Determine Tartan Knitwears:

Costs of Debt only (not WACC - this is a later question)

Show all calculations and working for each part of this question

Use the following information to help you answer the question

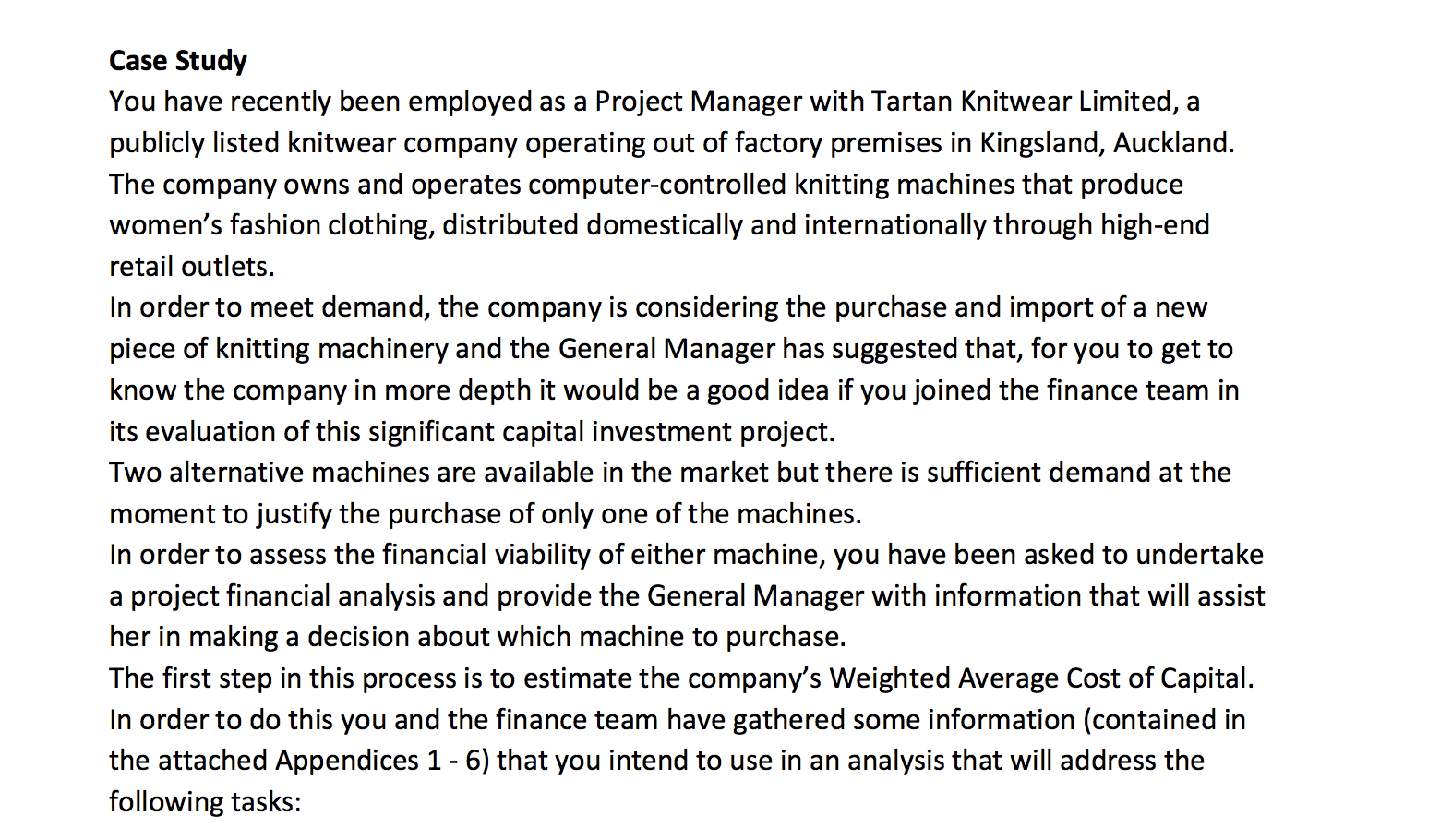

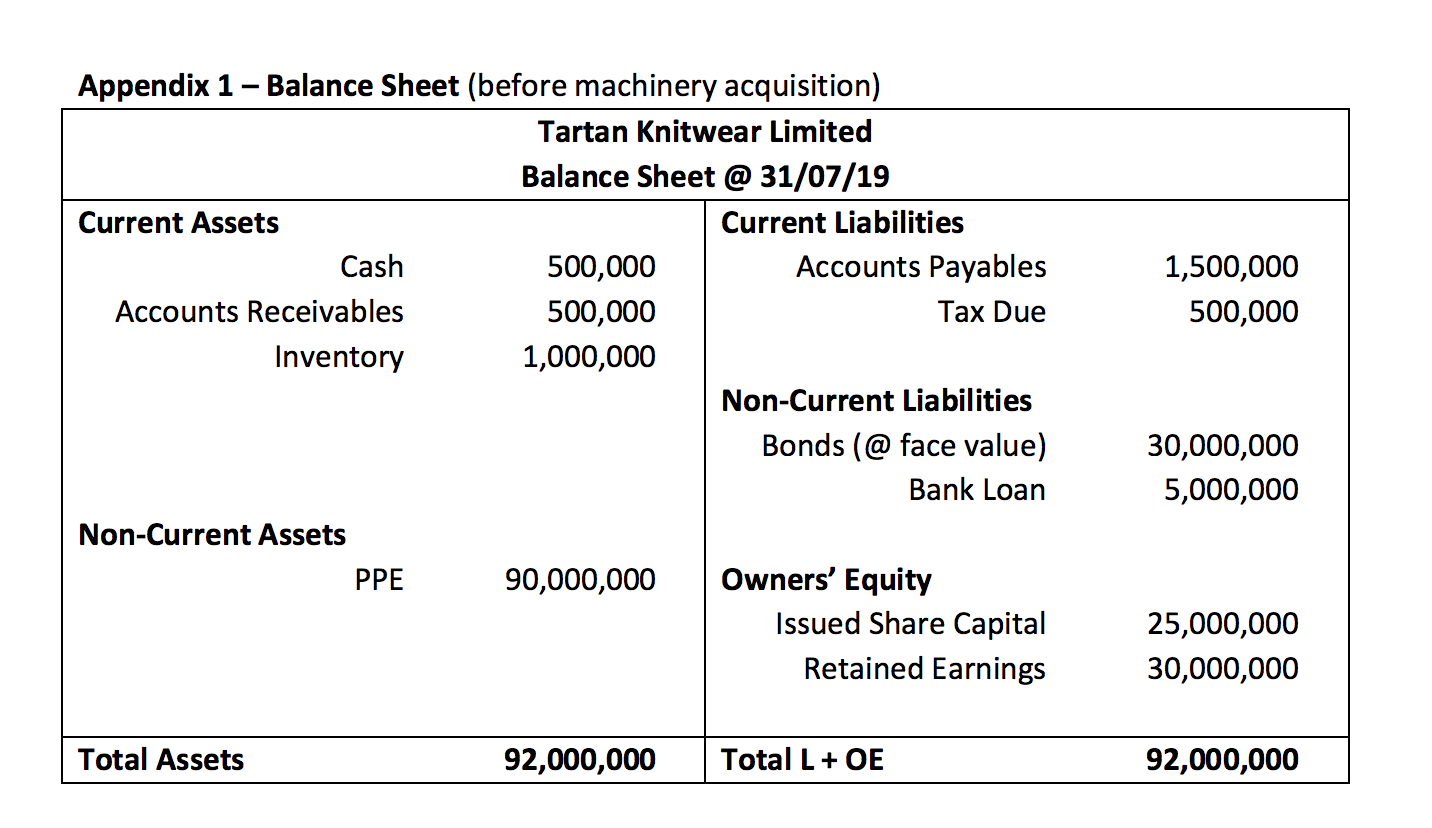

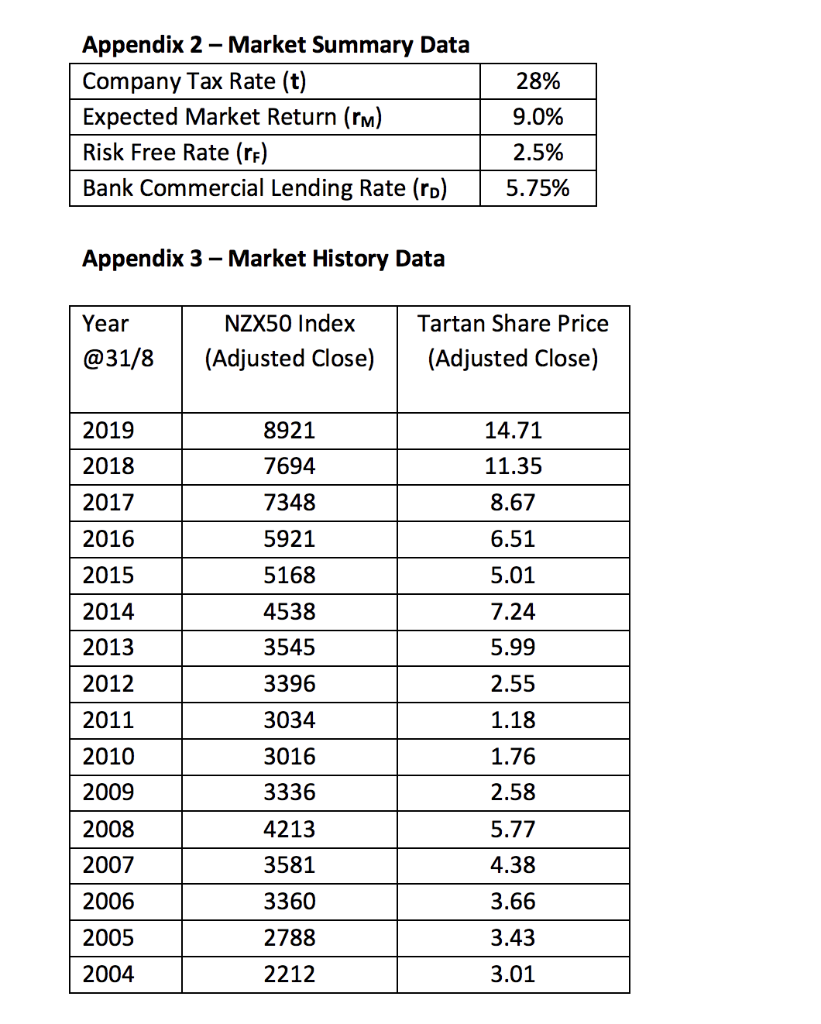

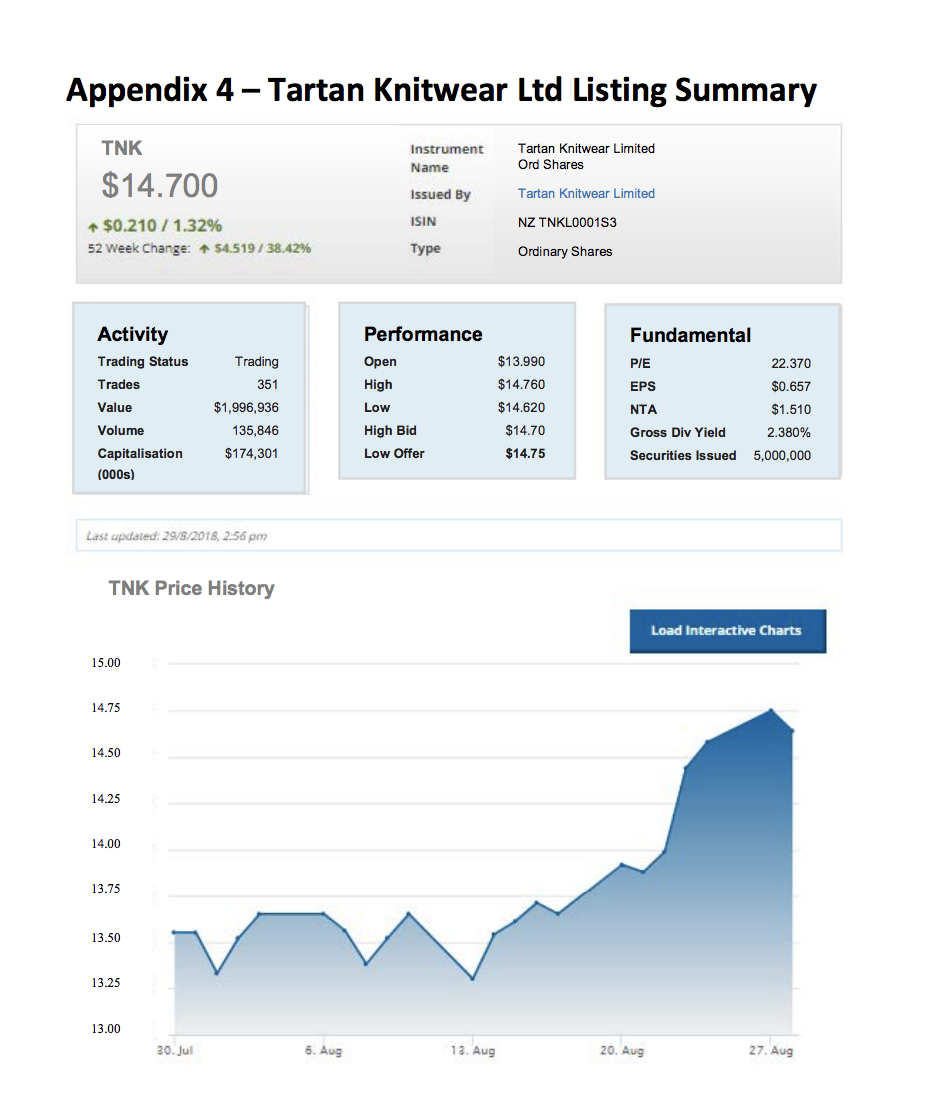

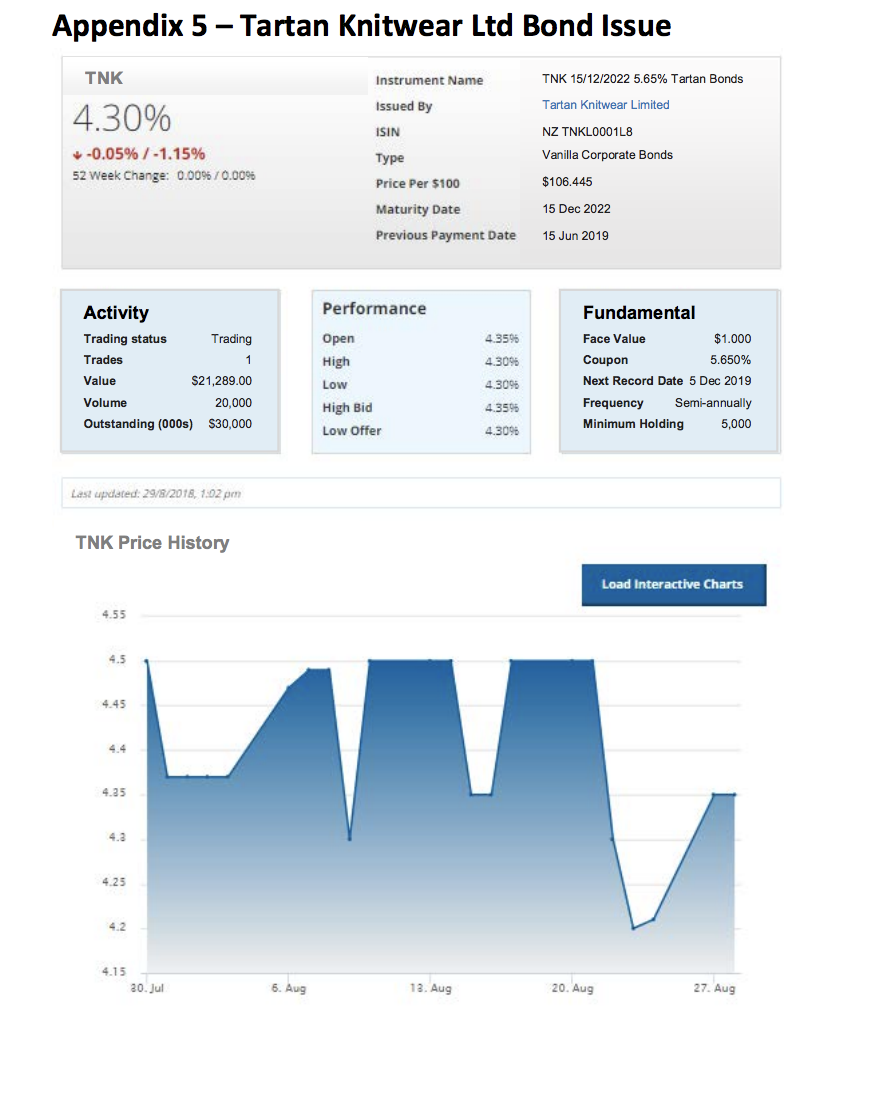

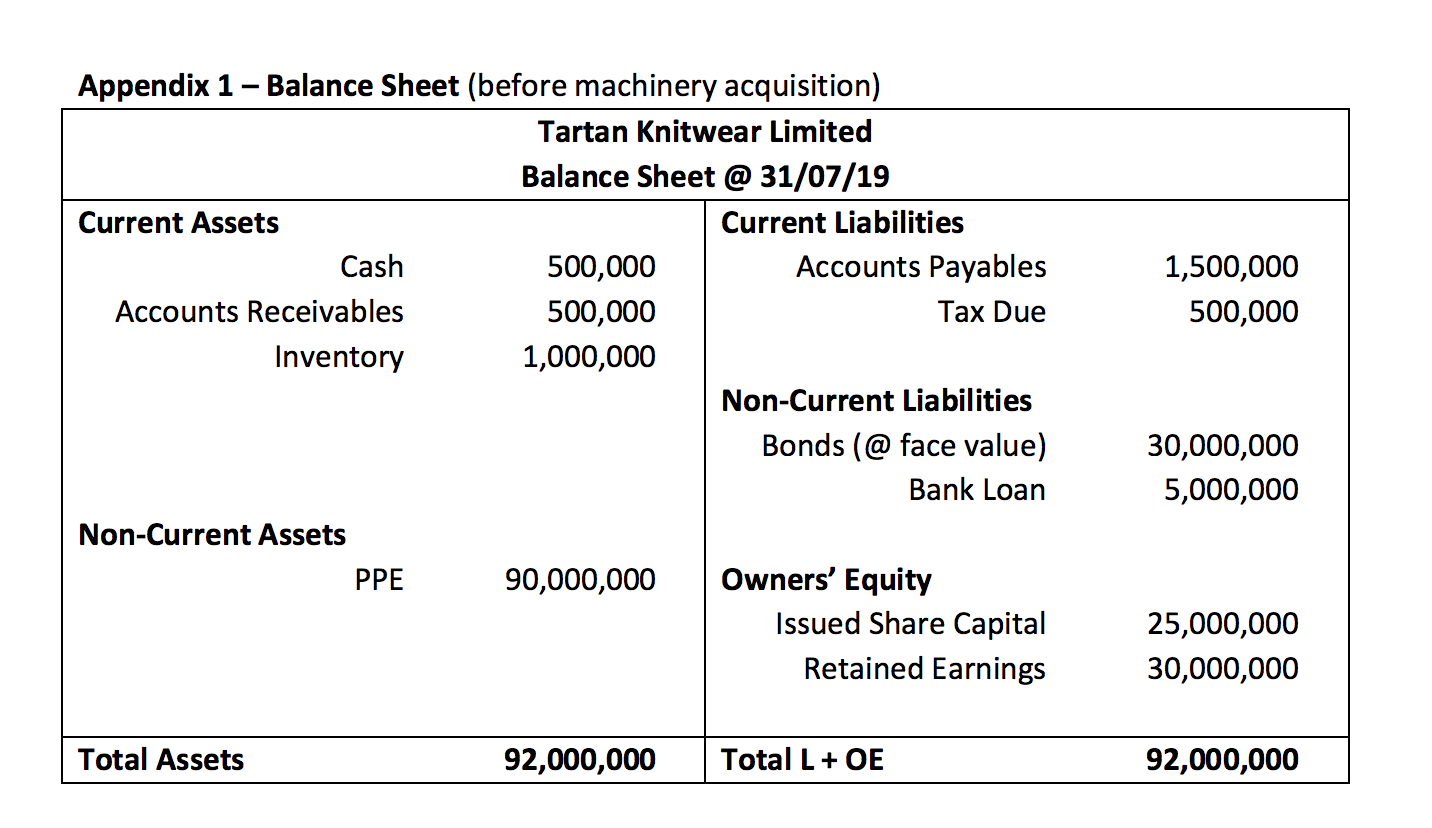

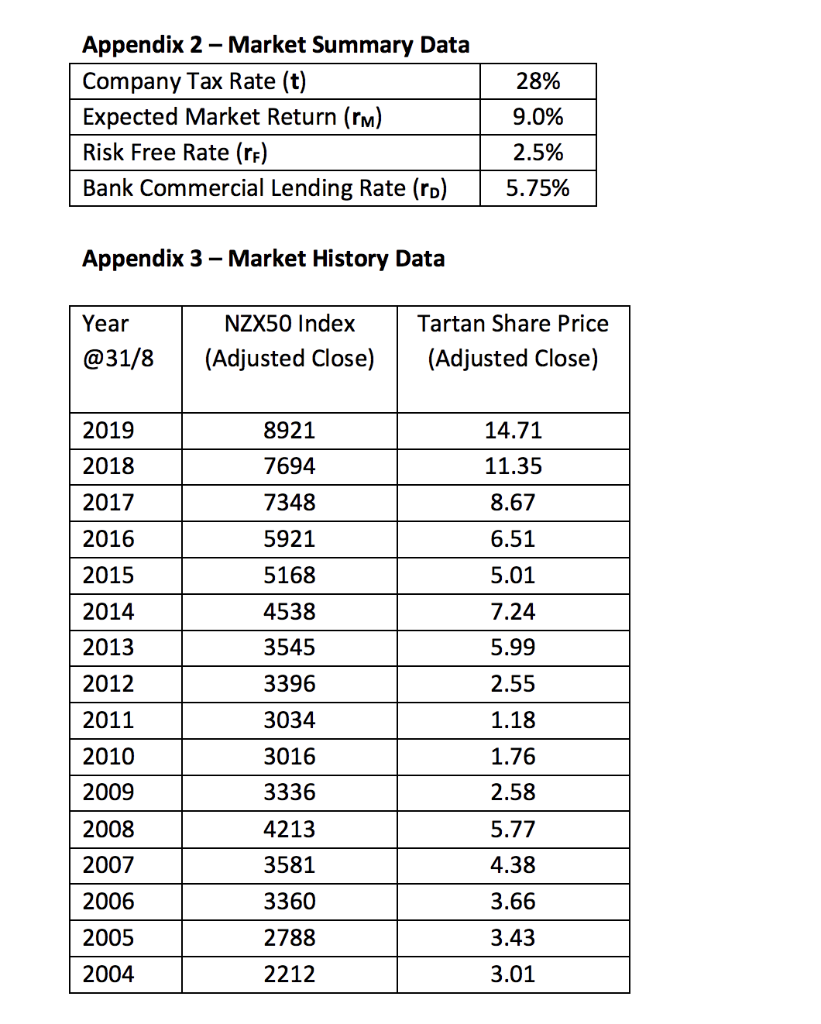

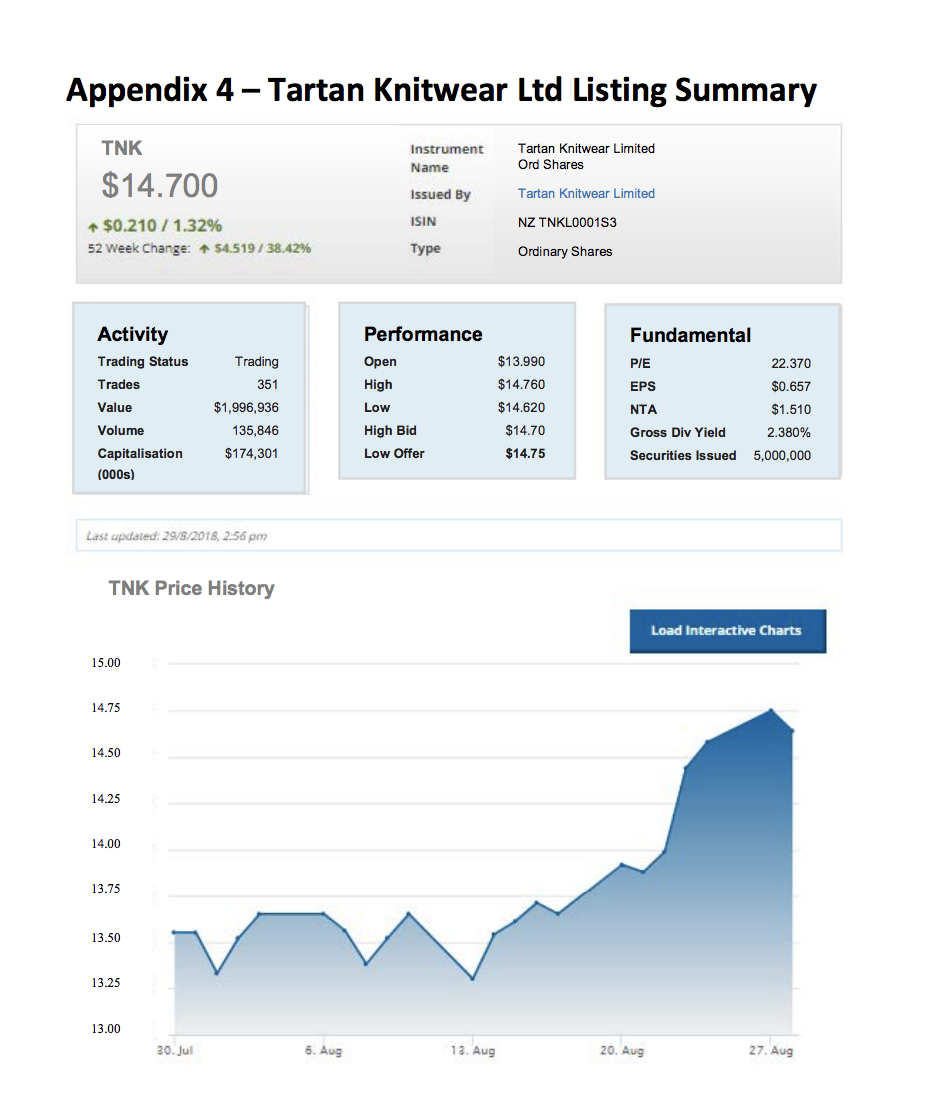

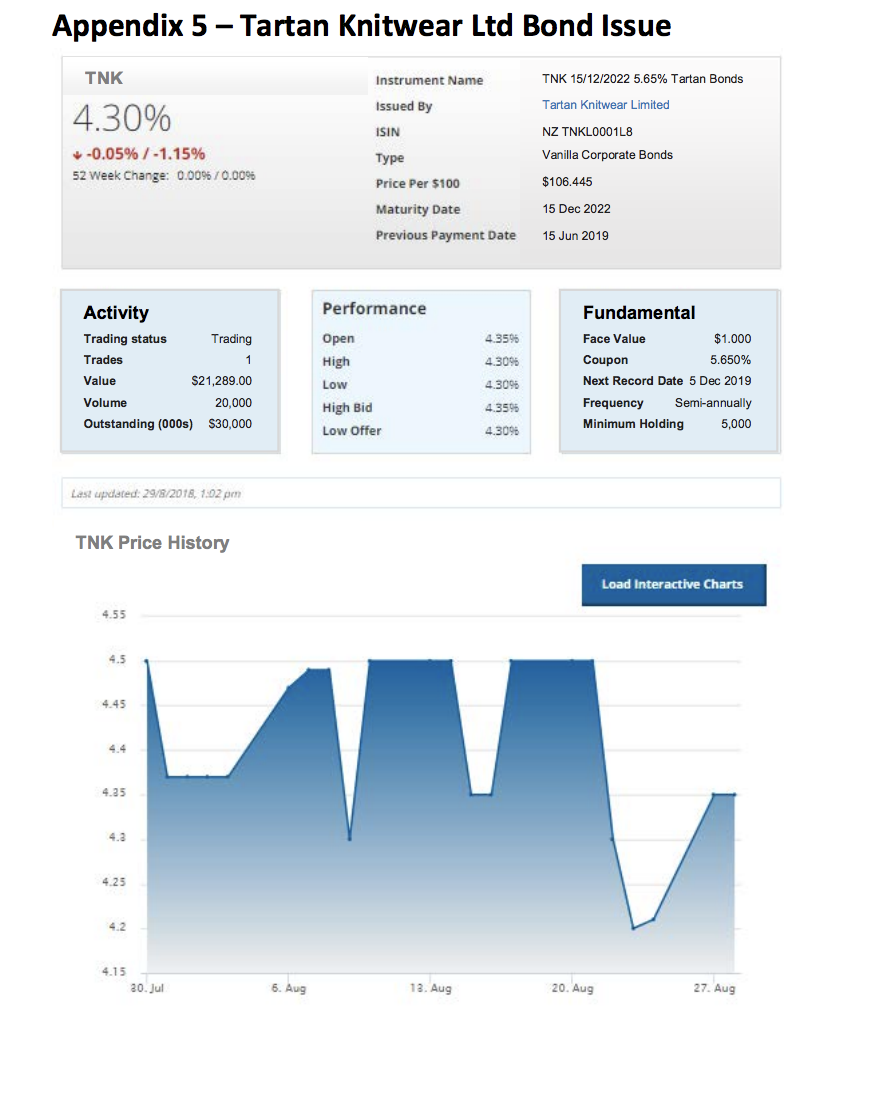

Case Study You have recently been employed as a Project Manager with Tartan Knitwear Limited, a publicly listed knitwear company operating out of factory premises in Kingsland, Auckland. The company owns and operates computer-controlled knitting machines that produce women's fashion clothing, distributed domestically and internationally through high-end retail outlets. In order to meet demand, the company is considering the purchase and import of a new piece of knitting machinery and the General Manager has suggested that, for you to get to know the company in more depth it would be a good idea if you joined the finance team in its evaluation of this significant capital investment project Two alternative machines are available in the market but there is sufficient demand at the moment to justify the purchase of only one of the machines. In order to assess the financial viability of either machine, you have been asked to undertake a project financial analysis and provide the General Manager with information that will assist her in making a decision about which machine to purchase. The first step in this process is to estimate the company's Weighted Average Cost of Capital. In order to do this you and the finance team have gathered some information (contained in the attached Appendices 1 -6) that you intend to use in an analysis that will address the following tasks: Appendix 1 - Balance Sheet (before machinery acquisition) Tartan Knitwear Limited Balance Sheet @ 31/07/19 Current Liabilities Current Assets Accounts Payables Cash 500,000 1,500,000 Accounts Receivables 500,000 Tax Due 500,000 Inventory 1,000,000 Non-Current Liabilities Bonds (@ face value) 30,000,000 Bank Loan 5,000,000 Non-Current Assets Owners' Equity Issued Share Capital PPE 90,000,000 25,000,000 Retained Earnings 30,000,000 Total L OE Total Assets 92,000,000 92,000,000 Appendix 2 Market Summary Data Company Tax Rate (t) Expected Market Return (rm) Risk Free Rate (rF) Bank Commercial Lending Rate (ro) 28% 9.0% 2.5% 5.75% Appendix 3 Market History Data Tartan Share Price NZX50 Index Year @31/8 (Adjusted Close) (Adjusted Close) 2019 8921 14.71 7694 2018 11.35 2017 7348 8.67 2016 5921 6.51 2015 5168 5.01 2014 7.24 4538 2013 3545 5.99 2012 3396 2.55 2011 3034 1.18 2010 3016 1.76 3336 2.58 2009 2008 4213 5.77 2007 3581 4.38 3360 3.66 2006 2005 2788 3.43 2004 2212 3.01 Appendix 4 Tartan Knitwear Ltd Listing Summary TNK Tartan Knitwear Limited Instrument Ord Shares Name $14.700 Issued By Tartan Knitwear Limited ISIN NZ TNKL0001S3 $0.210/1.32% 52 Week Change:$4.519/38.42 % Ordinary Shares Performance Activity Fundamental Trading Status Trading pen $13.990 P/E 22.370 Trades 351 High $14.760 EPS $0.657 $1,996,936 $14.620 Value Low NTA $1.510 Volume 135,846 High Bid $14.70 2.380% Gross Div Yield Capitalisation Low Offer $174,301 $14.75 Securities Issued 5,000,000 (000s) Last updated: 29/8/2018, 2:56 pm TNK Price History Load Interactive Charts 15.00 14.75 14.50 14.25 14.00 13.75 13.50 13.25 13.00 6. Aug 13. Aug 20. Aug 27. Aug 30. Jul Appendix 5 Tartan Knitwear Ltd Bond Issue TNK TNK 15/12/2022 5.65 % Tartan Bonds Instrument Name Issued By Tartan Knitwear Limited 4.30% ISIN NZ TNKL0001 L8 -0.05% / -1.15% Vanilla Corporate Bonds 52 Week Change: 0.00 %/0.00% $106.445 Price Per $100 Maturity Date 15 Dec 2022 Previous Payment Date 15 Jun 2019 Performance Activity Fundamental Face Value $1.000 Trading status Trading Open 4.35% Trades 1 Coupon 5.650% High 4.30% Value $21,289.00 Next Record Date 5 Dec 2019 4.309% Low Volume 20,000 Frequency Semi-annually 435% High Bid Minimum Holding Outstanding (000s) $30,000 5,000 Low Offer 4.30% Last updated: 29/8/2018, 1:02 pm TNK Price History Load Interactive Charts 4.55 4.5 4.45 4.4 4.35 4.3 4.25 4.2 4.15 a0. Jul 6. Aug 13. Aug 20. Aug 27. Aug