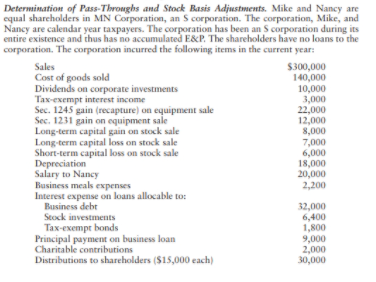

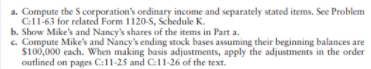

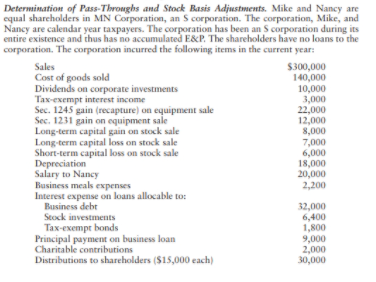

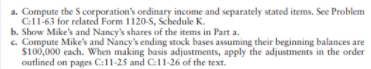

Determination of Pass-Throughs and Stock Basis Adjustments. Mike and Nancy are equal shareholders in MN Corporation, an corporation. The corporation, Mike, and Nancy are calendar year taxpayers. The corporation has been an Scorporation during its entire existence and thus has no accumulated E&P. The shareholders have no loans to the corporation. The corporation incurred the following items in the current year: Sales $300,000 Cost of goods sold 140,000 Dividends on corporate investments 10,000 Tax-exempt interest income 3,000 Sec. 1245 gain (recapture) on equipment sale 22,000 Sec. 1231 gain on equipment sale 12,000 Long-term capital gain on stock sale 8,000 Long-term capital loss on stock sale 7,000 Short-term capital loss on stock sale 6,000 Depreciation 18,000 Salary to Nancy 20,000 Business meals expenses 2,200 Interest expense on loans allocable to: Business debt 32,000 Stock investments 6,400 Tax-exempt bonds 1,800 Principal payment on business loan 9,000 Charitable contributions 2,000 Distributions to shareholders ($15,000 each) 30,000 a. Compute the corporation's ordinary income and separately stated items. See Problem C:11-63 for related Form 1120-5, Schedule K. b. Show Mike's and Nancy's shares of the items in Parta. c. Compute Mike's and Nancy's ending stock bases assuming their beginning balances are $100,000 each. When making basis adjustments, apply the adjustments in the order outlined on pages C:11-25 and C:11-26 of the text. Determination of Pass-Throughs and Stock Basis Adjustments. Mike and Nancy are equal shareholders in MN Corporation, an corporation. The corporation, Mike, and Nancy are calendar year taxpayers. The corporation has been an Scorporation during its entire existence and thus has no accumulated E&P. The shareholders have no loans to the corporation. The corporation incurred the following items in the current year: Sales $300,000 Cost of goods sold 140,000 Dividends on corporate investments 10,000 Tax-exempt interest income 3,000 Sec. 1245 gain (recapture) on equipment sale 22,000 Sec. 1231 gain on equipment sale 12,000 Long-term capital gain on stock sale 8,000 Long-term capital loss on stock sale 7,000 Short-term capital loss on stock sale 6,000 Depreciation 18,000 Salary to Nancy 20,000 Business meals expenses 2,200 Interest expense on loans allocable to: Business debt 32,000 Stock investments 6,400 Tax-exempt bonds 1,800 Principal payment on business loan 9,000 Charitable contributions 2,000 Distributions to shareholders ($15,000 each) 30,000 a. Compute the corporation's ordinary income and separately stated items. See Problem C:11-63 for related Form 1120-5, Schedule K. b. Show Mike's and Nancy's shares of the items in Parta. c. Compute Mike's and Nancy's ending stock bases assuming their beginning balances are $100,000 each. When making basis adjustments, apply the adjustments in the order outlined on pages C:11-25 and C:11-26 of the text