Question

determine Mike and Molly's overall federal income tax owed/refund for the current year Mike and Molly are happily married and want to file a joint

determine Mike and Molly's overall federal income tax owed/refund for the current year

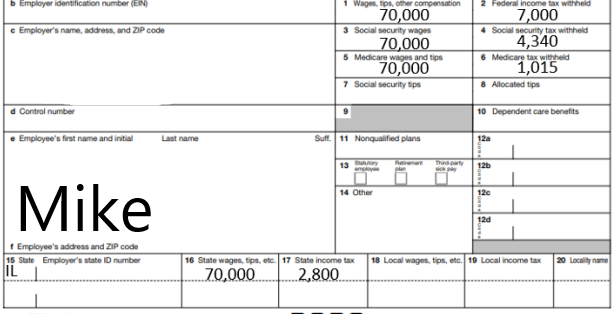

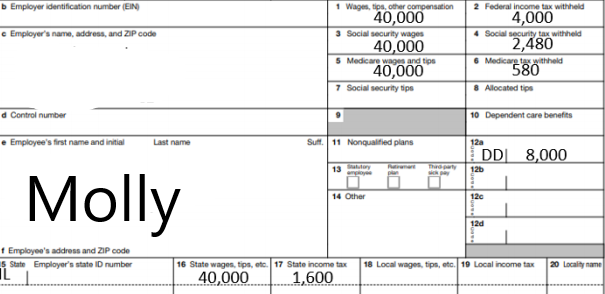

Mike and Molly are happily married and want to file a joint return. Mike works for Brown Corporation and Molly works for Red Inc. Their W-2s are included below. They have two children, who live at home with them. Kelly is 6 years old and Celeste is 17 years old. Mindy is a high school student, but she has a part-time job where she earned $4,900. The entire family has health insurance through Molly's employer. Premiums were $20,000, $8,000 of which was covered by Red Inc.(as indicated by code DD on his W-2). The family also had to pay $2,000 for various copays (not paid for by insurance) for doctor visits, medical tests, and prescription medicine. They had the following sales during the year: Sale of AMD stock for $2,200, purchased 2 years ago for $1,200. Sale of Cub Inc. stock for $9,000, purchased 3 months ago for $4,000. Sale of J Corp. stock for $1,600, purchased 3 years ago for $12,600. 20 days before selling the stock they received a dividend of $1,000 from J Corp. They made an $800 donation to their favorite public charity during the year. They incurred the following expenses related to their primary residence: Property taxes 7,500 Mortgage interest 9,000 Homeowners insurance 1,200 Cost of replacing roof 6,000 Utilities 2,400 They also own a townhouse that they rent out (as a residential property): Rental income 40,000 Mortgage interest 11,000 Property taxes 7,000 Utilities 1,800 Repairs and maintenance 5,000 Insurance 3,000 They purchased the rental townhouse in March 2016 for $300,000. Assume their rental activity does not qualify for the QBI deduction.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started