Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4) (15 Marks) Ms. Shirley Temple moved to Saskatchewan ion January 1, 2014 to commence work for Northern Star Ltd (NSL) as a sales

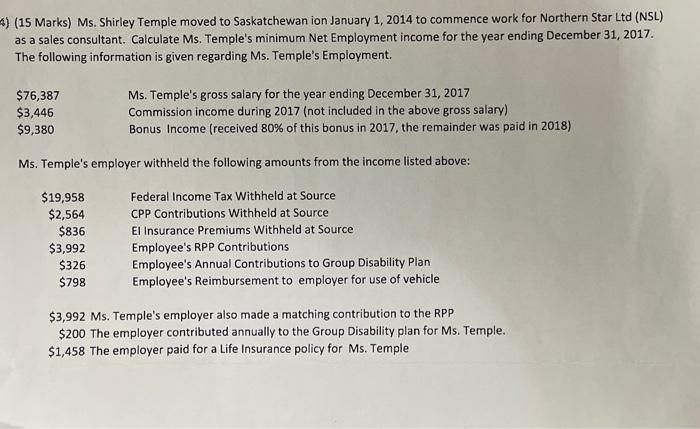

4) (15 Marks) Ms. Shirley Temple moved to Saskatchewan ion January 1, 2014 to commence work for Northern Star Ltd (NSL) as a sales consultant. Calculate Ms. Temple's minimum Net Employment income for the year ending December 31, 2017. The following information is given regarding Ms. Temple's Employment. $76,387 $3,446 $9,380 Ms. Temple's gross salary for the year ending December 31, 2017 Commission income during 2017 (not included in the above gross salary) Bonus Income (received 80% of this bonus in 2017, the remainder was paid in 2018) Ms. Temple's employer withheld the following amounts from the income listed above: $19,958 Federal Income Tax Withheld at Source CPP Contributions Withheld at Source $2,564 El Insurance Premiums Withheld at Source Employee's RPP Contributions Employee's Annual Contributions to Group Disability Plan Employee's Reimbursement to employer for use of vehicle $3,992 $326 $798 $3,992 Ms. Temple's employer also made a matching contribution to the RPP $200 The employer contributed annually to the Group Disability plan for Ms. Temple. $1,458 The employer paid for a Life Insurance policy for Ms. Temple

Step by Step Solution

★★★★★

3.36 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

The net Employment income of Ms Shirley Temple is 128829 Stepbystep explanation Assumptions The gros...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started