Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Determine the amount of tax benefit from the exclusion that Quail Ridge should recognize in its tax provision for the current year and prepare the

Determine the amount of tax benefit from the exclusion that Quail Ridge should recognize in its tax provision for the current year and prepare the journal entry needed to record the tax provision for the current year.

23

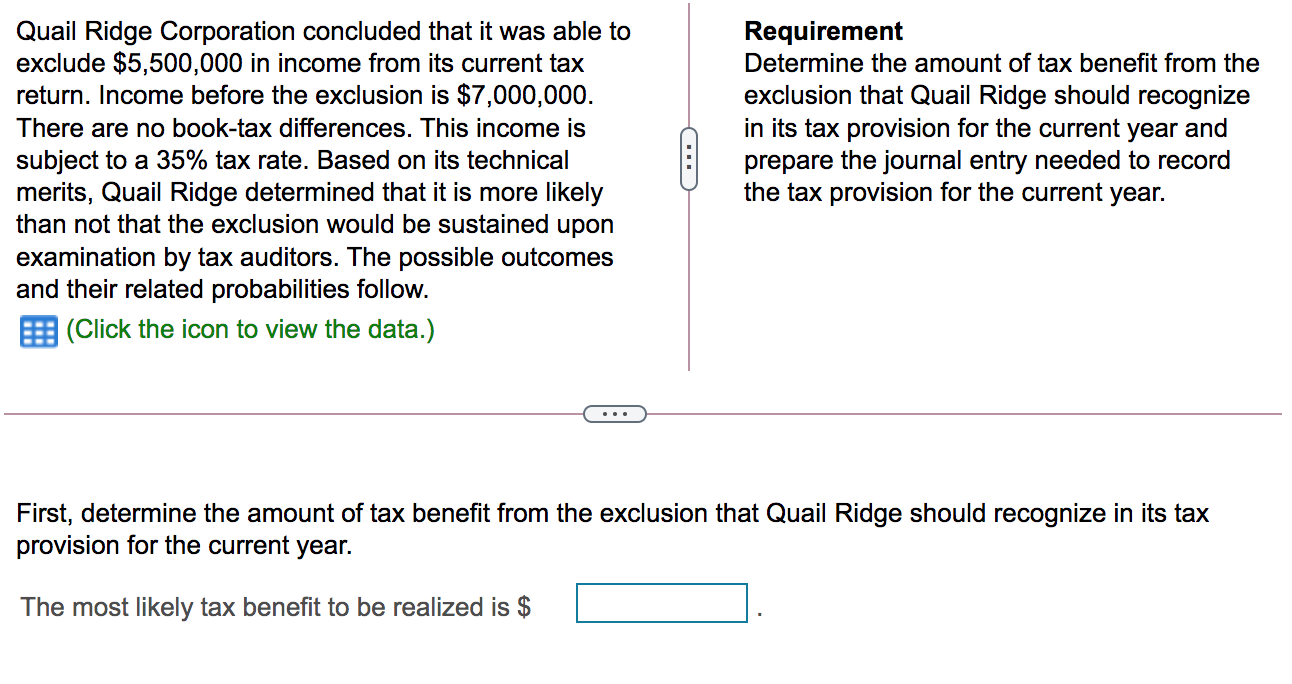

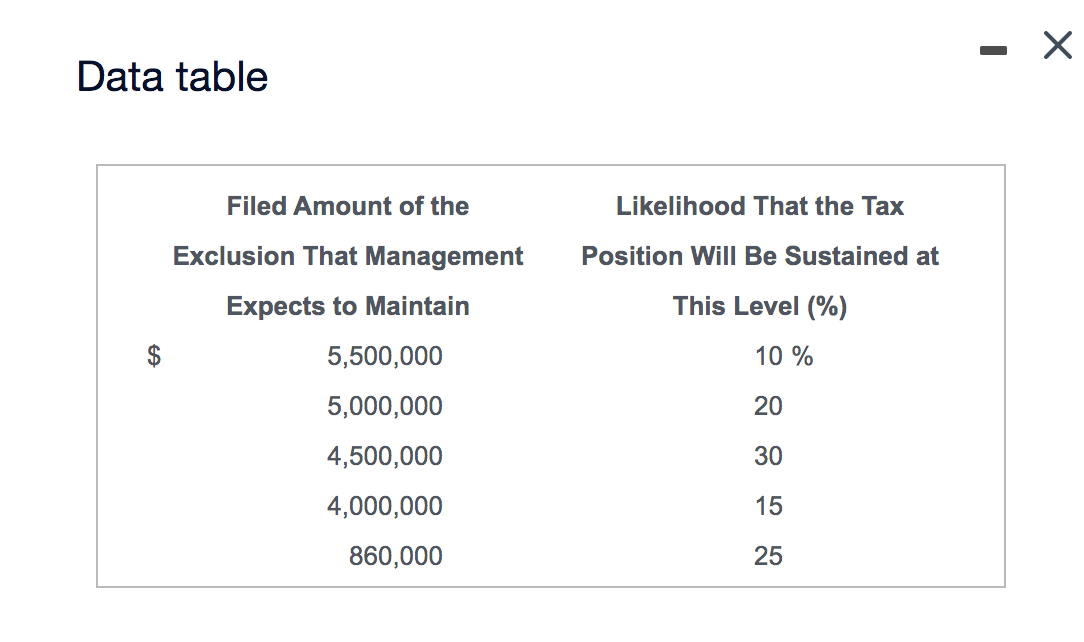

Quail Ridge Corporation concluded that it was able to exclude $5,500,000 in income from its current tax return. Income before the exclusion is $7,000,000. There are no book-tax differences. This income is subject to a 35% tax rate. Based on its technical merits, Quail Ridge determined that it is more likely than not that the exclusion would be sustained upon examination by tax auditors. The possible outcomes and their related probabilities follow. (Click the icon to view the data.) Requirement Determine the amount of tax benefit from the exclusion that Quail Ridge should recognize in its tax provision for the current year and prepare the journal entry needed to record the tax provision for the current year. First, determine the amount of tax benefit from the exclusion that Quail Ridge should recognize in its tax provision for the current year. The most likely tax benefit to be realized is $ Data table Filed Amount of the Likelihood That the Tax Position Will Be Sustained at This Level (%) 10 % Exclusion That Management Expects to Maintain 5,500,000 5,000,000 4,500,000 4,000,000 860,000 20 30 15 25Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started