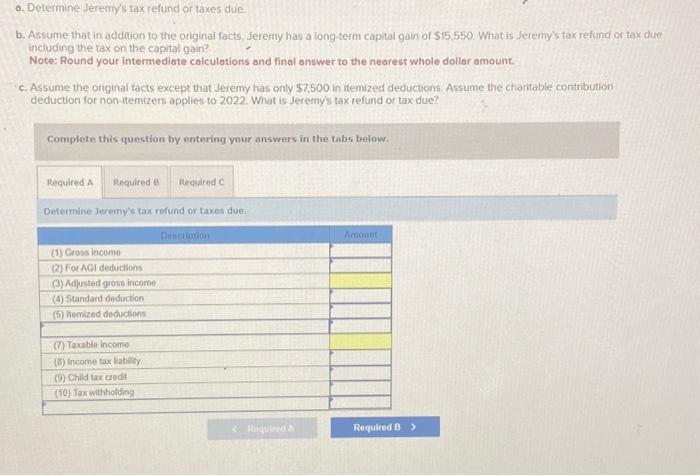

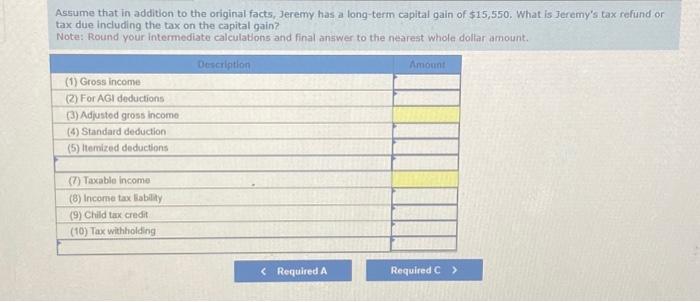

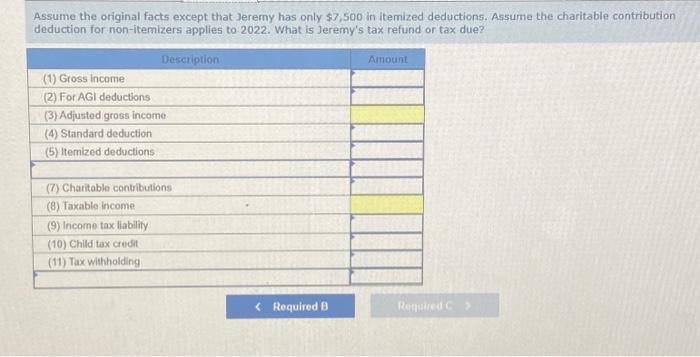

Determine Jeremy's tax refund of taxes due Assume that in addition to the original facts, Jeremy has a long-term capital gain of $15,550. What is Jeremy's tac refund or tax due including the tax on the capital gain? Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. c. Assume the original facts except that Jeremy has only $7.500 in itemized deductions. Assume the charitable contribution deduction for non-tiemizers applies to 2022. What is Jeremy's tax refund or tax due? Complete this question by entering your answers in the tabs below. Determine Jeremy's tax refund or taxes due. Assume that in addition to the original facts, Jeremy has a long-term capital gain of $15,550. What is Jeremy's tax refund or tax due including the tax on the capital gain? Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Assume the original facts except that Jeremy has only $7,500 in itemized deductions. Assume the charitable contribution deduction for non-itemizers applies to 2022. What is Jeremy's tax refund or tax due? Determine Jeremy's tax refund of taxes due Assume that in addition to the original facts, Jeremy has a long-term capital gain of $15,550. What is Jeremy's tac refund or tax due including the tax on the capital gain? Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. c. Assume the original facts except that Jeremy has only $7.500 in itemized deductions. Assume the charitable contribution deduction for non-tiemizers applies to 2022. What is Jeremy's tax refund or tax due? Complete this question by entering your answers in the tabs below. Determine Jeremy's tax refund or taxes due. Assume that in addition to the original facts, Jeremy has a long-term capital gain of $15,550. What is Jeremy's tax refund or tax due including the tax on the capital gain? Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Assume the original facts except that Jeremy has only $7,500 in itemized deductions. Assume the charitable contribution deduction for non-itemizers applies to 2022. What is Jeremy's tax refund or tax due