Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Determine tax payable for 2020 and prepare the journal entry required to record it. At the end of 2019, CeeNet, Inc., which uses the ASPE

Determine tax payable for 2020 and prepare the journal entry required to record it.

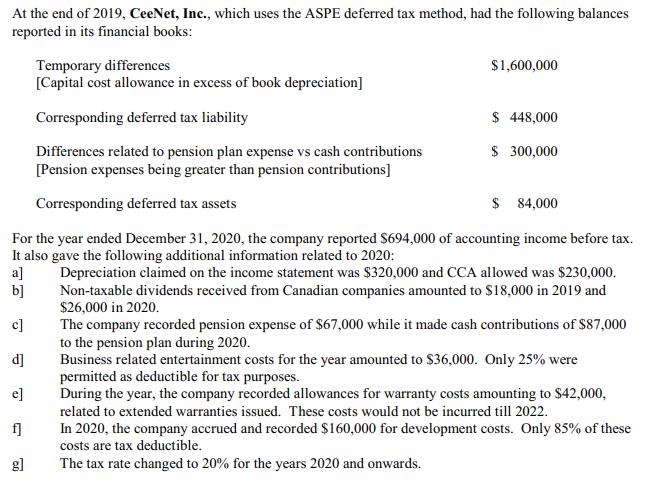

At the end of 2019, CeeNet, Inc., which uses the ASPE deferred tax method, had the following balances reported in its financial books: For the year ended December 31,2020 , the company reported $694,000 of accounting income before tax. It also gave the following additional information related to 2020: a] Depreciation claimed on the income statement was $320,000 and CCA allowed was $230,000. b] Non-taxable dividends received from Canadian companies amounted to $18,000 in 2019 and $26,000 in 2020. c] The company recorded pension expense of $67,000 while it made cash contributions of $87,000 to the pension plan during 2020. d] Business related entertainment costs for the year amounted to $36,000. Only 25% were permitted as deductible for tax purposes. e] During the year, the company recorded allowances for warranty costs amounting to $42,000, related to extended warranties issued. These costs would not be incurred till 2022. f] In 2020 , the company accrued and recorded $160,000 for development costs. Only 85% of these costs are tax deductible. g] The tax rate changed to 20% for the years 2020 and onwardsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started