Determine all the appropriate ratios for Carnevale. Then examine how they have changed and relate to both the previous year and the industry means. What problems for the firm does this examination and analyze point to for the firm in trying to deal with its shrinking profit margin? What would you suggest the firm do in order to address this issue. Make sure that your recommendation(s) relate back to the problem(s) that you identified

1. Benchmarks - Determination of the benchmark ratios for this firm

2. Analysis - The analysis of what the change in the various benchmarks means for the business exhibits good critical thinking and logical outcomes.

3. Recommendation - A clear, actionable recommendation is proposed and the justification for its choice is wellsupported through the examination and analysis of the benchmark ratios for the firm.

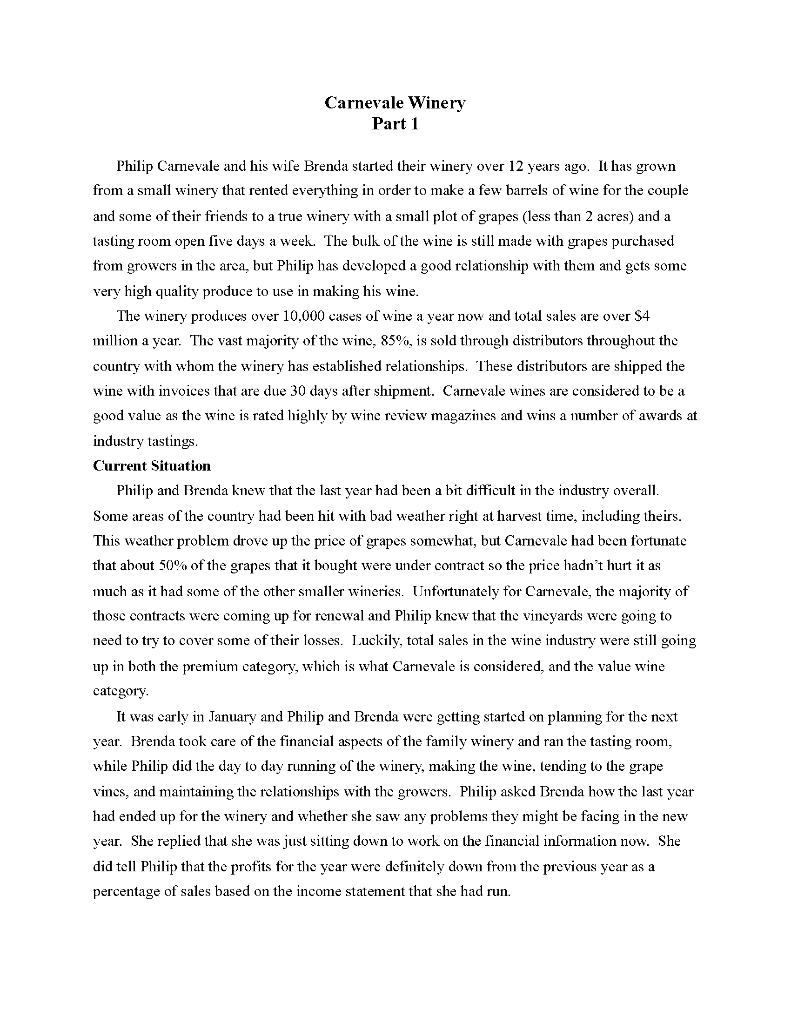

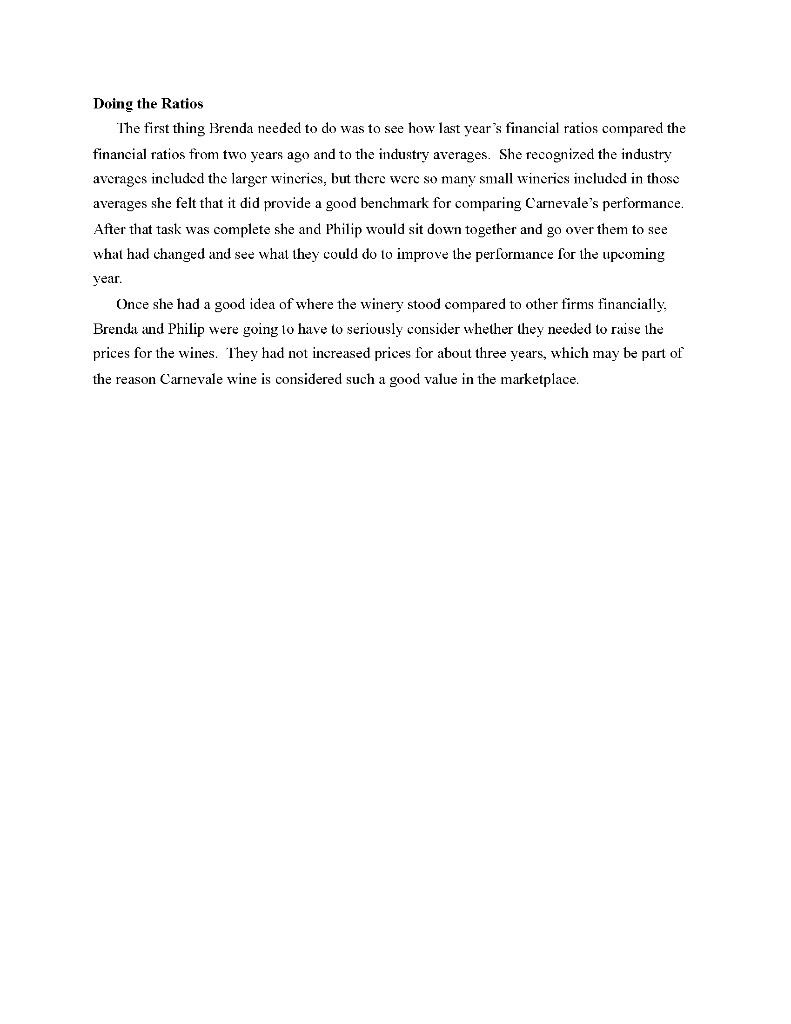

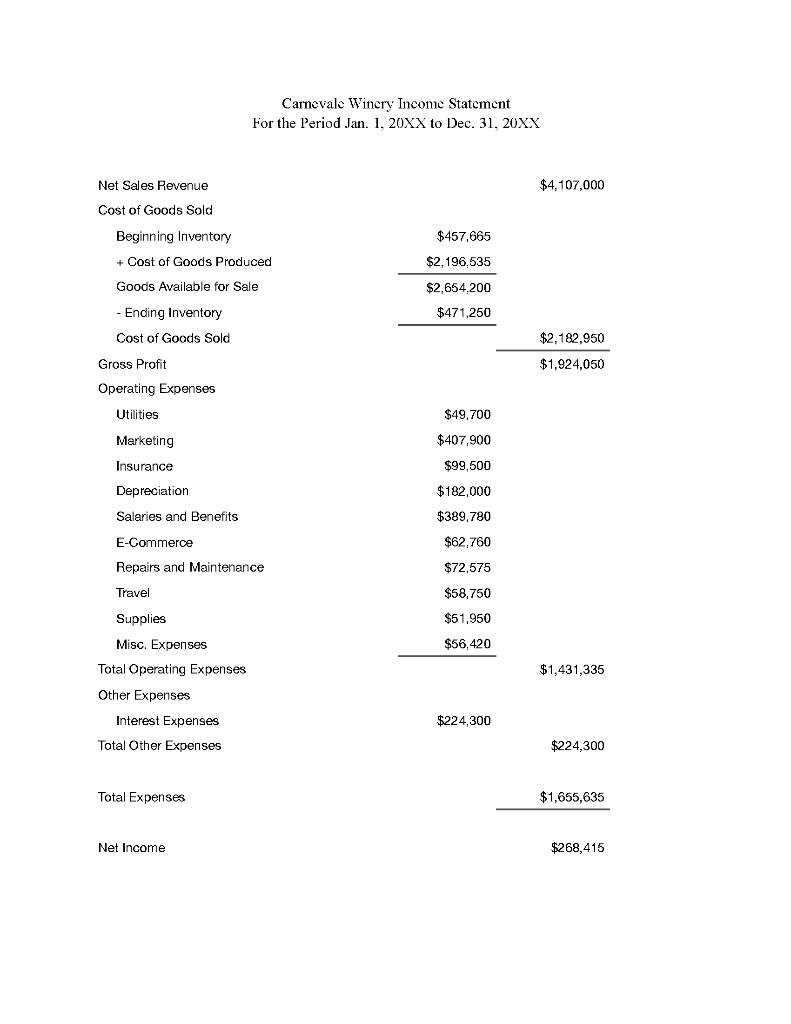

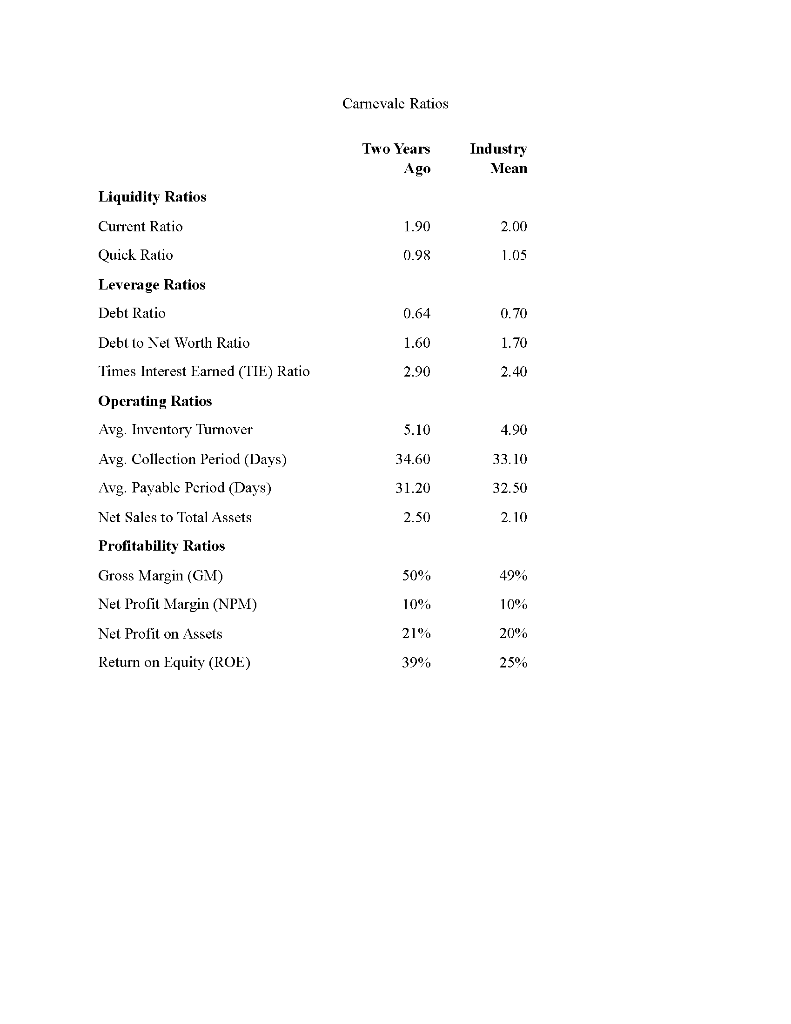

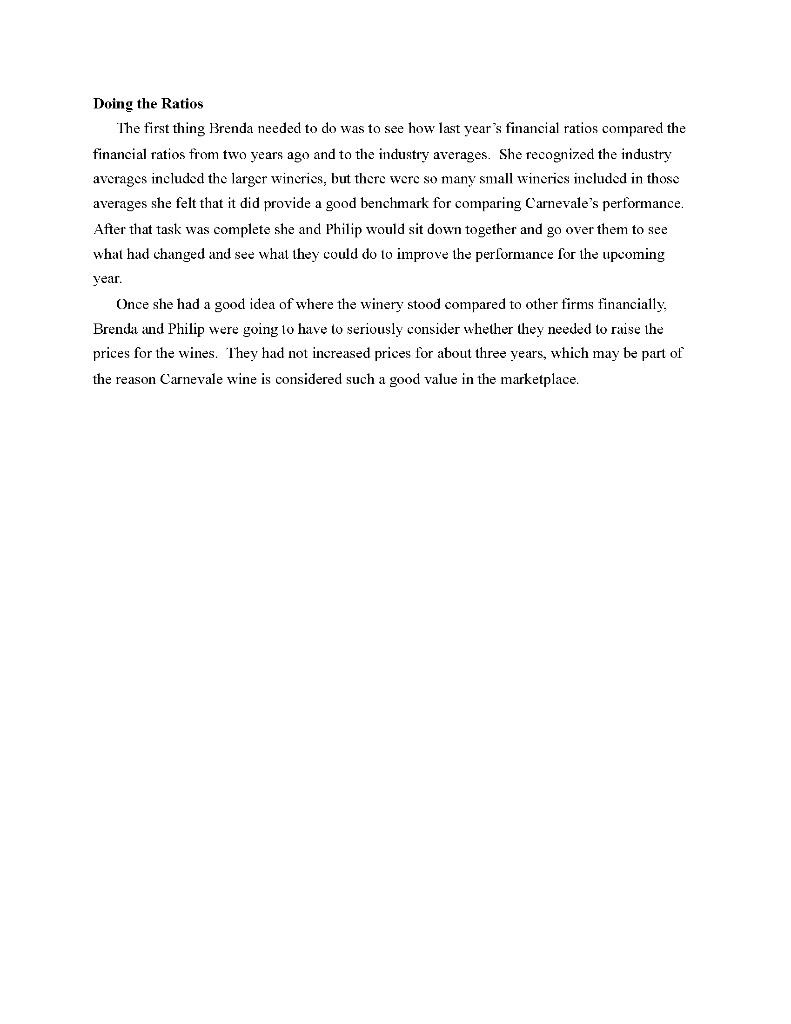

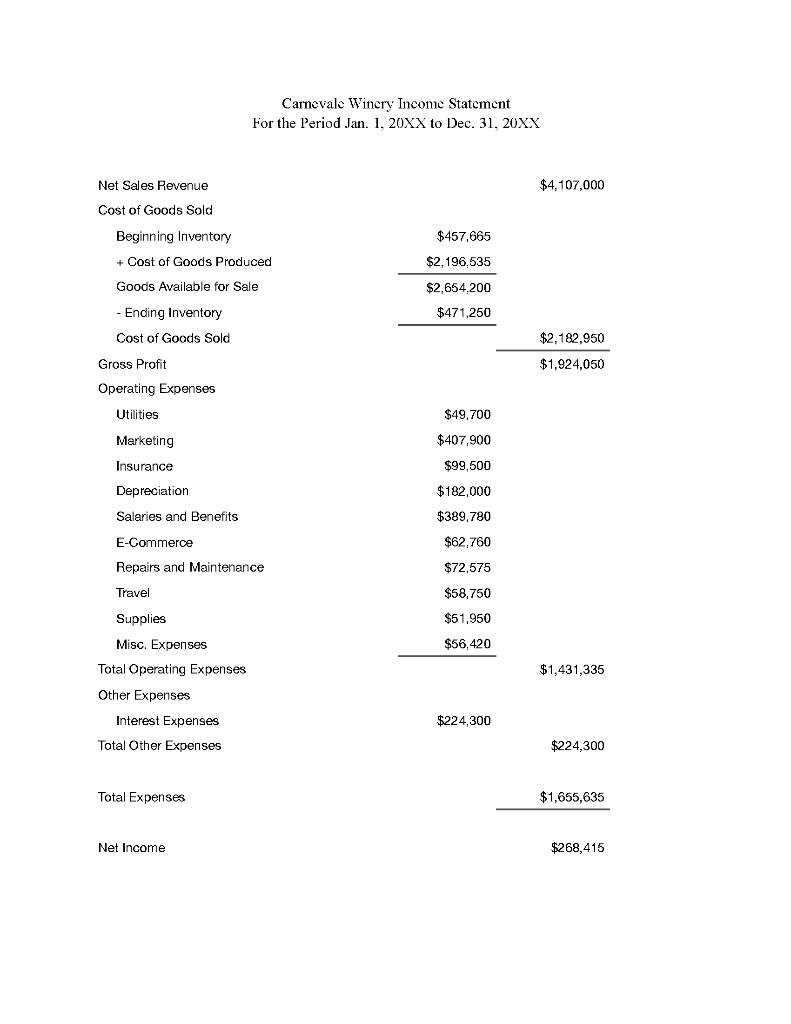

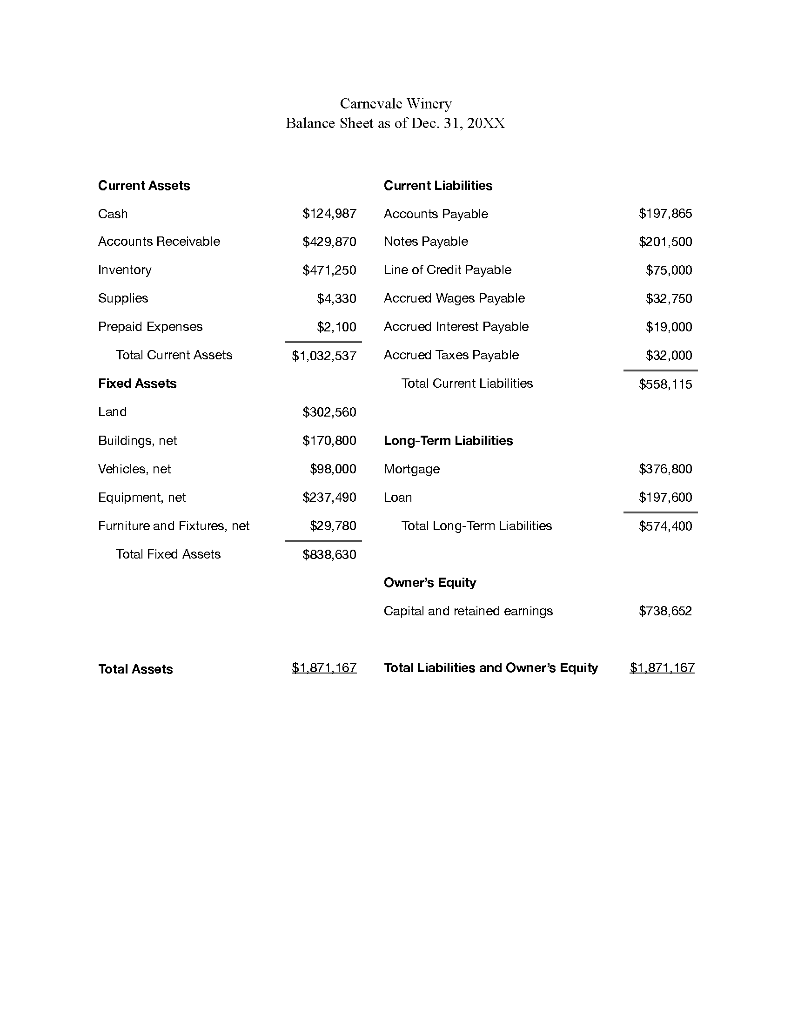

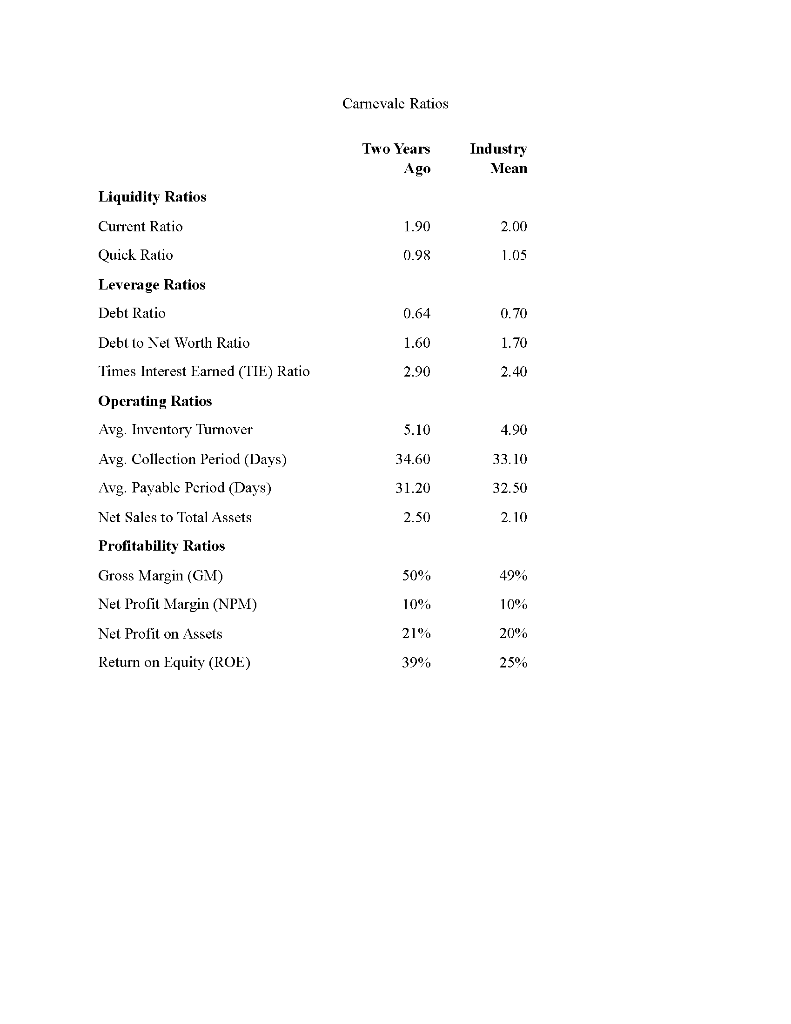

Carnevale Winery Part 1 Philip Carnevale and his wife Brenda started their winery over 12 years ago. It has grown from a small winery that rented everything in order to make a few barrels of wine for the couple and some of their friends to a true winery with a small plot of grapes (less than 2 acres) and a lasting room open five days a week. The bulk of the wine is still made with grapes purchased from growers in the area, but Philip has developed a good relationship with them and gets some very high quality produce to use in making his wine. The winery produces over 10,000 cases of wine a year now and total sales are over $4 million a year. The vast majority of the wine, 85%, is sold through distributors throughout the country with whom the winery has established relationships. These distributors are shipped the wine with invoices that are due 30 days after shipment. Carnevale wines are considered to be a good value as the wine is rated highly by wine review magazines and wins a number of awards at industry tastings Current Situation Philip and Brenda knew that the last year had been a bit difficult in the industry overall. Some areas of the country had been hit with bad weather right at harvest time, including theirs. This weather problem drove up the price of grapes somewhat, but Carnevale had been fortunate that about 50% of the grapes that it bought were under contract so the price hadn't hurt it as much as it had some of the other smaller wineries. Unfortunately for Carnevale, the majority of those contracts were coming up for renewal and Philip know that the vineyards were going to need to try to cover some of their losses. Luckily, total sales in the wine industry were still going up in both the premium category, which is what Carnevale is considered, and the value wine category. It was carly in January and Philip and Brenda were getting started on planning for the next year. Brenda took care of the financial aspects of the family winery and ran the tasting room, while Philip did the day to day running of the winery, making the wine, tending to the grape vines, and maintaining the relationships with the growers. Philip asked Brenda how the last year had ended up for the winery and whether she saw any problems they might be facing in the new vear. She replied that she was just sitting down to work on the financial information now. She did tell Philip that the profits for the year were definitely down from the previous year as a percentage of sales based on the income statement that she had run. Doing the Ratios The first thing Brenda needed to do was to see how last year's financial ratios compared the financial ratios from two years ago and to the industry averages. She recognized the industry averages included the larger wincrics, but there were so many small wineries included in those averages she felt that it did provide a good benchmark for comparing Carnevale's performance. After that task was complete she and Philip would sit down together and go over them to see what had changed and see what they could do to improve the performance for the upcoming year. Once she had a good idea of where the winery stood compared to other firms financially, Brenda and Philip were going to have to seriously consider whether they needed to raise the prices for the wines. They had not increased prices for about three years, which may be part of the reason Carnevale wine is considered such a good value in the marketplace. Carnevale Wincry Income Statement For the Period Jan. 1. 20XX to Dec. 31, 20XX $4,107,000 Net Sales Revenue Cost of Goods Sold Beginning Inventory + Cost of Goods Produced Goods Available for Sale - Ending Inventory Cost of Goods Sold Gross Profit Operating Expenses $457,665 $2,196,535 $2,654.200 $471,250 $2,182,950 $1,924,050 Utilities $49,700 Marketing $407,900 Insurance $99,500 Depreciation $182,000 Salaries and Benefits $389,780 $62,760 E-Commerce Repairs and Maintenance Travel $72,575 $58,750 $51,950 $56,420 Supplies Misc. Expenses Total Operating Expenses Other Expenses $1,431,335 $224,300 Interest Expenses Total Other Expenses $224,300 Total Expenses $1,655,635 Net Income $268,415 Carnevale Winery Balance Sheet as of Dec. 31, 20XX Current Assets Current Liabilities Cash $197,865 $ 124,987 $429,870 Accounts Payable Notes Payable Accounts Receivable $201,500 Inventory $471,250 Line of Credit Payable $75,000 Supplies $4,330 Accrued Wages Payable $32,750 Prepaid Expenses $2,100 Accrued Interest Payable $19,000 Total Current Assets $1,032,537 Accrued Taxes Payable $32,000 Fixed Assets Total Current Liabilities $558,115 Land $302,560 $170,800 Long-Term Liabilities Buildings, net Vehicles, net Equipment, net $98,000 $376,800 Mortgage Loan $237,490 $197,600 Furniture and Fixtures, net $29,780 Total Long-Term Liabilities $574,400 Total Fixed Assets $838,630 Owner's Equity Capital and retained earnings $738,652 Total Assets $1,871,167 Total Liabilities and Owner's Equity $1,871,167 Camevale Ratios Two Years Ago Industry Viean Liquidity Ratios Current Ratio 1.90 2.00 Quick Ratio 0.98 1.05 Leverage Ratios Debt Ratio 0.64 0.70 1.70 1.60 2.90 2.40 5.10 4.90 34.60 33.10 32.50 Debt to Net Worth Ratio Times Interest Earned (TIE) Ratio Operating Ratios Avg. Inventory Turnover Avg. Collection Period (Days) Avg. Payable Period (Days) Net Sales to Total Assets Profitability Ratios Gross Margin (GM) Net Profit Margin (NPM) Net Profit on Assets Return on Equity (ROE) 31.20 2.50 2.10 50% 49% 10% 10% 21% 20% 39% 25% Carnevale Winery Part 1 Philip Carnevale and his wife Brenda started their winery over 12 years ago. It has grown from a small winery that rented everything in order to make a few barrels of wine for the couple and some of their friends to a true winery with a small plot of grapes (less than 2 acres) and a lasting room open five days a week. The bulk of the wine is still made with grapes purchased from growers in the area, but Philip has developed a good relationship with them and gets some very high quality produce to use in making his wine. The winery produces over 10,000 cases of wine a year now and total sales are over $4 million a year. The vast majority of the wine, 85%, is sold through distributors throughout the country with whom the winery has established relationships. These distributors are shipped the wine with invoices that are due 30 days after shipment. Carnevale wines are considered to be a good value as the wine is rated highly by wine review magazines and wins a number of awards at industry tastings Current Situation Philip and Brenda knew that the last year had been a bit difficult in the industry overall. Some areas of the country had been hit with bad weather right at harvest time, including theirs. This weather problem drove up the price of grapes somewhat, but Carnevale had been fortunate that about 50% of the grapes that it bought were under contract so the price hadn't hurt it as much as it had some of the other smaller wineries. Unfortunately for Carnevale, the majority of those contracts were coming up for renewal and Philip know that the vineyards were going to need to try to cover some of their losses. Luckily, total sales in the wine industry were still going up in both the premium category, which is what Carnevale is considered, and the value wine category. It was carly in January and Philip and Brenda were getting started on planning for the next year. Brenda took care of the financial aspects of the family winery and ran the tasting room, while Philip did the day to day running of the winery, making the wine, tending to the grape vines, and maintaining the relationships with the growers. Philip asked Brenda how the last year had ended up for the winery and whether she saw any problems they might be facing in the new vear. She replied that she was just sitting down to work on the financial information now. She did tell Philip that the profits for the year were definitely down from the previous year as a percentage of sales based on the income statement that she had run. Doing the Ratios The first thing Brenda needed to do was to see how last year's financial ratios compared the financial ratios from two years ago and to the industry averages. She recognized the industry averages included the larger wincrics, but there were so many small wineries included in those averages she felt that it did provide a good benchmark for comparing Carnevale's performance. After that task was complete she and Philip would sit down together and go over them to see what had changed and see what they could do to improve the performance for the upcoming year. Once she had a good idea of where the winery stood compared to other firms financially, Brenda and Philip were going to have to seriously consider whether they needed to raise the prices for the wines. They had not increased prices for about three years, which may be part of the reason Carnevale wine is considered such a good value in the marketplace. Carnevale Wincry Income Statement For the Period Jan. 1. 20XX to Dec. 31, 20XX $4,107,000 Net Sales Revenue Cost of Goods Sold Beginning Inventory + Cost of Goods Produced Goods Available for Sale - Ending Inventory Cost of Goods Sold Gross Profit Operating Expenses $457,665 $2,196,535 $2,654.200 $471,250 $2,182,950 $1,924,050 Utilities $49,700 Marketing $407,900 Insurance $99,500 Depreciation $182,000 Salaries and Benefits $389,780 $62,760 E-Commerce Repairs and Maintenance Travel $72,575 $58,750 $51,950 $56,420 Supplies Misc. Expenses Total Operating Expenses Other Expenses $1,431,335 $224,300 Interest Expenses Total Other Expenses $224,300 Total Expenses $1,655,635 Net Income $268,415 Carnevale Winery Balance Sheet as of Dec. 31, 20XX Current Assets Current Liabilities Cash $197,865 $ 124,987 $429,870 Accounts Payable Notes Payable Accounts Receivable $201,500 Inventory $471,250 Line of Credit Payable $75,000 Supplies $4,330 Accrued Wages Payable $32,750 Prepaid Expenses $2,100 Accrued Interest Payable $19,000 Total Current Assets $1,032,537 Accrued Taxes Payable $32,000 Fixed Assets Total Current Liabilities $558,115 Land $302,560 $170,800 Long-Term Liabilities Buildings, net Vehicles, net Equipment, net $98,000 $376,800 Mortgage Loan $237,490 $197,600 Furniture and Fixtures, net $29,780 Total Long-Term Liabilities $574,400 Total Fixed Assets $838,630 Owner's Equity Capital and retained earnings $738,652 Total Assets $1,871,167 Total Liabilities and Owner's Equity $1,871,167 Camevale Ratios Two Years Ago Industry Viean Liquidity Ratios Current Ratio 1.90 2.00 Quick Ratio 0.98 1.05 Leverage Ratios Debt Ratio 0.64 0.70 1.70 1.60 2.90 2.40 5.10 4.90 34.60 33.10 32.50 Debt to Net Worth Ratio Times Interest Earned (TIE) Ratio Operating Ratios Avg. Inventory Turnover Avg. Collection Period (Days) Avg. Payable Period (Days) Net Sales to Total Assets Profitability Ratios Gross Margin (GM) Net Profit Margin (NPM) Net Profit on Assets Return on Equity (ROE) 31.20 2.50 2.10 50% 49% 10% 10% 21% 20% 39% 25%