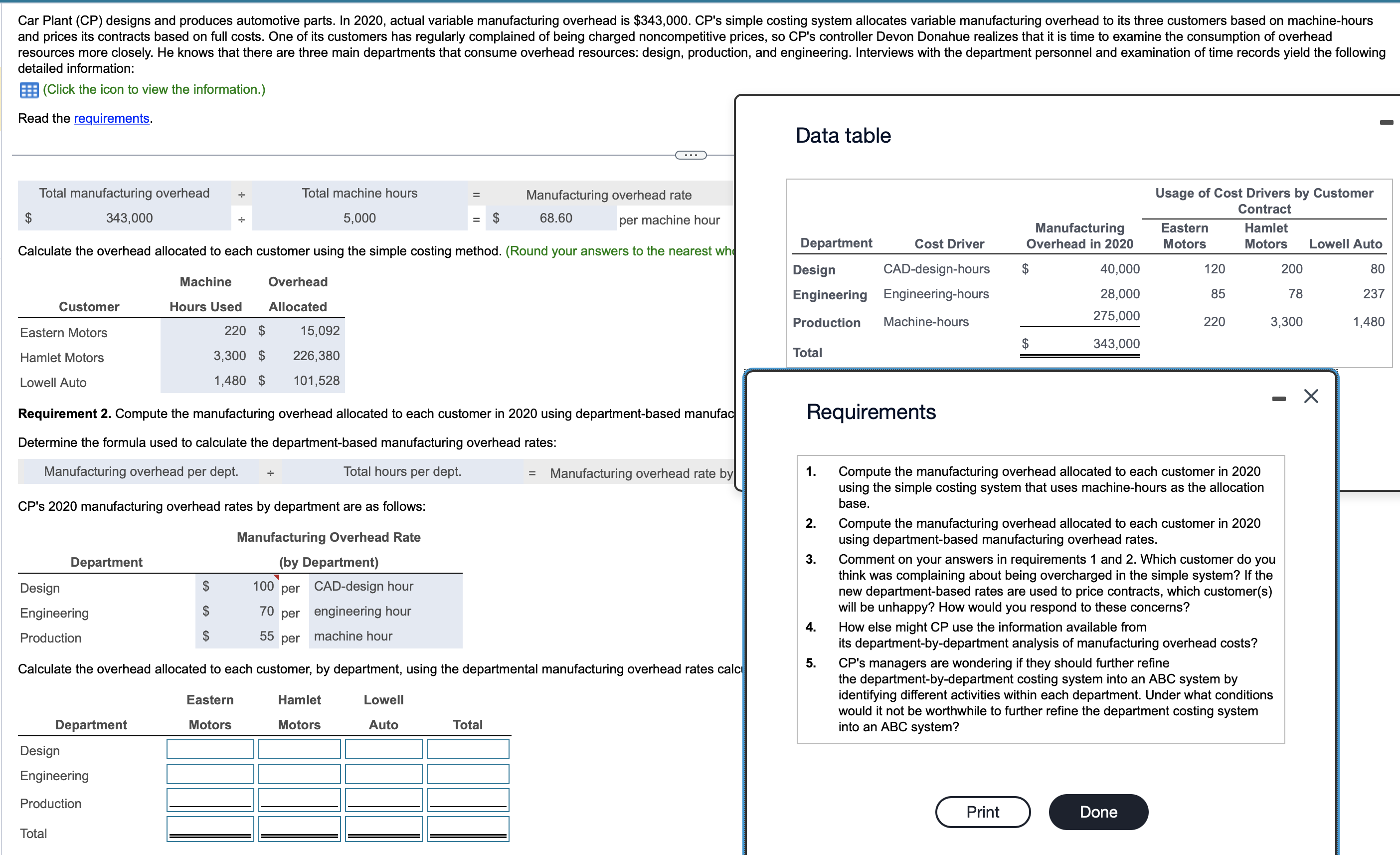

Requirement Compute the manufacturing overhead allocated to each customer in using departmentbased manufac

Determine the formula used to calculate the departmentbased manufacturing overhead rates:

Manufacturing overhead per dept. Total hours per dept. Manufacturing overhead rate by

CPs manufacturing overhead rates by department are as follows:

Manufacturing Overhead Rate

Calculate the overhead allocated to each customer, by department, using the departmental manufacturing overhead rates calc

Requirements

Compute the manufacturing overhead allocated to each customer in

using the simple costing system that uses machinehours as the allocation

base.

Compute the manufacturing overhead allocated to each customer in

using departmentbased manufacturing overhead rates.

Comment on your answers in requirements and Which customer do you

think was complaining about being overcharged in the simple system? If the

new departmentbased rates are used to price contracts, which customers

will be unhappy? How would you respond to these concerns?

How else might use the information available from

its departmentbydepartment analysis of manufacturing overhead costs?

CPs managers are wondering if they should further refine

the departmentbydepartment costing system into an ABC system by

identifying different activities within each department. Under what conditions

would it not be worthwhile to further refine the department costing system

into an ABC system?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started