Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chan has been recommended for promotion to the head of the marketing department of Cemerlang Sdn Bhd. The promotion will involve a salary increase

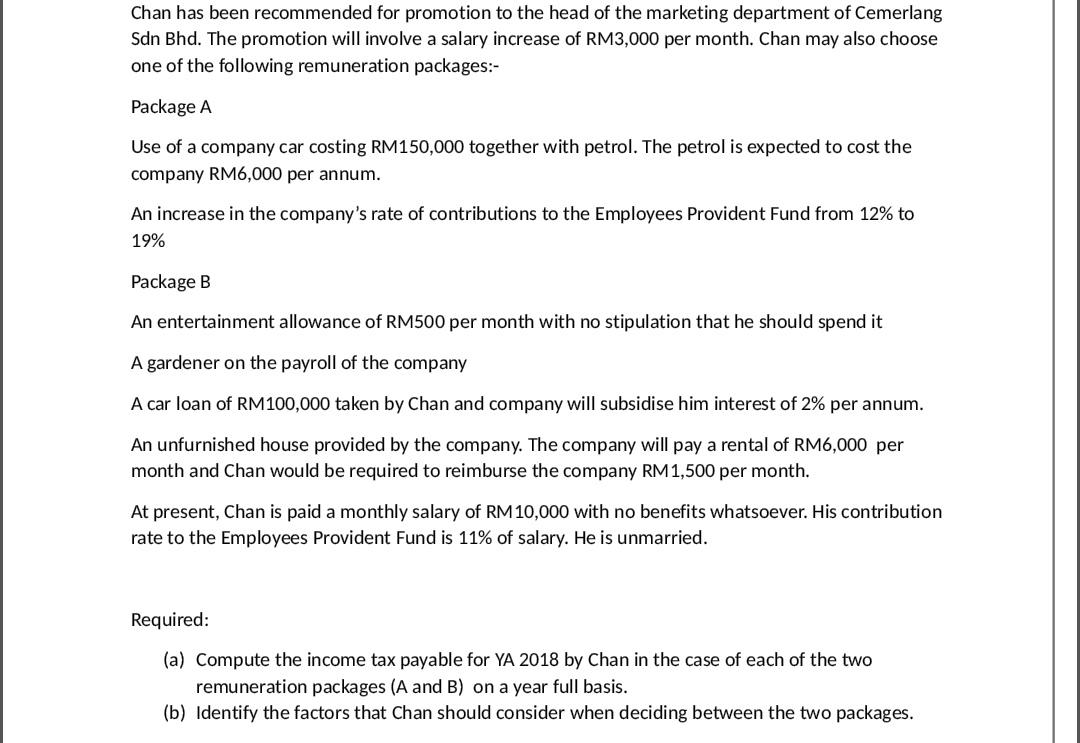

Chan has been recommended for promotion to the head of the marketing department of Cemerlang Sdn Bhd. The promotion will involve a salary increase of RM3,000 per month. Chan may also choose one of the following remuneration packages:- Package A Use of a company car costing RM150,000 together with petrol. The petrol is expected to cost the company RM6,000 per annum. An increase in the company's rate of contributions to the Employees Provident Fund from 12% to 19% Package B An entertainment allowance of RM500 per month with no stipulation that he should spend it A gardener on the payroll of the company A car loan of RM100,000 taken by Chan and company will subsidise him interest of 2% per annum. An unfurnished house provided by the company. The company will pay a rental of RM6,000 per month and Chan would be required to reimburse the company RM 1,500 per month. At present, Chan is paid a monthly salary of RM10,000 with no benefits whatsoever. His contribution rate to the Employees Provident Fund is 11% of salary. He is unmarried. Required: (a) Compute the income tax payable for YA 2018 by Chan in the case of each of the two remuneration packages (A and B) on a year full basis. (b) Identify the factors that Chan should consider when deciding between the two packages.

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Chan income tax when he choose For package A Gross total inco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started