Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Details 1.2 Musa Manini is a sole shareholder and director of Kaylan (Pty) Ltd, a Tax consulting firm in Khayelitsha, Cape Town. Musa is

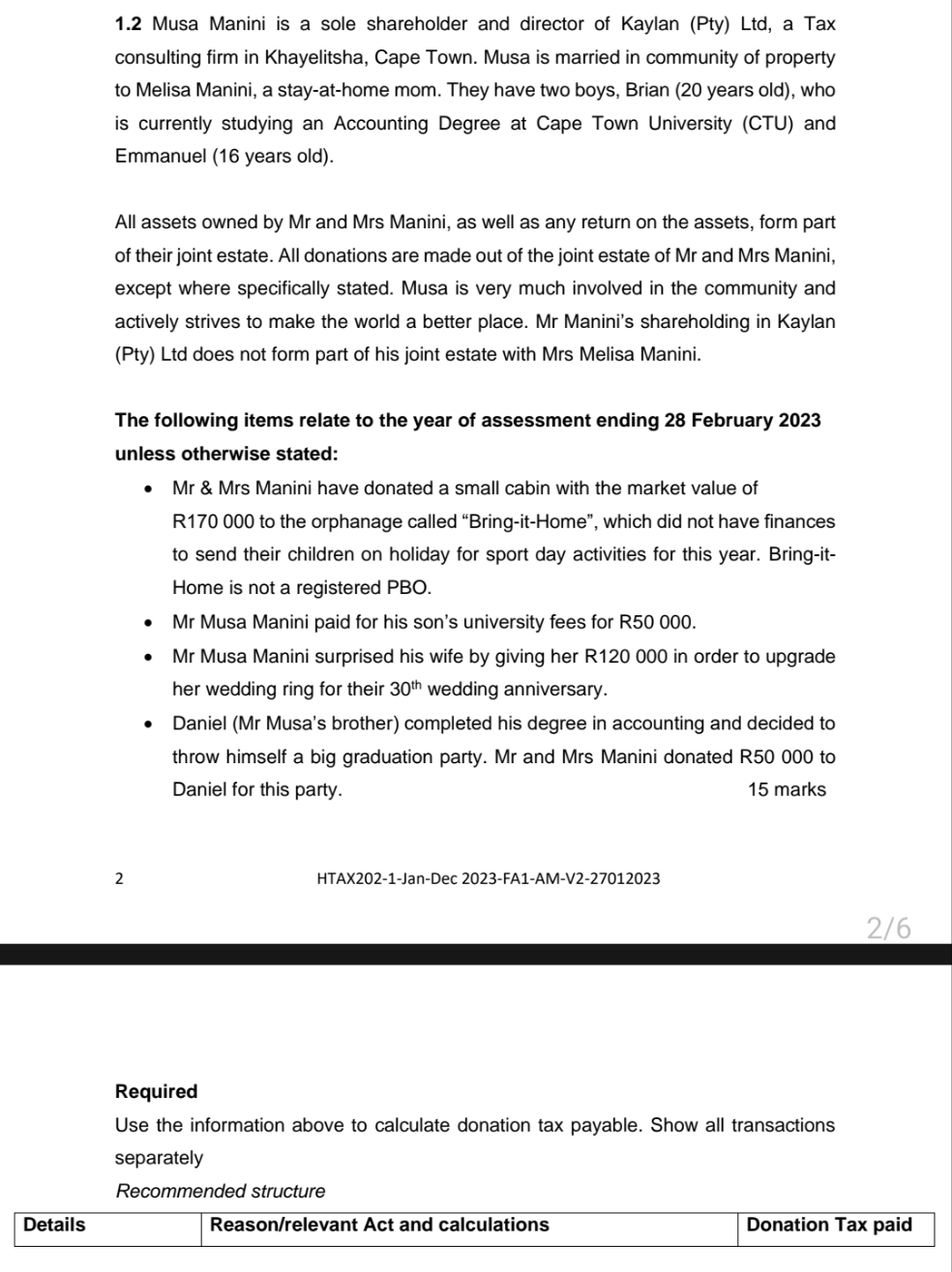

Details 1.2 Musa Manini is a sole shareholder and director of Kaylan (Pty) Ltd, a Tax consulting firm in Khayelitsha, Cape Town. Musa is married in community of property to Melisa Manini, a stay-at-home mom. They have two boys, Brian (20 years old), who is currently studying an Accounting Degree at Cape Town University (CTU) and Emmanuel (16 years old). All assets owned by Mr and Mrs Manini, as well as any return on the assets, form part of their joint estate. All donations are made out of the joint estate of Mr and Mrs Manini, except where specifically stated. Musa is very much involved in the community and actively strives to make the world a better place. Mr Manini's shareholding in Kaylan (Pty) Ltd does not form part of his joint estate with Mrs Melisa Manini. The following items relate to the year of assessment ending 28 February 2023 unless otherwise stated: 2 Mr & Mrs Manini have donated a small cabin with the market value of R170 000 to the orphanage called "Bring-it-Home", which did not have finances to send their children on holiday for sport day activities for this year. Bring-it- Home is not a registered PBO. Mr Musa Manini paid for his son's university fees for R50 000. Mr Musa Manini surprised his wife by giving her R120 000 in order to upgrade her wedding ring for their 30th wedding anniversary. Daniel (Mr Musa's brother) completed his degree in accounting and decided to throw himself a big graduation party. Mr and Mrs Manini donated R50 000 to Daniel for this party. 15 marks HTAX202-1-Jan-Dec 2023-FA1-AM-V2-27012023 Required Use the information above to calculate donation tax payable. Show all transactions separately Recommended structure Reason/relevant Act and calculations 2/6 Donation Tax paid

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the donation tax payable based on the information provided well analyze each donation separately Its important to note that donation tax ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started