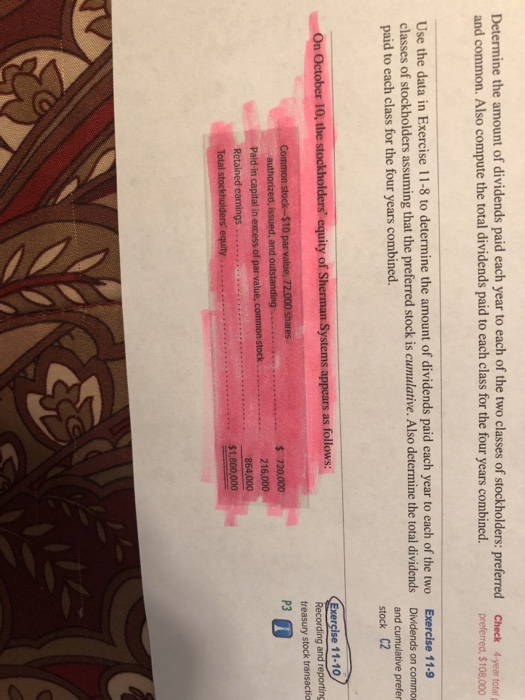

Determine the amount of dividends paid each year to each of the two classes of stockholders: preferred and common. Also compute the total dividends paid to each class for the four years combined. Check 4-year total preferred, $108,000 Use the data in Exercise 11-8 to determine the amount of dividends paid cach year to each of the two classes of stockholders assuming that the preferred stock is cumulative. Also determine the total dividends paid to each class for the four years combined. Exercise 11-9 Dividends on commor and cumulative prefer stock C2 On October 10, the stockholders equity of Sherman Systems appears as follows: Exercise 11-10, Recording and reporting treasury stock transactio Common stock-$10 parvaltie, 72.000 shares authorized, issued, and outstanding $ 720,000 216,000 P3 T Pald-in capital in excess of par value, common stock 864,000 Retained carmings Total stockholders equity. $1,800,000 nd Analysis ord the following transactions for Sherman Systems. f its own common stock at $25 per share on s on November 1 for $31 cash per share. ry shares on November 25 for $20 cash per share. equity section changes after the October 11 treasury stock purchase, and ction of its balance sheet at that date. October 11. ailable for Amos Company for the year ended December 31, 2017. -, December 31, 2016, prior to discovery of error, $1,375,000. paid during 2017, $43,000. reciation expense of $55,500, which is net of $4,500 in tax benefits. 00 in 2017 net income. ined earnings for Amos Company. 000 of net income for 2017 and declares $388,020 of cash dividends on the end of 2017, the company had 678,000 weighted-average shares of is available to common stockholders for 2017? EPS for 2017? d a.-1...100 000 of gngh dividends on its A017 Determine the amount of dividends paid each year to each of the two classes of stockholders: preferred and common. Also compute the total dividends paid to each class for the four years combined. Check 4-year total preferred, $108,000 Use the data in Exercise 11-8 to determine the amount of dividends paid cach year to each of the two classes of stockholders assuming that the preferred stock is cumulative. Also determine the total dividends paid to each class for the four years combined. Exercise 11-9 Dividends on commor and cumulative prefer stock C2 On October 10, the stockholders equity of Sherman Systems appears as follows: Exercise 11-10, Recording and reporting treasury stock transactio Common stock-$10 parvaltie, 72.000 shares authorized, issued, and outstanding $ 720,000 216,000 P3 T Pald-in capital in excess of par value, common stock 864,000 Retained carmings Total stockholders equity. $1,800,000 nd Analysis ord the following transactions for Sherman Systems. f its own common stock at $25 per share on s on November 1 for $31 cash per share. ry shares on November 25 for $20 cash per share. equity section changes after the October 11 treasury stock purchase, and ction of its balance sheet at that date. October 11. ailable for Amos Company for the year ended December 31, 2017. -, December 31, 2016, prior to discovery of error, $1,375,000. paid during 2017, $43,000. reciation expense of $55,500, which is net of $4,500 in tax benefits. 00 in 2017 net income. ined earnings for Amos Company. 000 of net income for 2017 and declares $388,020 of cash dividends on the end of 2017, the company had 678,000 weighted-average shares of is available to common stockholders for 2017? EPS for 2017? d a.-1...100 000 of gngh dividends on its A017