Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Assume that you are a consultant working for GLORY Ltd., which is investigating the possibility of releasing a new gaming console known as GR1.

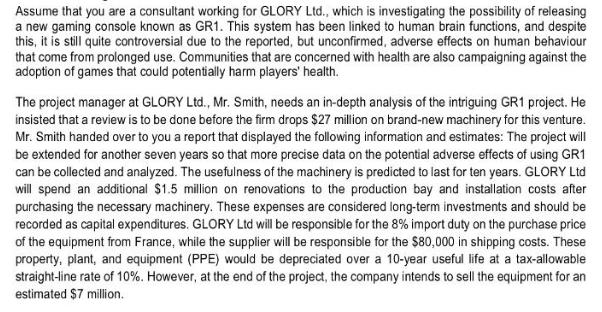

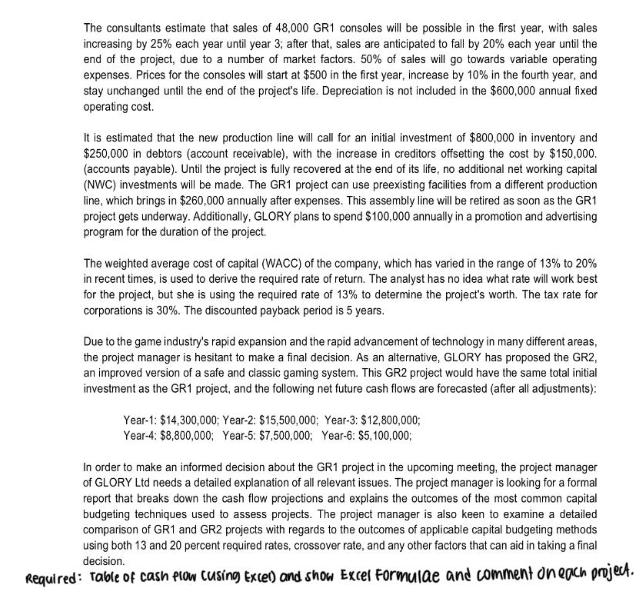

Assume that you are a consultant working for GLORY Ltd., which is investigating the possibility of releasing a new gaming console known as GR1. This system has been linked to human brain functions, and despite this, it is still quite controversial due to the reported, but unconfirmed, adverse effects on human behaviour that come from prolonged use. Communities that are concerned with health are also campaigning against the adoption of games that could potentially harm players' health. The project manager at GLORY Ltd., Mr. Smith, needs an in-depth analysis of the intriguing GR1 project. He insisted that a review is to be done before the firm drops $27 million on brand-new machinery for this venture. Mr. Smith handed over to you a report that displayed the following information and estimates: The project will be extended for another seven years so that more precise data on the potential adverse effects of using GR1 can be collected and analyzed. The usefulness of the machinery is predicted to last for ten years. GLORY Ltd will spend an additional $1.5 million on renovations to the production bay and installation costs after purchasing the necessary machinery. These expenses are considered long-term investments and should be recorded as capital expenditures. GLORY Ltd will be responsible for the 8% import duty on the purchase price of the equipment from France, while the supplier will be responsible for the $80,000 in shipping costs. These property, plant, and equipment (PPE) would be depreciated over a 10-year useful life at a tax-allowable straight-line rate of 10%. However, at the end of the project, the company intends to sell the equipment for an estimated $7 million. The consultants estimate that sales of 48,000 GR1 consoles will be possible in the first year, with sales increasing by 25% each year until year 3; after that, sales are anticipated to fall by 20% each year until the end of the project, due to a number of market factors. 50% of sales will go towards variable operating expenses. Prices for the consoles will start at $500 in the first year, increase by 10% in the fourth year, and stay unchanged until the end of the project's life. Depreciation is not included in the $600,000 annual fixed operating cost. It is estimated that the new production line will call for an initial investment of $800,000 in inventory and $250,000 in debtors (account receivable), with the increase in creditors offsetting the cost by $150,000. (accounts payable). Until the project is fully recovered at the end of its life, no additional net working capital (NWC) investments will be made. The GR1 project can use preexisting facilities from a different production line, which brings in $260,000 annually after expenses. This assembly line will be retired as soon as the GR1 project gets underway. Additionally, GLORY plans to spend $100,000 annually in a promotion and advertising program for the duration of the project. The weighted average cost of capital (WACC) of the company, which has varied in the range of 13% to 20% in recent times, is used to derive the required rate of return. The analyst has no idea what rate will work best for the project, but she is using the required rate of 13% to determine the project's worth. The tax rate for corporations is 30%. The discounted payback period is 5 years. Due to the game industry's rapid expansion and the rapid advancement of technology in many different areas, the project manager is hesitant to make a final decision. As an alternative, GLORY has proposed the GR2, an improved version of a safe and classic gaming system. This GR2 project would have the same total initial investment as the GR1 project, and the following net future cash flows are forecasted (after all adjustments): Year-1: $14,300,000; Year-2: $15,500,000; Year-3: $12,800,000; Year-4: $8,800,000; Year-5: $7,500,000; Year-6: $5,100,000; In order to make an informed decision about the GR1 project in the upcoming meeting, the project manager of GLORY Ltd needs a detailed explanation of all relevant issues. The project manager is looking for a formal report that breaks down the cash flow projections and explains the outcomes of the most common capital budgeting techniques used to assess projects. The project manager is also keen to examine a detailed comparison of GR1 and GR2 projects with regards to the outcomes of applicable capital budgeting methods using both 13 and 20 percent required rates, crossover rate, and any other factors that can aid in taking a final decision. Required: Table of cash flow Cusing Excel) and show Excel Formulae and comment on each project.

Step by Step Solution

★★★★★

3.43 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Here is my analysis of the GR1 and GR2 gaming console projects for GLORY Ltd Cash Flow Projections for GR1 Project I have created a cash flow statemen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started