Answered step by step

Verified Expert Solution

Question

1 Approved Answer

detailed solution for q1 and q2 please Cost of Capital: 2 Questions The following information applies to the next TWO questions: The market risk premium

detailed solution for q1 and q2 please

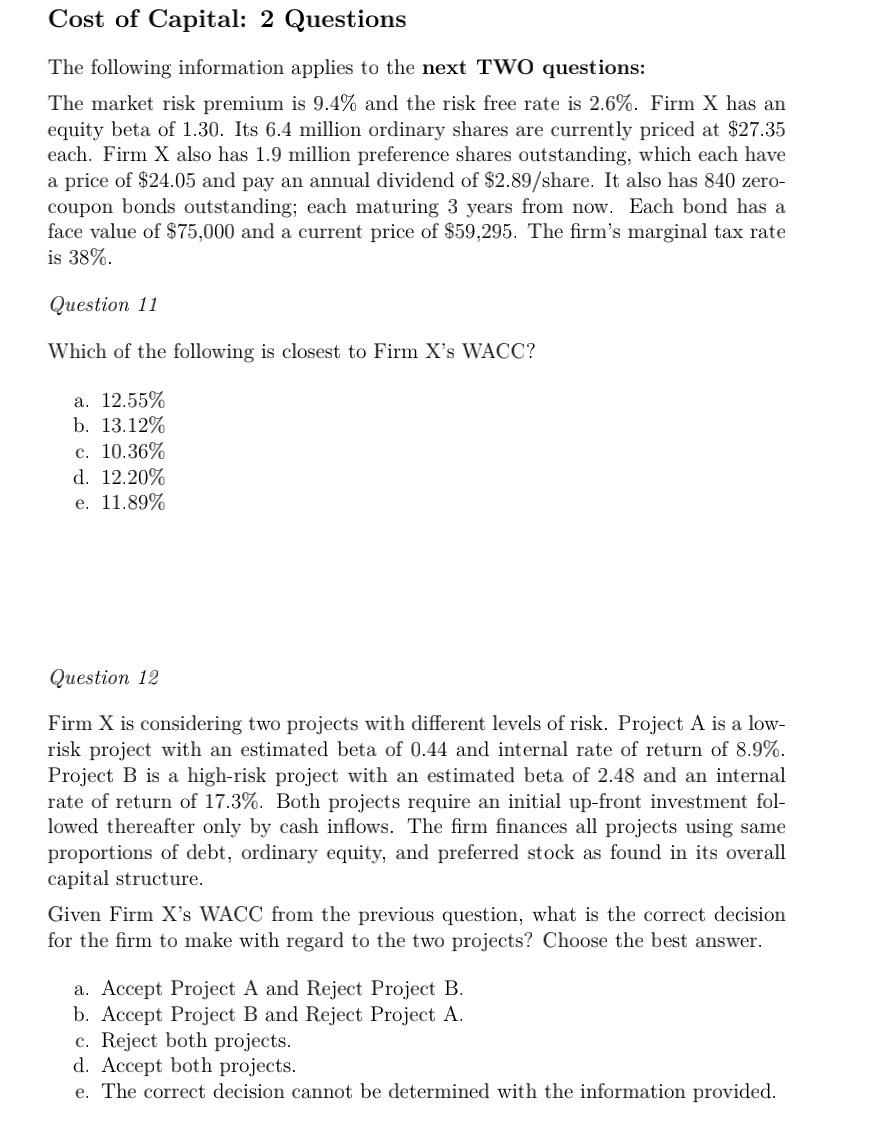

Cost of Capital: 2 Questions The following information applies to the next TWO questions: The market risk premium is 9.4% and the risk free rate is 2.6%. Firm X has an equity beta of 1.30. Its 6.4 million ordinary shares are currently priced at $27.35 each. Firm X also has 1.9 million preference shares outstanding, which each have a price of $24.05 and pay an annual dividend of $2.89/share. It also has 840 zero- coupon bonds outstanding; each maturing 3 years from now. Each bond has a face value of $75,000 and a current price of $59,295. The firm's marginal tax rate is 38%. Question 11 Which of the following is closest to Firm X's WACC? a. 12.55% b. 13.12% c. 10.36% d. 12.20% e. 11.89% Question 12 Firm X is considering two projects with different levels of risk. Project A is a low- risk project with an estimated beta of 0.44 and internal rate of return of 8.9%. Project B is a high-risk project with an estimated beta of 2.48 and an internal rate of return of 17.3%. Both projects require an initial up-front investment fol- lowed thereafter only by cash inflows. The firm finances all projects using same proportions of debt, ordinary equity, and preferred stock as found in its overall capital structure. Given Firm X's WACC from the previous question, what is the correct decision for the firm to make with regard to the two projects? Choose the best answer. a. Accept Project A and Reject Project B. b. Accept Project B and Reject Project A. c. Reject both projects. d. Accept both projects. e. The correct decision cannot be determined with the information providedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started