Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Detemination & Distribution Schedule Company Implied Value Parent Price (80%) NCI Value (20%) Subsidiary's FMV Less: BV of interest acquired: Common Stock ($5 Par) R/E

| Detemination & Distribution Schedule | Company Implied Value | |||||

| Parent Price (80%) | NCI Value (20%) | |||||

| Subsidiary's FMV | ||||||

| Less: BV of interest acquired: | ||||||

| Common Stock ($5 Par) | ||||||

| R/E | ||||||

| New Proceeds | ||||||

| Total Equity | n/a | |||||

| Interest Acquired | 100% | 80% | 20% | |||

| Book Value | ||||||

| Excess fair value over BV | ||||||

| n/a | n/a | n/a | ||||

| Adjustment of identifiable accounts: | Adjustment | Amortization per Year | Life | Worksheet Key | ||

| Building | n/a | |||||

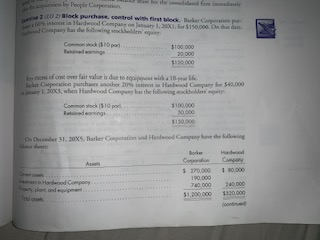

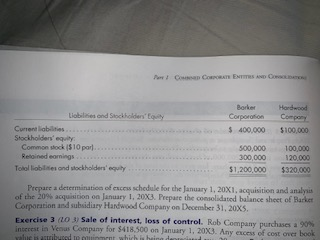

i lee the oemsolidad fem inmedily prition by People Corporation e 202Block purchase, control wih first biock. Bker Cop pur p isse ia Hardwood Company on January 1, 200, e $150,000 On dha da Company has the following socklelden equ Common ock 0pr $100 000 20 000 s120 000 da in nons of cont over fair value is due to squipows widh a 10re Sekr Crpocation purchases anocher 20% ins in Handwod Company for $40,000 iy 1. 2003, when Hadwood Compasy hs the following ockbolders quity Common sock 5 10 p s100,000 edeaing s0,000 $150,000 Thmber 31, 20xs, Barker Coporation and Hasdwood Compeny have dhe loing Ner de Hadwod Bokr Conpany Coporon Asels s 270,000 s0,000 190 000 dood Compony ry plont ond qipmen tel a 240000 740 000 $20,000- 51,200,000 Coean CooT ETS AD Co P Hardwood Company Borker Liobilnes ond Stockholders' Equity Corporotion Current liabilities. Stockholdens' equity Common stock ($10par) . Reloined earnings Tolol liobilities ond stockholders' equity 400,000 $100,000 100,000 120.000 $320,000 500,000 300,000 $1,200,000 Prepare a determination of excess schedule for the January 1, 20X1, acquisition and analyis of the 20% acquisition Corporation and subsidiary Hardwood Company on December 31, 20X5 Exercise 3 (10 3) Sale of interest, loss of control. Rob Company purchases a 90% intrrest in Venus Company for $418.500 on January 1, 20X3. Any excess of cost over book value is attribused to couinmenr which is beina deou January 1, 20X3. Prepare the consolidated balance sheet of Barker o0 i lee the oemsolidad fem inmedily prition by People Corporation e 202Block purchase, control wih first biock. Bker Cop pur p isse ia Hardwood Company on January 1, 200, e $150,000 On dha da Company has the following socklelden equ Common ock 0pr $100 000 20 000 s120 000 da in nons of cont over fair value is due to squipows widh a 10re Sekr Crpocation purchases anocher 20% ins in Handwod Company for $40,000 iy 1. 2003, when Hadwood Compasy hs the following ockbolders quity Common sock 5 10 p s100,000 edeaing s0,000 $150,000 Thmber 31, 20xs, Barker Coporation and Hasdwood Compeny have dhe loing Ner de Hadwod Bokr Conpany Coporon Asels s 270,000 s0,000 190 000 dood Compony ry plont ond qipmen tel a 240000 740 000 $20,000- 51,200,000 Coean CooT ETS AD Co P Hardwood Company Borker Liobilnes ond Stockholders' Equity Corporotion Current liabilities. Stockholdens' equity Common stock ($10par) . Reloined earnings Tolol liobilities ond stockholders' equity 400,000 $100,000 100,000 120.000 $320,000 500,000 300,000 $1,200,000 Prepare a determination of excess schedule for the January 1, 20X1, acquisition and analyis of the 20% acquisition Corporation and subsidiary Hardwood Company on December 31, 20X5 Exercise 3 (10 3) Sale of interest, loss of control. Rob Company purchases a 90% intrrest in Venus Company for $418.500 on January 1, 20X3. Any excess of cost over book value is attribused to couinmenr which is beina deou January 1, 20X3. Prepare the consolidated balance sheet of Barker o0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started