Question

Q3. [ ] An asset has a purchase price of SR 800,000 and expected to realize a net revenue of SR 190,000 each year

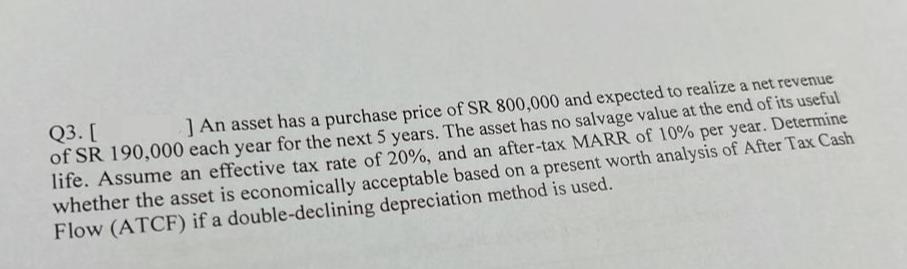

Q3. [ ] An asset has a purchase price of SR 800,000 and expected to realize a net revenue of SR 190,000 each year for the next 5 years. The asset has no salvage value at the end of its useful life. Assume an effective tax rate of 20%, and an after-tax MARR of 10% per year. Determine whether the asset is economically acceptable based on a present worth analysis of After Tax Cash Flow (ATCF) if a double-declining depreciation method is used.

Step by Step Solution

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Solution Equation of two simple harmonic moti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting Decision Making and Performance Management

Authors: Ray Proctor

4th edition

273764489, 978-0273764489

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App