Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Determinants of stock option premiums Consider an American - style call option on Blaze Industries stock that has a premium of $ 0 . 0

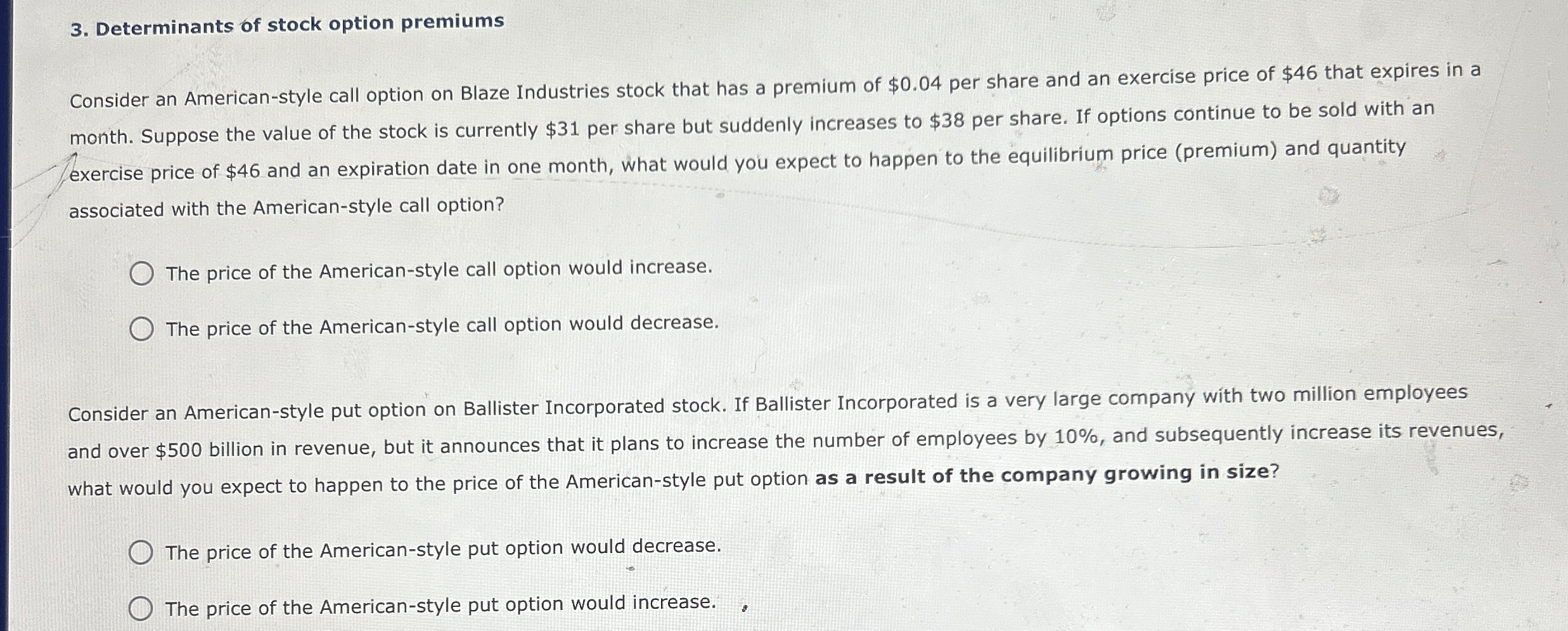

Determinants of stock option premiums

Consider an Americanstyle call option on Blaze Industries stock that has a premium of $ per share and an exercise price of $ that expires in a month. Suppose the value of the stock is currently $ per share but suddenly increases to $ per share. If options continue to be sold with an exercise price of $ and an expiration date in one month, what would you expect to happen to the equilibrium price premium and quantity associated with the Americanstyle call option?

The price of the Americanstyle call option would increase.

The price of the Americanstyle call option would decrease.

Consider an Americanstyle put option on Ballister Incorporated stock. If Ballister Incorporated is a very large company with two million employees and over $ billion in revenue, but it announces that it plans to increase the number of employees by and subsequently increase its revenues, what would you expect to happen to the price of the Americanstyle put option as a result of the company growing in size?

The price of the Americanstyle put option would decrease.

The price of the Americanstyle put option would increase.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started