Detailes solution on excel please

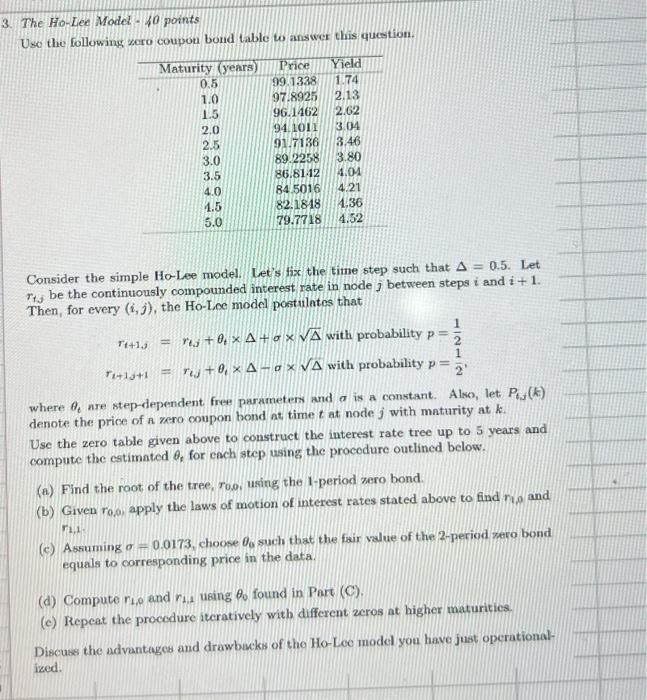

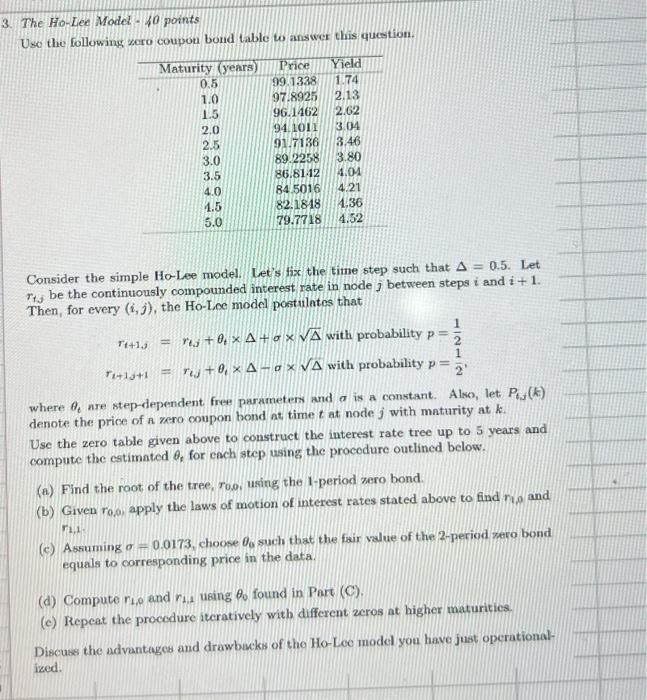

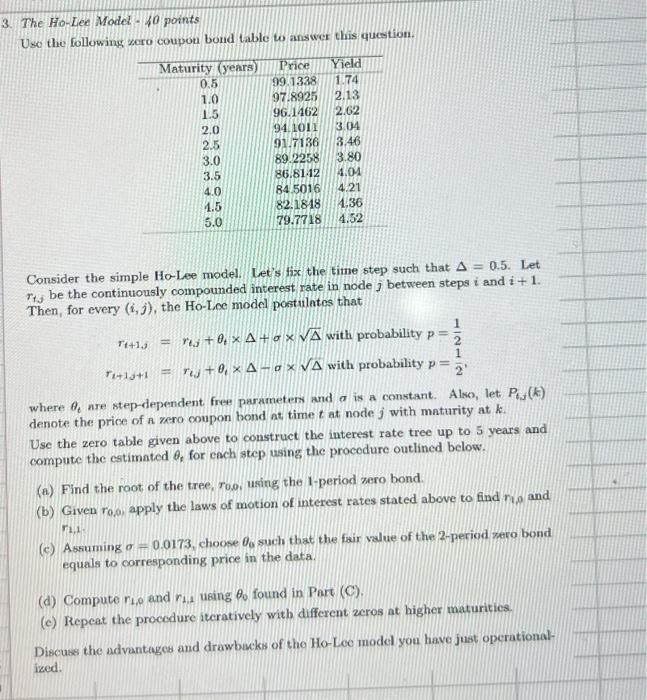

3. The Ho-Lee Model-40 points Uso the following zero coupon bond table to answer this question. Consider the simple Ho-Lee model. Let's fix the time step such that =0.5. Let r1,j be the continuously compounded interest rate in node j between steps i and i+1. Then, for every (i,j), the Ho-Loe model postulntes that rt+1,j=rij+t+withprobabilityp=21ri+1j+1=rid+iwithprobabilityp=21 where t are step-dependent. free parameten and a is a constant. Also, let Ptj(k) denote the price of a zero coupon bond at time t at node j with maturity at k. Use the zero table given above to construct the interest rate tree up to 5 years and compute the estimated t for cach step using the procedure outlined below. (a) Find the root of the tree, ro.0, using the 1-period zero bond (b) Given ro,. apply the laws of motion of interest rates stated above to find ri,a and ri,1. (c) Assuming =0.0173, choose 0 such that the fair value of the 2 -period zero bond equals to corresponding price in the data. (d) Compute r1,0 and r1,1 using 0 found in Part (C). (c) Repeat the procodure iteratively with different zeros at higher maturities. Discuss the advantages and drawbacks of the Ho-Leo model you have just opcrationalized. 3. The Ho-Lee Model-40 points Uso the following zero coupon bond table to answer this question. Consider the simple Ho-Lee model. Let's fix the time step such that =0.5. Let r1,j be the continuously compounded interest rate in node j between steps i and i+1. Then, for every (i,j), the Ho-Loe model postulntes that rt+1,j=rij+t+withprobabilityp=21ri+1j+1=rid+iwithprobabilityp=21 where t are step-dependent. free parameten and a is a constant. Also, let Ptj(k) denote the price of a zero coupon bond at time t at node j with maturity at k. Use the zero table given above to construct the interest rate tree up to 5 years and compute the estimated t for cach step using the procedure outlined below. (a) Find the root of the tree, ro.0, using the 1-period zero bond (b) Given ro,. apply the laws of motion of interest rates stated above to find ri,a and ri,1. (c) Assuming =0.0173, choose 0 such that the fair value of the 2 -period zero bond equals to corresponding price in the data. (d) Compute r1,0 and r1,1 using 0 found in Part (C). (c) Repeat the procodure iteratively with different zeros at higher maturities. Discuss the advantages and drawbacks of the Ho-Leo model you have just opcrationalized