Answered step by step

Verified Expert Solution

Question

1 Approved Answer

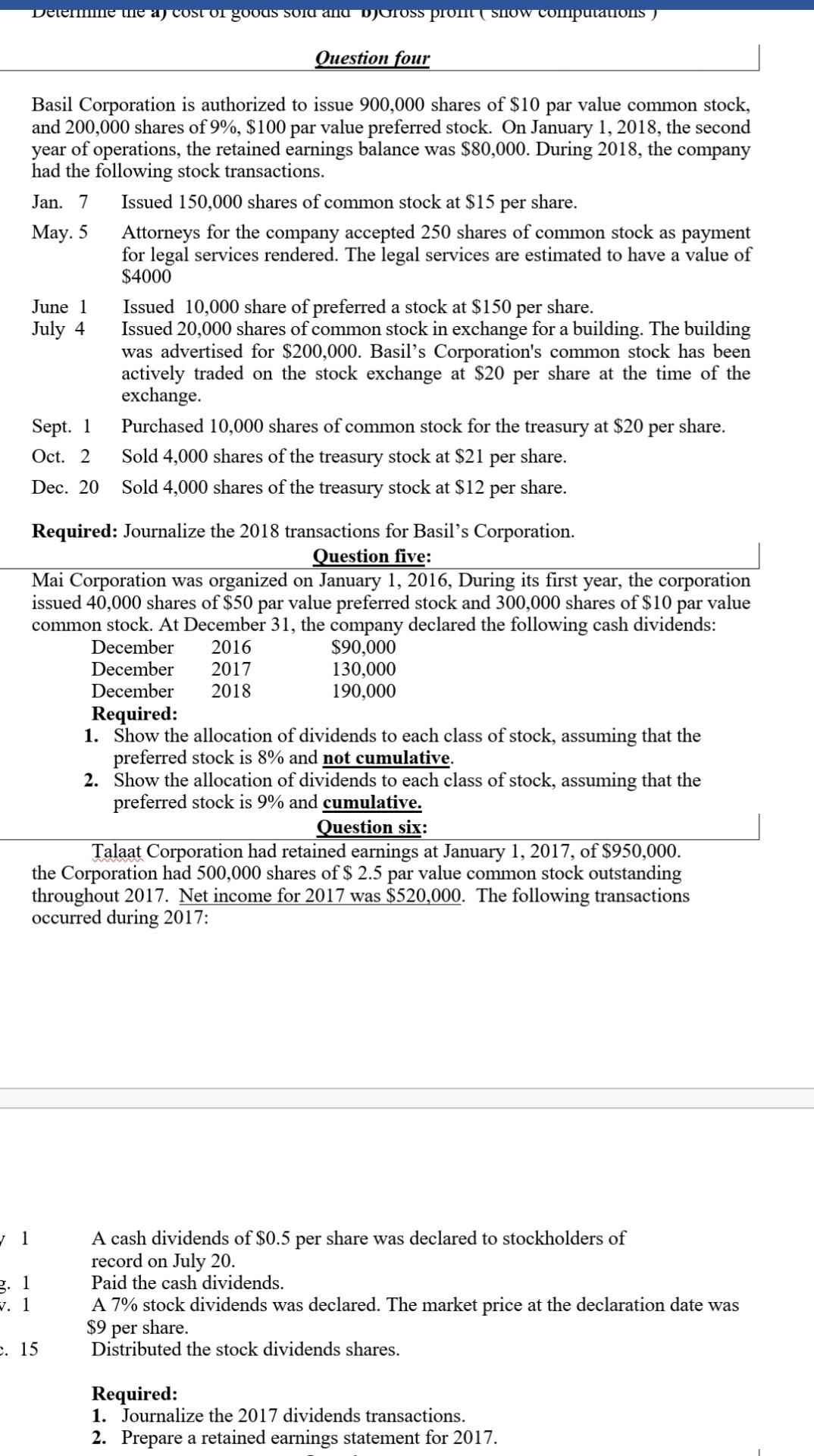

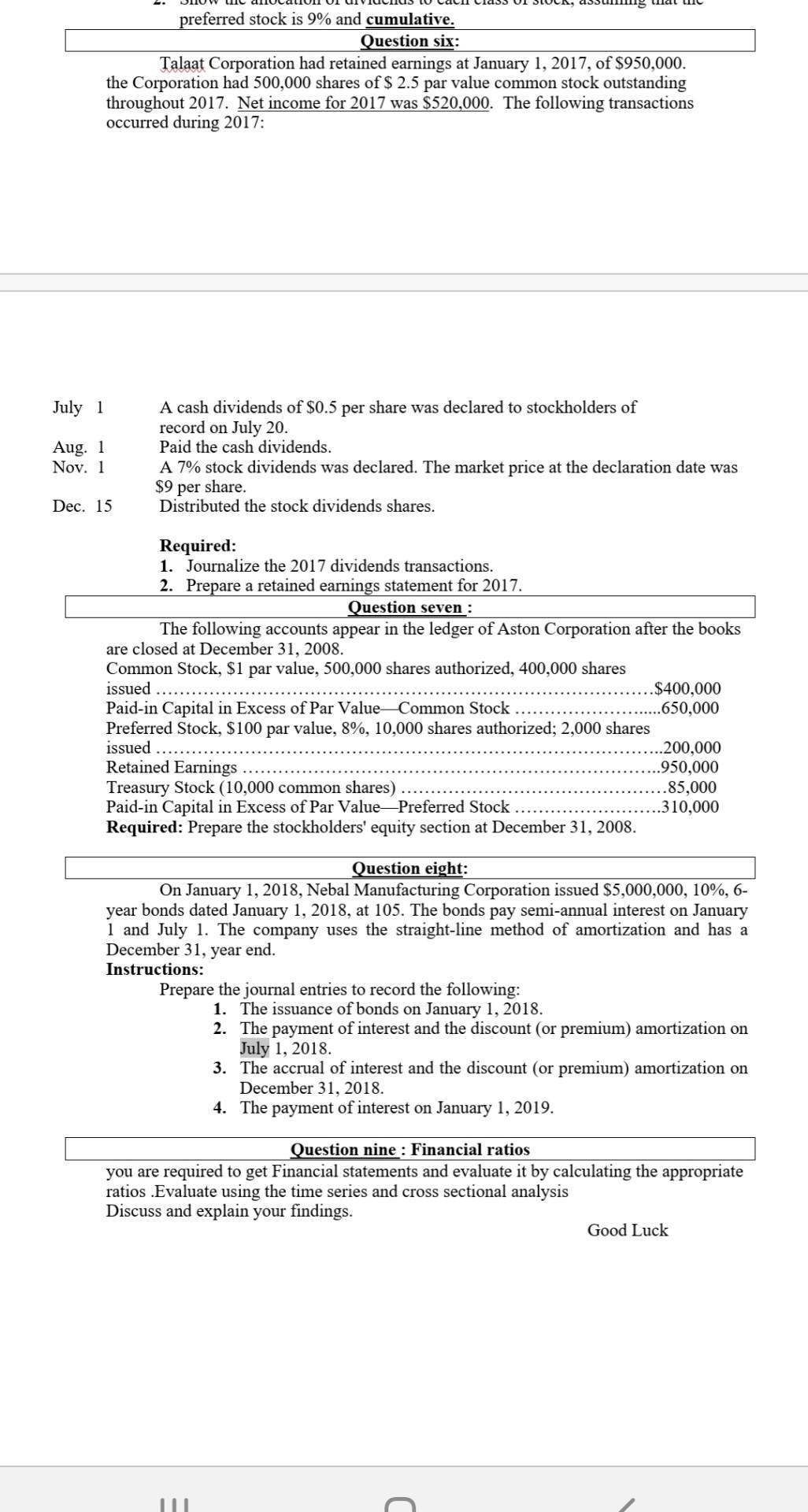

Determine me a cost or goods sold and DJUross prom SHOW computations) Question four Basil Corporation is authorized to issue 900,000 shares of $10 par

Determine me a cost or goods sold and DJUross prom SHOW computations) Question four Basil Corporation is authorized to issue 900,000 shares of $10 par value common stock, and 200,000 shares of 9%, $100 par value preferred stock. On January 1, 2018, the second year of operations, the retained earnings balance was $80,000. During 2018, the company had the following stock transactions. Jan. 7 Issued 150,000 shares of common stock at $15 per share. May. 5 Attorneys for the company accepted 250 shares of common stock as payment for legal services rendered. The legal services are estimated to have a value of $4000 June 1 Issued 10,000 share of preferred a stock at $150 per share. July 4 Issued 20,000 shares of common stock in exchange for a building. The building was advert ed for $200,000. Basil's Corporation's common stock has actively traded on the stock exchange at $20 per share at the time of the exchange. Sept. 1 Purchased 10,000 shares of common stock for the treasury at $20 per share. Oct. 2 Sold 4,000 shares of the treasury stock at $21 per share. Dec. 20 Sold 4,000 shares of the treasury stock at $12 per share. Required: Journalize the 2018 transactions for Basil's Corporation. Question five: Mai Corporation was organized on January 1, 2016, During its first year, the corporation issued 40,000 shares of $50 par value preferred stock and 300,000 shares of $10 par value common stock. At December 31, the company declared the following cash dividends: December 2016 $90,000 December 2017 130,000 December 2018 190,000 Required: 1. Show the allocation of dividends to each class of stock, assuming that the preferred stock is 8% and not cumulative. 2. Show the allocation of dividends to each class of stock, assuming that the preferred stock is 9% and cumulative. Question six: Talaat Corporation had retained earnings at January 1, 2017, of $950,000. the Corporation had 500,000 shares of $ 2.5 par value common stock outstanding throughout 2017. Net income for 2017 was $520,000. The following transactions occurred during 2017: 3. 1 w. 1 A cash dividends of $0.5 per share was declared to stockholders of record on July 20. Paid the cash dividends. A 7% stock dividends was declared. The market price at the declaration date was $9 per share. Distributed the stock dividends shares. . 15 Required: 1. Journalize the 2017 dividends transactions. 2. Prepare a retained earnings statement for 2017. preferred stock is 9% and cumulative. Question six: Talaat Corporation had retained earnings at January 1, 2017, of $950,000. the Corporation had 500,000 shares of $ 2.5 par value common stock outstanding throughout 2017. Net income for 2017 was $520,000. The following transactions occurred during 2017: July 1 Aug. 1 Nov. 1 A cash dividends of $0.5 per share was declared to stockholders of record on July 20. Paid the cash dividends. A 7% stock dividends was declared. The market price at the declaration date was $9 per share. Distributed the stock dividends shares. Dec. 15 Required: 1. Journalize the 2017 dividends transactions. 2. Prepare a retained earnings statement for 2017. Question seven : The following accounts appear in the ledger of Aston Corporation after the books are closed at December 31, 2008. Common Stock, $1 par value, 500,000 shares authorized, 400,000 shares issued $400,000 Paid-in Capital in Excess of Par ValueCommon Stock .650,000 Preferred Stock, $100 par value, 8%, 10,000 shares authorized; 2,000 shares issued .200,000 Retained Earnings ..950,000 Treasury Stock (10,000 common shares) ..85,000 Paid-in Capital in Excess of Par ValuePreferred Stock ..310,000 Required: Prepare the stockholders' equity section at December 31, 2008. Question eight: On January 1, 2018, Nebal Manufacturing Corporation issued $5,000,000, 10%, 6- year bonds dated January 1, 2018, at 105. The bonds pay semi-annual interest on January 1 and July 1. The company uses the straight-line method of amortization and has a December 31, year end. Instructions: Prepare the journal entries to record the following: 1. The issuance of bonds on January 1, 2018. 2. The payment of interest and the discount (or premium) amortization on July 1, 2018. 3. The accrual of interest and the discount (or premium) amortization on December 31, 2018. 4. The payment of interest on January 1, 2019. Question nine : Financial ratios you are required to get Financial statements and evaluate it by calculating the appropriate ratios .Evaluate using the time series and cross sectional analysis Discuss and explain your findings. Good Luck u C Determine me a cost or goods sold and DJUross prom SHOW computations) Question four Basil Corporation is authorized to issue 900,000 shares of $10 par value common stock, and 200,000 shares of 9%, $100 par value preferred stock. On January 1, 2018, the second year of operations, the retained earnings balance was $80,000. During 2018, the company had the following stock transactions. Jan. 7 Issued 150,000 shares of common stock at $15 per share. May. 5 Attorneys for the company accepted 250 shares of common stock as payment for legal services rendered. The legal services are estimated to have a value of $4000 June 1 Issued 10,000 share of preferred a stock at $150 per share. July 4 Issued 20,000 shares of common stock in exchange for a building. The building was advert ed for $200,000. Basil's Corporation's common stock has actively traded on the stock exchange at $20 per share at the time of the exchange. Sept. 1 Purchased 10,000 shares of common stock for the treasury at $20 per share. Oct. 2 Sold 4,000 shares of the treasury stock at $21 per share. Dec. 20 Sold 4,000 shares of the treasury stock at $12 per share. Required: Journalize the 2018 transactions for Basil's Corporation. Question five: Mai Corporation was organized on January 1, 2016, During its first year, the corporation issued 40,000 shares of $50 par value preferred stock and 300,000 shares of $10 par value common stock. At December 31, the company declared the following cash dividends: December 2016 $90,000 December 2017 130,000 December 2018 190,000 Required: 1. Show the allocation of dividends to each class of stock, assuming that the preferred stock is 8% and not cumulative. 2. Show the allocation of dividends to each class of stock, assuming that the preferred stock is 9% and cumulative. Question six: Talaat Corporation had retained earnings at January 1, 2017, of $950,000. the Corporation had 500,000 shares of $ 2.5 par value common stock outstanding throughout 2017. Net income for 2017 was $520,000. The following transactions occurred during 2017: 3. 1 w. 1 A cash dividends of $0.5 per share was declared to stockholders of record on July 20. Paid the cash dividends. A 7% stock dividends was declared. The market price at the declaration date was $9 per share. Distributed the stock dividends shares. . 15 Required: 1. Journalize the 2017 dividends transactions. 2. Prepare a retained earnings statement for 2017. preferred stock is 9% and cumulative. Question six: Talaat Corporation had retained earnings at January 1, 2017, of $950,000. the Corporation had 500,000 shares of $ 2.5 par value common stock outstanding throughout 2017. Net income for 2017 was $520,000. The following transactions occurred during 2017: July 1 Aug. 1 Nov. 1 A cash dividends of $0.5 per share was declared to stockholders of record on July 20. Paid the cash dividends. A 7% stock dividends was declared. The market price at the declaration date was $9 per share. Distributed the stock dividends shares. Dec. 15 Required: 1. Journalize the 2017 dividends transactions. 2. Prepare a retained earnings statement for 2017. Question seven : The following accounts appear in the ledger of Aston Corporation after the books are closed at December 31, 2008. Common Stock, $1 par value, 500,000 shares authorized, 400,000 shares issued $400,000 Paid-in Capital in Excess of Par ValueCommon Stock .650,000 Preferred Stock, $100 par value, 8%, 10,000 shares authorized; 2,000 shares issued .200,000 Retained Earnings ..950,000 Treasury Stock (10,000 common shares) ..85,000 Paid-in Capital in Excess of Par ValuePreferred Stock ..310,000 Required: Prepare the stockholders' equity section at December 31, 2008. Question eight: On January 1, 2018, Nebal Manufacturing Corporation issued $5,000,000, 10%, 6- year bonds dated January 1, 2018, at 105. The bonds pay semi-annual interest on January 1 and July 1. The company uses the straight-line method of amortization and has a December 31, year end. Instructions: Prepare the journal entries to record the following: 1. The issuance of bonds on January 1, 2018. 2. The payment of interest and the discount (or premium) amortization on July 1, 2018. 3. The accrual of interest and the discount (or premium) amortization on December 31, 2018. 4. The payment of interest on January 1, 2019. Question nine : Financial ratios you are required to get Financial statements and evaluate it by calculating the appropriate ratios .Evaluate using the time series and cross sectional analysis Discuss and explain your findings. Good Luck u C

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started