Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Determination of Tax Dawn is a single taxpayer. Her income and expenses for the year is as follows: Income Salary - $ 6 9 ,

Determination of Tax

Dawn is a single taxpayer. Her income and expenses for the year is as follows:

Income

Salary $

Interest $

Short term capital loss $

Expenses

Medical expenses $

Home mortgage interest $

Property Taxes $

Charitable contributions $

Requirements A Compute Maria's adjusted gross income

Requirement B Compute Maria's taxable income.

Start by computing Dawn's adjusted gross income and then her taxable income.

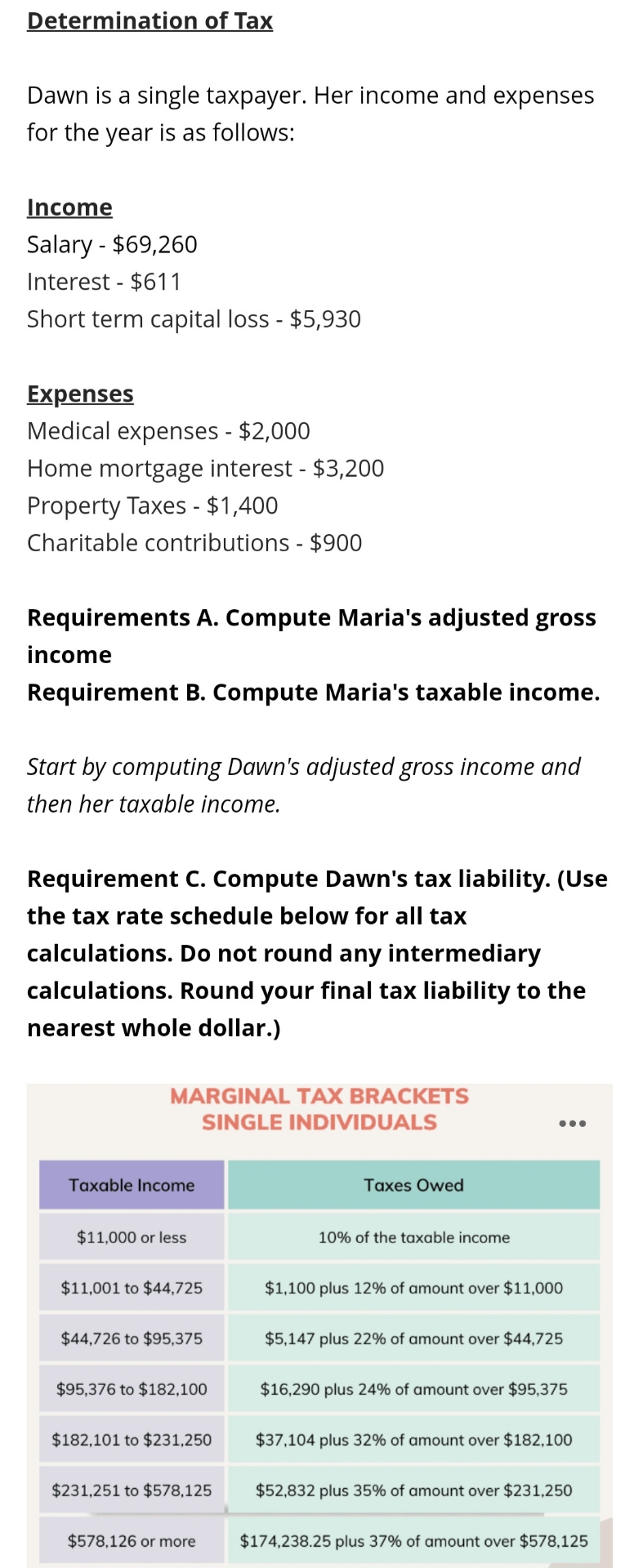

Requirement C Compute Dawn's tax liability. Use the tax rate schedule below for all tax calculations. Do not round any intermediary calculations. Round your final tax liability to the nearest whole dollar.

MARGINAL TAX BRACKETS

SINGLE INDIVIDUALS

tabletableMARGINAL TAX BRACKETSSINGLE INDIVIDUALSTaxable Income,Taxes Owed$ or less, of the taxable income$ to $$ plus of amount over $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started