Answered step by step

Verified Expert Solution

Question

1 Approved Answer

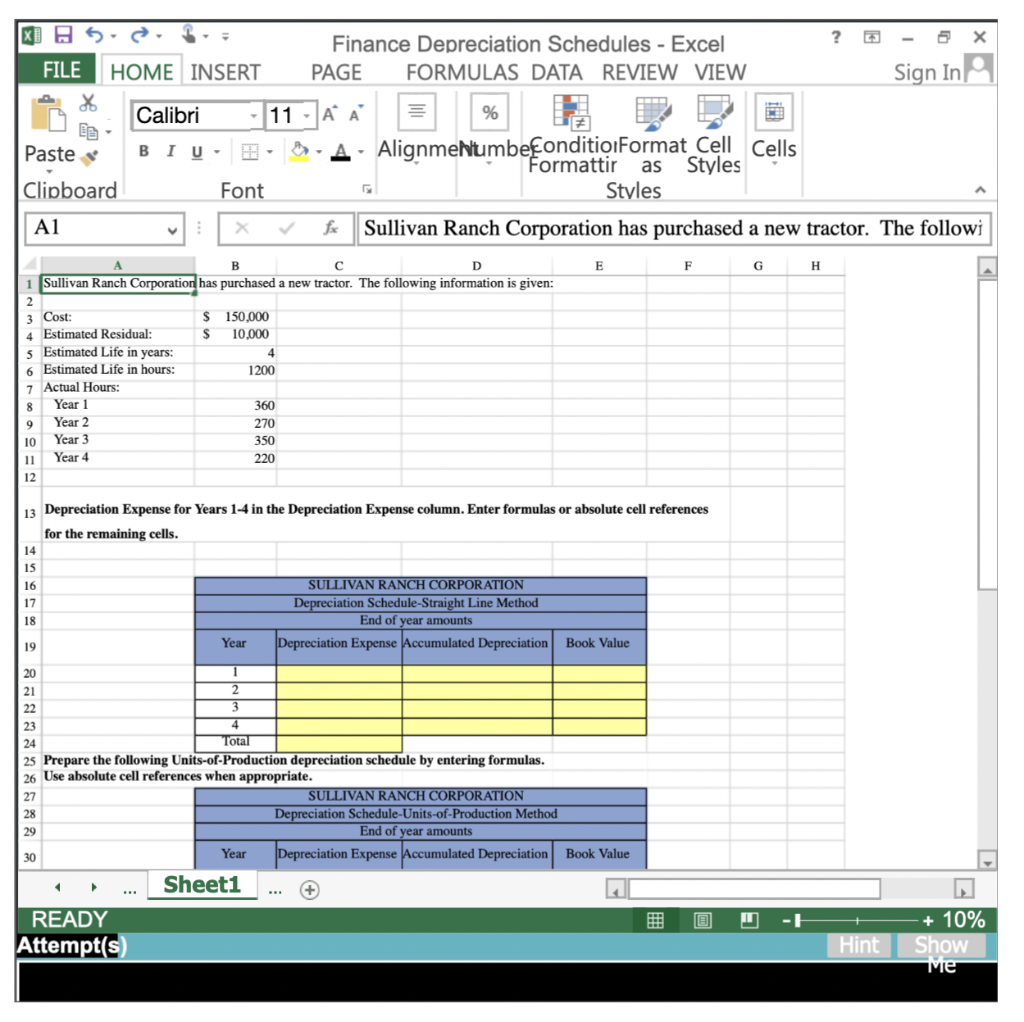

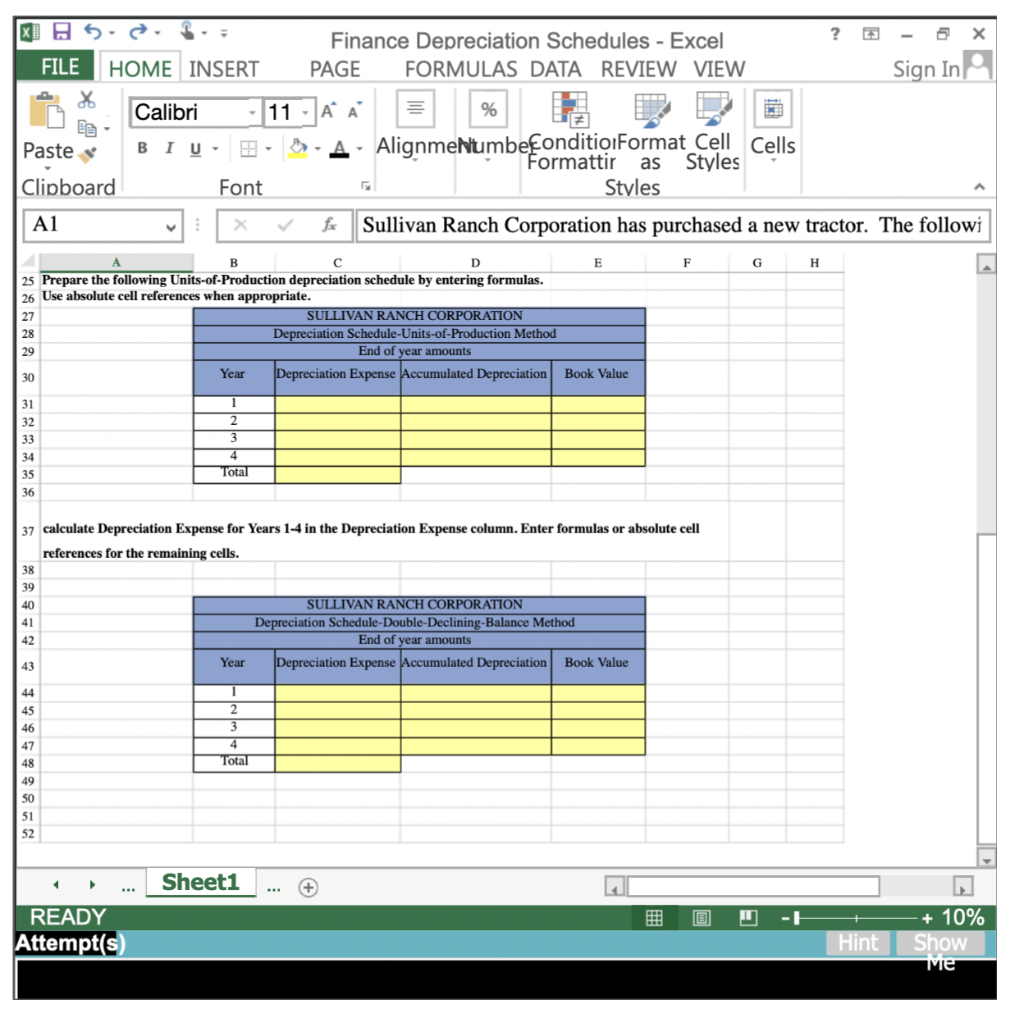

Determine depreciation using three methods. ( SOLVE AS FORMULAS ) Prepare depreciation schedules using Straight-Line, Units-of-Production, and Double-Declining Balance Depreciation. XBB5 FILE HOME INSERT Calibri

Determine depreciation using three methods. ( SOLVE AS FORMULAS )

- Prepare depreciation schedules using Straight-Line, Units-of-Production, and Double-Declining Balance Depreciation.

XBB5 FILE HOME INSERT Calibri - 11 Paste BIU Clipboard Font Finance Depreciation Schedules - Excel PAGE FORMULAS DATA REVIEW VIEW Sign In A % AlignmeNumbeconditioFormat Cell Cells Formattir as Styles Styles fx Sullivan Ranch Corporation has purchased a new tractor. The followi A1 E F G H B D 1 Sullivan Ranch Corporation has purchased a new tractor. The following information is given: 2 3 Cost: S 150,000 4 Estimated Residual: $ 10,000 5 Estimated Life in years: 4 6 Estimated Life in hours: 1200 7 Actual Hours: 8 Year 1 360 9 Year 2 270 10 Year 3 350 11 Year 4 220 12 13 Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. 14 15 16 17 18 SULLIVAN RANCH CORPORATION Depreciation Schedule-Straight Line Method End of year amounts Depreciation Expense Accumulated Depreciation Book Value 19 Year 20 1 21 2 22 3 23 4 24 Total 25 Prepare the following Units-of-Production depreciation schedule by entering formulas. 26 Use absolute cell references when appropriate. 27 SULLIVAN RANCH CORPORATION Depreciation Schedule-Units-of-Production Method End of year amounts Year 30 Depreciation Expense Accumulated Depreciation Book Value Sheet1 READY Attempt(s) 28 29 Hint + 10% Show Me XA ? 6 Finance Depreciation Schedules - Excel PAGE FORMULAS DATA REVIEW VIEW HOME INSERT Sign In FILE Calibri - 11 Paste BIU | A % - Alignmehlumbeconditio Format Cell Cells Formattir as Styles Styles Clipboard Font A1 fx Sullivan Ranch Corporation has purchased a new tractor. The followi F G H B D E 25 Prepare the following Units-of-Production depreciation schedule by entering formulas. 26 Use absolute cell references when appropriate. SULLIVAN RANCH CORPORATION Depreciation Schedule-Units-of-Production Method End of year amounts 30 Year Depreciation Expense Accumulated Depreciation Book Value 28 29 31 32 33 2 3 4 Total 34 35 36 37 calculate Depreciation Expense for Years 1-4 in the Depreciation Expense column. Enter formulas or absolute cell references for the remaining cells. 38 39 40 41 42 SULLIVAN RANCH CORPORATION Depreciation Schedule-Double-Declining-Balance Method End of year amounts Depreciation Expense Accumulated Depreciation Book Value Year 43 44 45 46 1 2 3 4 Total 47 48 49 50 51 52 Sheet1 + 10% READY Attempt(s) Hint Show Me

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started