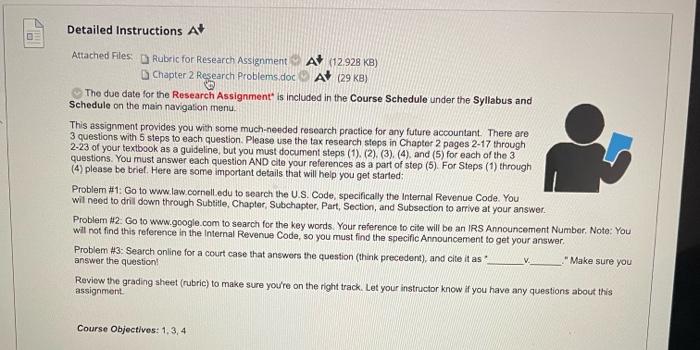

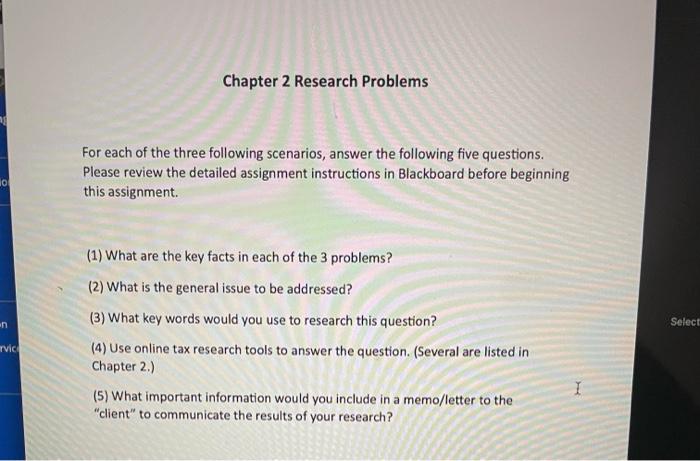

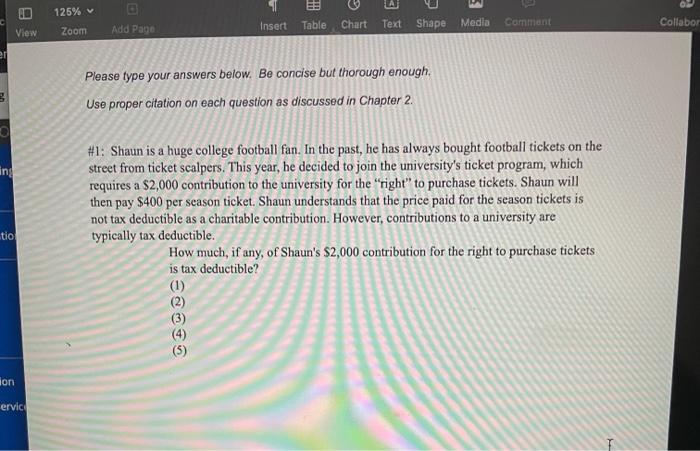

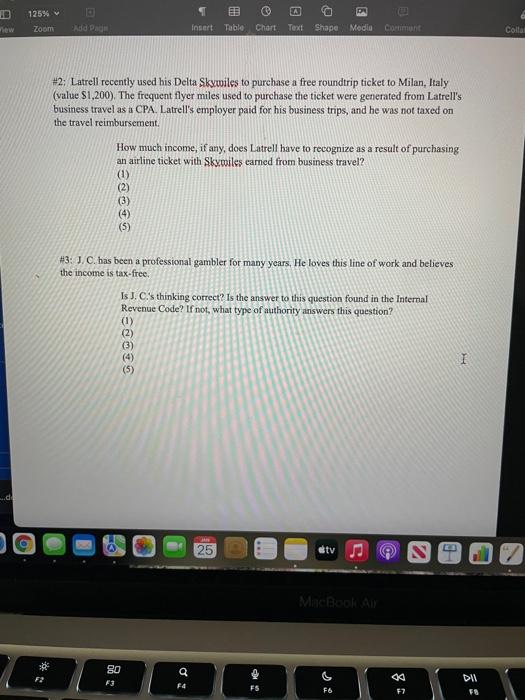

Detailed Instructions At Attached Files Rubric for Research Assignment A (12.928 KB) Chapter 2 Research Problems.doc A (29 KB) The due date for the Research Assignment is included in the Course Schedule under the Syllabus and Schedule on the main navigation menu This assignment provides you with some much-needed research practice for any future accountant. There are 3 questions with 5 steps to each question. Please use the tax research steps in Chapter 2 pages 2-17 through 2-23 of your textbook as a guideline, but you must document steps (1), (2), (3), (4), and (5) for each of the 3 questions. You must answer each question AND cite your references as a part of step (5) For Steps (1) through (4) please be brief. Here are some important details that will help you get started: Problem #1: Go to www.law.cornell.edu to search the U.S. Code, specifically the Internal Revenue Code. You will need to dril down through Subtitle, Chapter, Subchapter. Part, Section, and Subsection to arrive at your answer. Problem #2. Go to www.google.com to search for the key words. Your reference to cite will be an IRS Announcement Number. Note: You will not find this reference in the Internal Revenue Code, so you must find the specific Announcement to get your answer. Problem #3: Search online for a court case that answers the question (think precedent), and cite it as "Make sure you answer the questioni Review the grading sheet (rubric) to make sure you're on the right track. Let your instructor know if you have any questions about this assignment Course Objectives: 1.3.4 Chapter 2 Research Problems For each of the three following scenarios, answer the following five questions. Please review the detailed assignment instructions in Blackboard before beginning this assignment. 10 en Select (1) What are the key facts in each of the 3 problems? (2) What is the general issue to be addressed? (3) What key words would you use to research this question? (4) Use online tax research tools to answer the question. (Several are listed in Chapter 2.) (5) What important information would you include in a memo/letter to the "client" to communicate the results of your research? mrvice 1 125% v Zoom Insert Table Add Page Comment Chart Text Shape Media View Collabor 21 Please type your answers below. Be concise but thorough enough. Use proper citation on each question as discussed in Chapter 2. ing #1: Shaun is a huge college football fan. In the past, he has always bought football tickets on the street from ticket scalpers. This year, he decided to join the university's ticket program, which requires a $2,000 contribution to the university for the "right" to purchase tickets. Shaun will then pay $400 per season ticket. Shaun understands that the price paid for the season tickets is not tax deductible as a charitable contribution. However, contributions to a university are typically tax deductible How much, if any, of Shaun's $2,000 contribution for the right to purchase tickets is tax deductible? (1) tio lon ervice ID 125% EB Insert Table new Zoom Add Page Chart Text Shape Media Comment Colla #2: Latrell recently used his Delta Skywiles to purchase a free roundtrip ticket to Milan, Italy (value $1,200). The frequent flyer miles used to purchase the ticket were generated from Latrell's business travel as a CPA. Latrell's employer paid for his business trips, and he was not taxed on the travel reimbursement. How much income, if any, does Latrell have to recognize as a result of purchasing an airline ticket with Skycoiles earned from business travel? ( (2) (3) (4) (5) #3: J.C. has been a professional gambler for many years. He loves this line of work and believes the income is tax-free. Is J. C.s thinking correct? Is the answer to this question found in the Internal Revenue Code? If not, what type of authority answers this question? (1) (2) (3) (4) (5) I 25 dtv E MacBook All 80 Q F3 F4 ES DI FB F6 F2 Detailed Instructions At Attached Files Rubric for Research Assignment A (12.928 KB) Chapter 2 Research Problems.doc A (29 KB) The due date for the Research Assignment is included in the Course Schedule under the Syllabus and Schedule on the main navigation menu This assignment provides you with some much-needed research practice for any future accountant. There are 3 questions with 5 steps to each question. Please use the tax research steps in Chapter 2 pages 2-17 through 2-23 of your textbook as a guideline, but you must document steps (1), (2), (3), (4), and (5) for each of the 3 questions. You must answer each question AND cite your references as a part of step (5) For Steps (1) through (4) please be brief. Here are some important details that will help you get started: Problem #1: Go to www.law.cornell.edu to search the U.S. Code, specifically the Internal Revenue Code. You will need to dril down through Subtitle, Chapter, Subchapter. Part, Section, and Subsection to arrive at your answer. Problem #2. Go to www.google.com to search for the key words. Your reference to cite will be an IRS Announcement Number. Note: You will not find this reference in the Internal Revenue Code, so you must find the specific Announcement to get your answer. Problem #3: Search online for a court case that answers the question (think precedent), and cite it as "Make sure you answer the questioni Review the grading sheet (rubric) to make sure you're on the right track. Let your instructor know if you have any questions about this assignment Course Objectives: 1.3.4 Chapter 2 Research Problems For each of the three following scenarios, answer the following five questions. Please review the detailed assignment instructions in Blackboard before beginning this assignment. 10 en Select (1) What are the key facts in each of the 3 problems? (2) What is the general issue to be addressed? (3) What key words would you use to research this question? (4) Use online tax research tools to answer the question. (Several are listed in Chapter 2.) (5) What important information would you include in a memo/letter to the "client" to communicate the results of your research? mrvice 1 125% v Zoom Insert Table Add Page Comment Chart Text Shape Media View Collabor 21 Please type your answers below. Be concise but thorough enough. Use proper citation on each question as discussed in Chapter 2. ing #1: Shaun is a huge college football fan. In the past, he has always bought football tickets on the street from ticket scalpers. This year, he decided to join the university's ticket program, which requires a $2,000 contribution to the university for the "right" to purchase tickets. Shaun will then pay $400 per season ticket. Shaun understands that the price paid for the season tickets is not tax deductible as a charitable contribution. However, contributions to a university are typically tax deductible How much, if any, of Shaun's $2,000 contribution for the right to purchase tickets is tax deductible? (1) tio lon ervice ID 125% EB Insert Table new Zoom Add Page Chart Text Shape Media Comment Colla #2: Latrell recently used his Delta Skywiles to purchase a free roundtrip ticket to Milan, Italy (value $1,200). The frequent flyer miles used to purchase the ticket were generated from Latrell's business travel as a CPA. Latrell's employer paid for his business trips, and he was not taxed on the travel reimbursement. How much income, if any, does Latrell have to recognize as a result of purchasing an airline ticket with Skycoiles earned from business travel? ( (2) (3) (4) (5) #3: J.C. has been a professional gambler for many years. He loves this line of work and believes the income is tax-free. Is J. C.s thinking correct? Is the answer to this question found in the Internal Revenue Code? If not, what type of authority answers this question? (1) (2) (3) (4) (5) I 25 dtv E MacBook All 80 Q F3 F4 ES DI FB F6 F2