Prepare account balances for each account. Make sure all transactions are entered into T-Accounts.

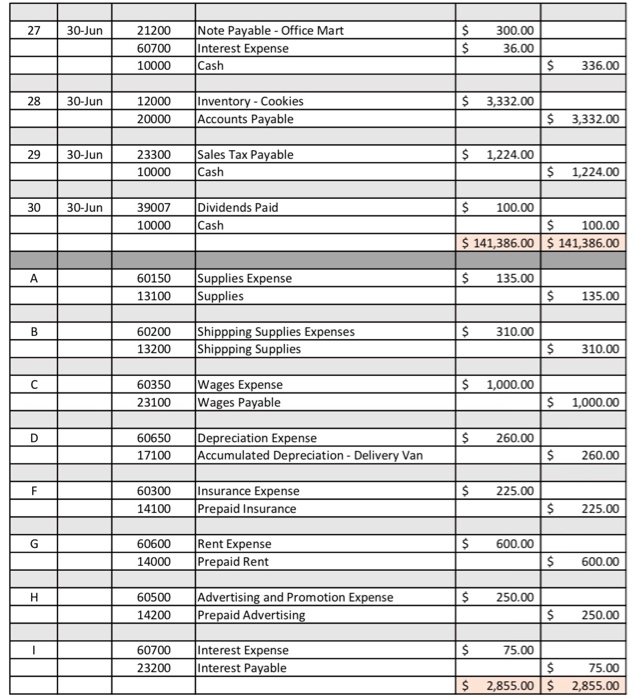

**A-I are Adjusting Entries

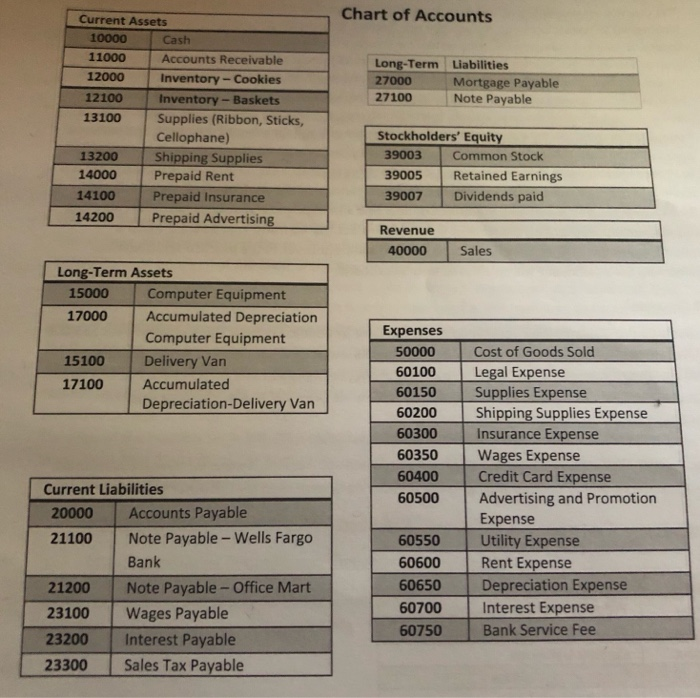

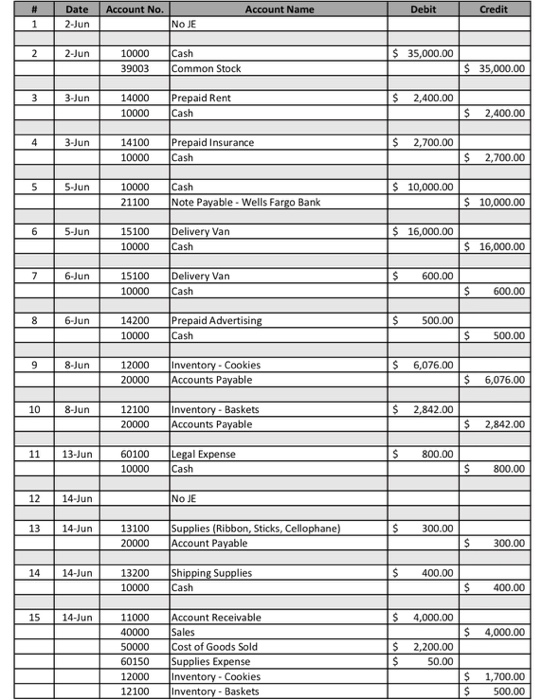

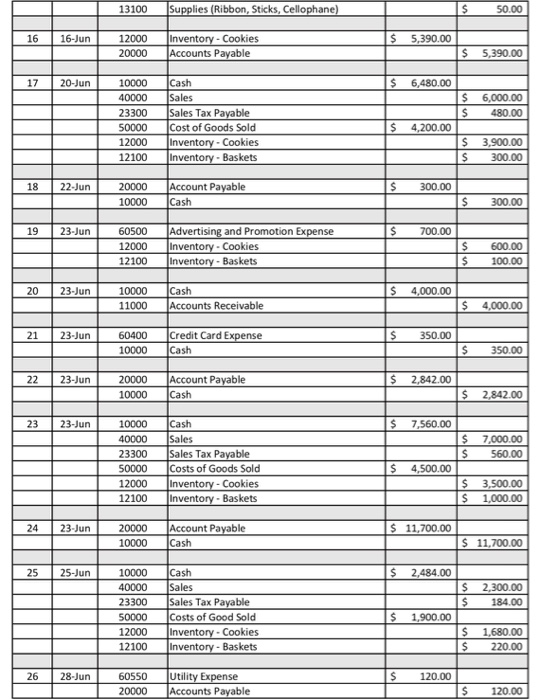

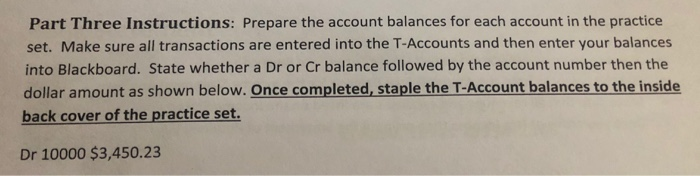

Part Three Instructions: Prepare the account balances for each account in the practice set. Make sure all transactions are entered into the T-Accounts and then enter your balances into Blackboard. State whether a Dr or Cr balance followed by the account number then the dollar amount as shown below. Once completed, staple the T-Account balances to the inside back cover of the practice set. Dr 10000 $3,450. 23 Chart of Accounts Current Assets 10000 Cash 11000 Accounts Receivable Long-Term Liabilities 12000 Inventory-Cookies 27000 Mortgage Payable Note Payable 12100 27100 Inventory-Baskets 13100 Supplies (Ribbon, Sticks, Stockholders' Equity Cellophane) Shipping Supplies Prepaid Rent 39003 13200 Common Stock 14000 39005 Retained Earnings Dividends paid 14100 Prepaid Insurance 39007 Prepaid Advertising 14200 Revenue Sales 40000 Long-Term Assets 15000 Computer Equipment Accumulated Depreciation 17000 Expenses Computer Equipment 50000 Cost of Goods Sold Delivery Van 15100 Legal Expense Supplies Expense Shipping Supplies Expense Insurance Expense 60100 17100 Accumulated 60150 Depreciation-Delivery Van 60200 60300 60350 Wages Expense Credit Card Expense 60400 Current Liabilities Advertising and Promotion Expense Utility Expense 60500 Accounts Payable 20000 21100 Note Payable- Wells Fargo 60550 Bank Rent Expense Depreciation Expense 60600 60650 Note Payable-Office Mart 21200 Interest Expense 60700 23100 Wages Payable Bank Service Fee 60750 Interest Payable 23200 Sales Tax Payable 23300 Account No. Debit Credit Date Account Name No JE 1 2-Jun Cash 2-Jun 10000 $35,000.00 $35,000.00 39003 Common Stock Prepaid Rent Cash 3-Jun 14000 2,400.00 10000 2,400.00 Prepaid Insurance Cash 2,700.00 4 3-Jun 14100 S 10000 2,700.00 Cash S $10,000.00 5-Jun 10000 Note Payable- Wells Fargo Bank $ 10,000.00 21100 Delivery Van Cash 5-Jun 15100 16,000.00 $ 16,000.00 10000 Delivery Van Cash 7 6-Jun 15100 600.00 10000 600.00 Prepaid Advertising 6-Jun 14200 S 500.00 Cash 10000 500.00 Inventory- Cookies Accounts Payable 8-Jun 12000 6,076.00 $ 20000 6,076.00 Inventory- Baskets Accounts Payable 10 8-Jun 2,842.00 12100 20000 2,842.00 Legal Expense Cash 60100 11 13-Jun 800.00 10000 800.00 No JE 12 14-Jun Supplies (Ribbon, Sticks, Cellophane) 13 S 300.00 14-Jun 13100 Account Payable 20000 300.00 Shipping Supplies Cash 14 14-Jun 13200 400.00 10000 400.00 Account Receivable Sales Cost of Goods Sold Supplies Expense Inventory- Cookies Inventory- Baskets 15 14-Jun 11000 4,000.00 40000 4,000.00 S 2,200.00 50000 60150 50.00 12000 1,700.00 12100 500,00 O Supplies (Ribbon, Sticks, Cellophane) 50.00 13100 Inventory- Cookies Accounts Payable 16 16-Jun 12000 5,390.00 S 20000 5,390.00 Cash 17 20-Jun 10000 6,480.00 Sales 6,000.00 40000 Sales Tax Payable Cost of Goods Sold Inventory- Cookies Inventory- Baskets 23300 480.00 50000 4,200.00 12000 S 3,900.00 12100 S 300.00 Account Payable S 300.00 18 22-Jun 20000 Cash 10000 300.00 Adv rtising and Promotion Expense Inventory- Cookies Inventory- Baskets 19 23-Jun 60500 700.00 600.00 12000 12100 100.00 Cash 20 23-Jun 10000 4,000.00 Accounts Receivable 11000 S 4,000.00 Credit Card Expense 21 23-Jun 60400 S 350.00 Cash 350.00 10000 Account Payable 22 23-Jun 20000 2,842.00 Cash S 10000 2,842.00 Cash Sales Sales Tax Payable Costs of Goods Sold Inventory - Cookies Inventory- Baskets 23 23-Jun 10000 7,560.00 S 40000 7,000.00 S 23300 560.00 50000 4,500.00 12000 3,500.00 1,000.00 12100 S Account Payable Cash 23-Jun 20000 11,700.00 $ 11,700.00 10000 Cash Sales Sales Tax Payable Costs of Good Sold Inventory- Cookies Inventory- Baskets 25 25-Jun 10000 2,484.00 40000 S 2,300.00 23300 184.00 50000 1,900.00 S 12000 1,680.00 12100 220.00 Utility Expense Accounts Payable 26 28-Jun 60550 120.00 20000 120.00 24 Note Payable Office Mart Interest Expense 27 $ 300.00 30-Jun 21200 $ 60700 36.00 Cash 10000 $ 336.00 Inventory Cookies Accounts Payable $ 28 30-Jun 12000 3,332.00 $ 20000 3,332.00 Sales Tax Payable Cash 23300 $ 29 30-Jun 1,224.00 S 10000 1,224.00 Dividends Paid 30-Jun $ 39007 100.00 Cash 100.00 10000 $ 141,386.00 $141,386.00 Supplies Expense Supplies $ A 60150 135.00 $ 13100 135.00 |Shippping Supplies Expenses Shippping Supplies 60200 $ 310.00 $ 13200 310.00 Wages Expense Wages Payable $ 60350 1,000.00 $ 23100 1,000.00 Depreciation Expense Accumulated Depreciation - Delivery Van $ D 60650 260.00 $ 17100 260.00 Insurance Expense Prepaid Insurance $ F 60300 225.00 S 14100 225.00 Rent Expense Prepaid Rent $ 60600 600.00 $ 600.00 14000 Advertising and Promotion Expense Prepaid Advertising 60500 $ 250.00 H 250.00 14200 Interest Expense Interest Payable $ 60700 75.00 $ 23200 75.00 $ 2,855.00 $ 2,855.00 (n m 30