Answered step by step

Verified Expert Solution

Question

1 Approved Answer

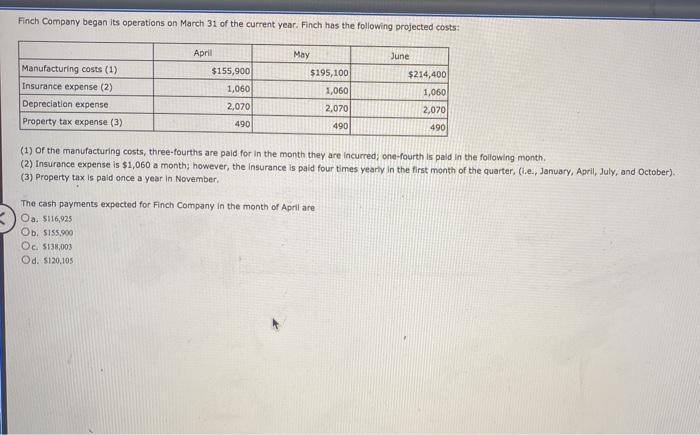

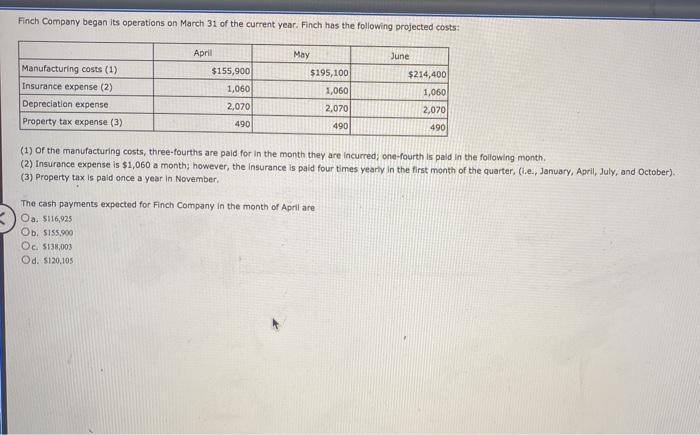

Determine cash payments expected for finch company in the month of April Finch Company began its operations on March 31 of the current year. Finch

Determine cash payments expected for finch company in the month of April

Finch Company began its operations on March 31 of the current year. Finch has the following projected costs: April May June $214,400 Manufacturing costs (1) Insurance expense (2) Depreciation expense Property tax expense (3) $155,900 1,060 2,070 490 $195,100 2,060 2.070 1,060 2,070 490 490 (1) of the manufacturing costs, three-fourths are paid for in the month they are incurred; one-fourth is paid in the following month. (2) Insurance expense is $1,060 a month; however, the insurance is paid four times yearly in the first month of the quarter. (.e., January, April, July, and October). (3) Property tax is paid once a year in November The cash payments expected for Finch Company in the month of April are Oa. $116,925 Ob 5155.900 Oc. 5138,003 Od S120.105

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started