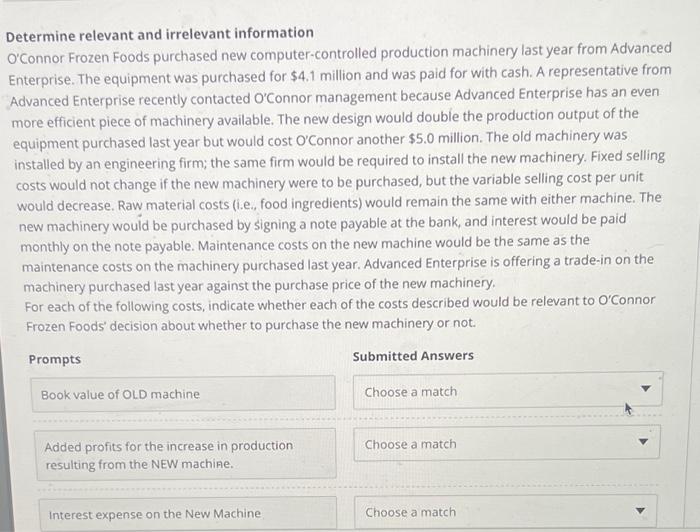

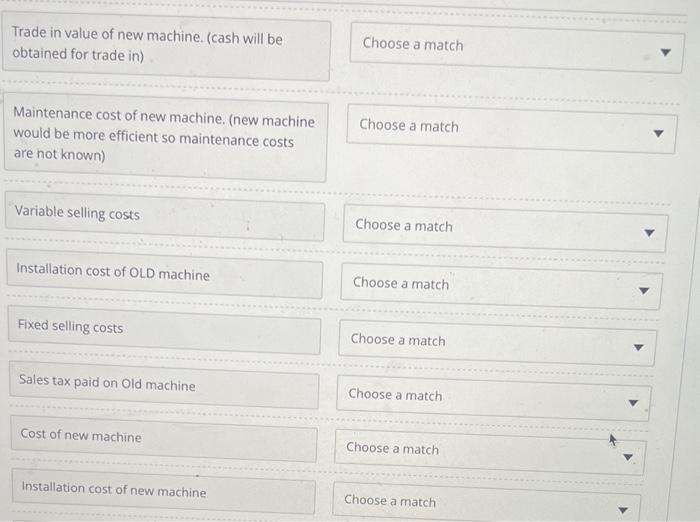

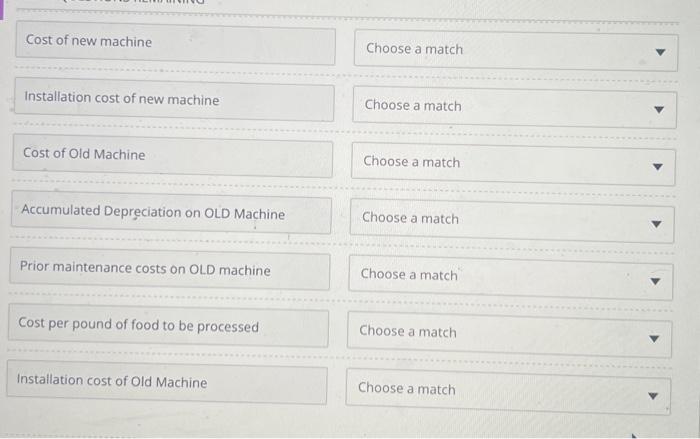

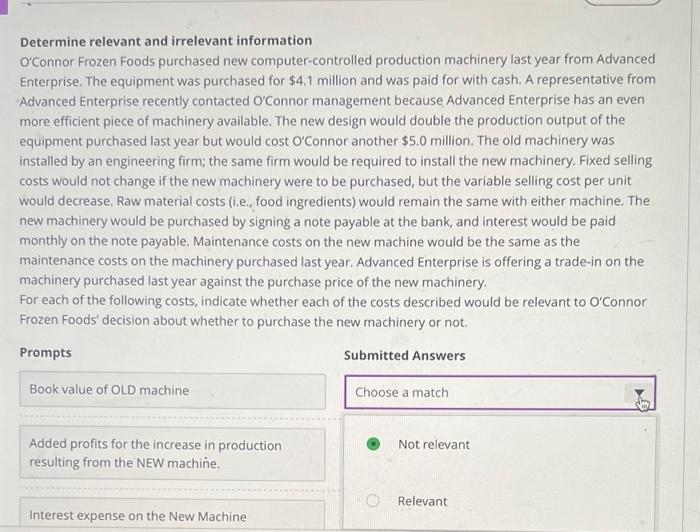

Determine relevant and irrelevant information Connor Frozen Foods purchased new computer-controlled production machinery last year from Advanced Enterprise. The equipment was purchased for $4.1 million and was paid for with cash. A representative from Advanced Enterprise recently contacted O'Connor management because Advanced Enterprise has an even more efficient piece of machinery available. The new design would double the production output of the equipment purchased last year but would cost O Connor another $5.0 million. The old machinery was installed by an engineering firm; the same firm would be required to install the new machinery. Fixed selling costs would not change if the new machinery were to be purchased, but the variable selling cost per unit would decrease. Raw material costs (i.e., food ingredients) would remain the same with either machine. The new machinery would be purchased by signing a note payable at the bank, and interest would be paid monthly on the note payable. Maintenance costs on the new machine would be the same as the maintenance costs on the machinery purchased last year. Advanced Enterprise is offering a trade-in on the machinery purchased last year against the purchase price of the new machinery. For each of the following costs, indicate whether each of the costs described would be relevant to O'Connor Frozen Foods' decision about whether to purchase the new machinery or not. Prompts Submitted Answers Trade in value of new machine. (cash will be obtained for trade in) Cost of new machine Choose a match Installation cost of new machine Choose a match Cost of Old Machine Choose a match Accumulated Depreciation on OLD Machine Choose a match Prior maintenance costs on OLD machine Choose a match Cost per pound of food to be processed Choose a mateh Installation cost of Old Machine Choose a match Determine relevant and irrelevant information O'Connor Frozen Foods purchased new computer-controlled production machinery last year from Advanced Enterprise. The equipment was purchased for $4.1 million and was paid for with cash. A representative from Advanced Enterprise recently contacted O'Connor management because Advanced Enterprise has an even more efficient piece of machinery available. The new design would double the production output of the equipment purchased last year but would cost o'Connor another $5.0 million. The old machinery was installed by an engineering firm; the same firm would be required to install the new machinery. Fixed selling costs would not change if the new machinery were to be purchased, but the variable selling cost per unit would decrease, Raw material costs (i.e., food ingredients) would remain the same with either machine. The new machinery would be purchased by signing a note payable at the bank, and interest would be paid monthly on the note payable. Maintenance costs on the new machine would be the same as the maintenance costs on the machinery purchased last year. Advanced Enterprise is offering a trade-in on the machinery purchased last year against the purchase price of the new machinery. For each of the following costs, indicate whether each of the costs described would be relevant to O'Connor Frozen Foods' decision about whether to purchase the new machinery or not. Prompts Submitted Answers Not relevant Relevant