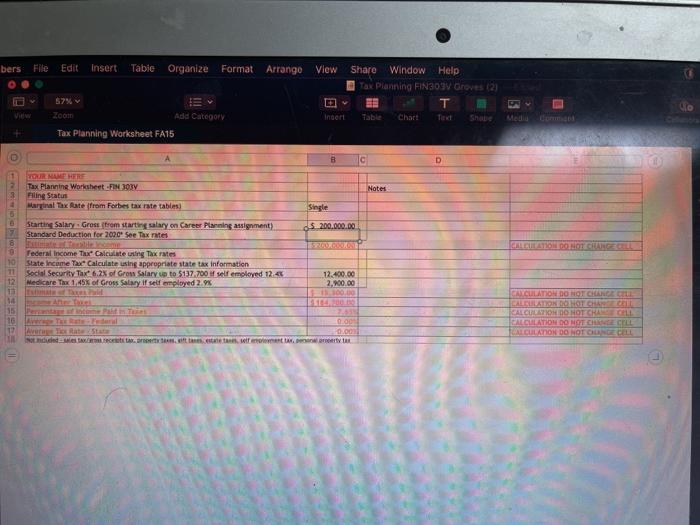

Determine the amount of Federal Income, State Income, Social Security and Medicare taxes you will be paying (based on 2020 tax law) on your estimated income after graduation, from your Career Planning Assignment. If you plan to live in a state other than New Mexico upon graduation, please specify which location you are using and make sure to calculate the appropriate city, local and state income taxes for that area. Also, find out if personal property taxes apply. Determine what percentage of your total gross income will be going to taxes. Show your results on the spreadsheet provided and include your calculations. You may enter information into the field for your name, for notes, and into the green cells. The file is protected so that you cannot change my calculations. Refer to the example provided. Tax Planning Use the following resources, along with your Textbook to complete the assignment: Tax Planning Example Your Complete Guide to the 2018. Tax Changes ht IRS Releases 2020 Tax Rate Tables Standard Deduction Amounts And More Rates Limits2020 taxbrackets.orge Also, check the state's taxation and revenue website! bers File Edit Insert Table Organize Format Arrange View Share Window Help Tax Planning FIN30V Graves (2) T Table Chart TERE She View 524V Zoom Add Category Tax Planning Worksheet FA15 Incert Mediu como B D WUR NAME HERE Tax Planning Worksheet FX3037 Filling Status Marginal Tax Rate from Forbes tax rate tables Notes Single Starting Salary: Gross from starting salary on Career Planning assignment) Standard Deduction for 2010 See Tax rates $ 200.000.00 CALLATION DO NOT CHANGE BILL Federal Income Tax Calculate ting Tax rates 10 State Income Tax Calculate using appropriate state tax information 11 Social Security Tak 6.2% of Grons Salary up to $137.700 of self employed 12.4% 12 Medicare Thx 1,45% of Gross Salary if self employed 2.9% 12.400.00 2.800.00 100.00 14 CALCULATION DO NOT CHANCE CALCULATION DO NOT CHANCELL CALCULATOR DO NOT CHACALL GALGULATION DO NOT CEE CELL CALCULATON DO NOT ONGE CELL 0.00 12 a Determine the amount of Federal Income, State Income, Social Security and Medicare taxes you will be paying (based on 2020 tax law) on your estimated income after graduation, from your Career Planning Assignment. If you plan to live in a state other than New Mexico upon graduation, please specify which location you are using and make sure to calculate the appropriate city, local and state income taxes for that area. Also, find out if personal property taxes apply. Determine what percentage of your total gross income will be going to taxes. Show your results on the spreadsheet provided and include your calculations. You may enter information into the field for your name, for notes, and into the green cells. The file is protected so that you cannot change my calculations. Refer to the example provided. Tax Planning Use the following resources, along with your Textbook to complete the assignment: Tax Planning Example Your Complete Guide to the 2018. Tax Changes ht IRS Releases 2020 Tax Rate Tables Standard Deduction Amounts And More Rates Limits2020 taxbrackets.orge Also, check the state's taxation and revenue website! bers File Edit Insert Table Organize Format Arrange View Share Window Help Tax Planning FIN30V Graves (2) T Table Chart TERE She View 524V Zoom Add Category Tax Planning Worksheet FA15 Incert Mediu como B D WUR NAME HERE Tax Planning Worksheet FX3037 Filling Status Marginal Tax Rate from Forbes tax rate tables Notes Single Starting Salary: Gross from starting salary on Career Planning assignment) Standard Deduction for 2010 See Tax rates $ 200.000.00 CALLATION DO NOT CHANGE BILL Federal Income Tax Calculate ting Tax rates 10 State Income Tax Calculate using appropriate state tax information 11 Social Security Tak 6.2% of Grons Salary up to $137.700 of self employed 12.4% 12 Medicare Thx 1,45% of Gross Salary if self employed 2.9% 12.400.00 2.800.00 100.00 14 CALCULATION DO NOT CHANCE CALCULATION DO NOT CHANCELL CALCULATOR DO NOT CHACALL GALGULATION DO NOT CEE CELL CALCULATON DO NOT ONGE CELL 0.00 12 a