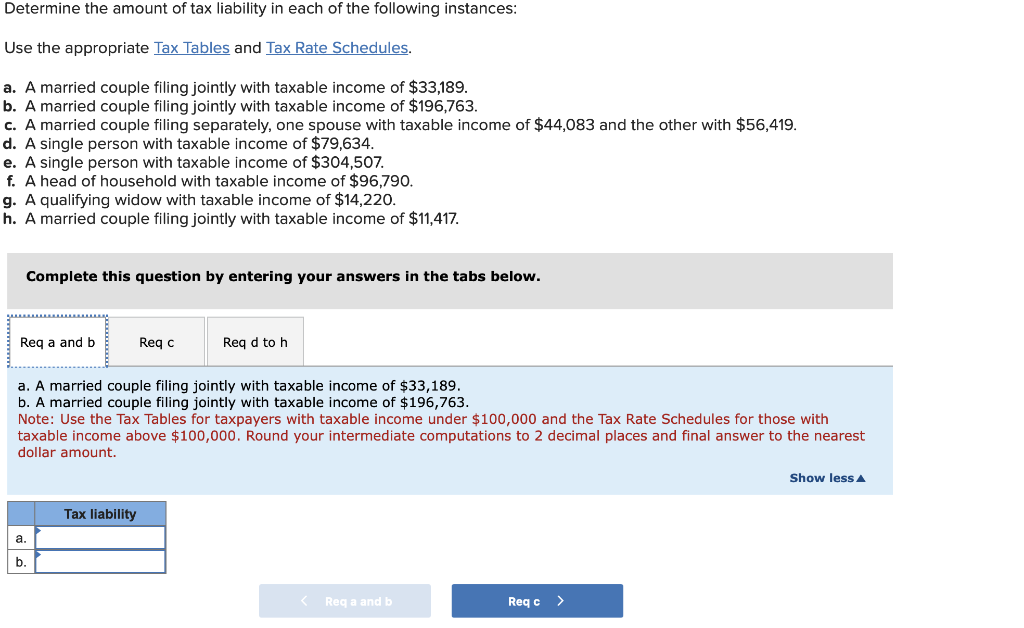

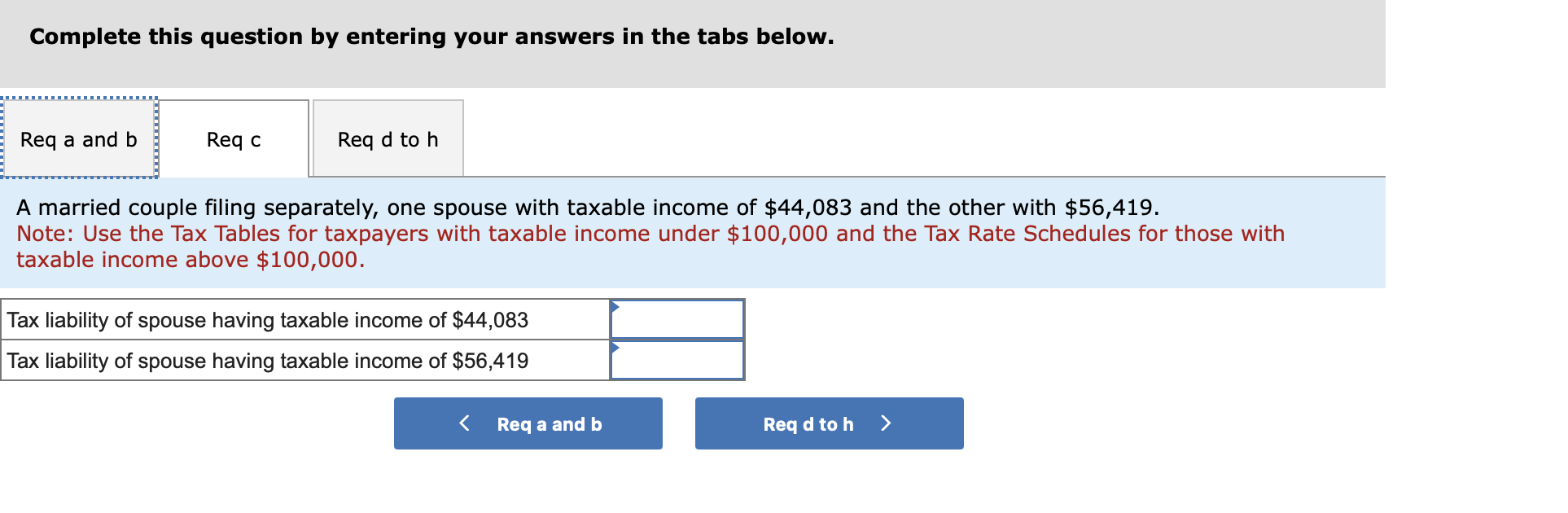

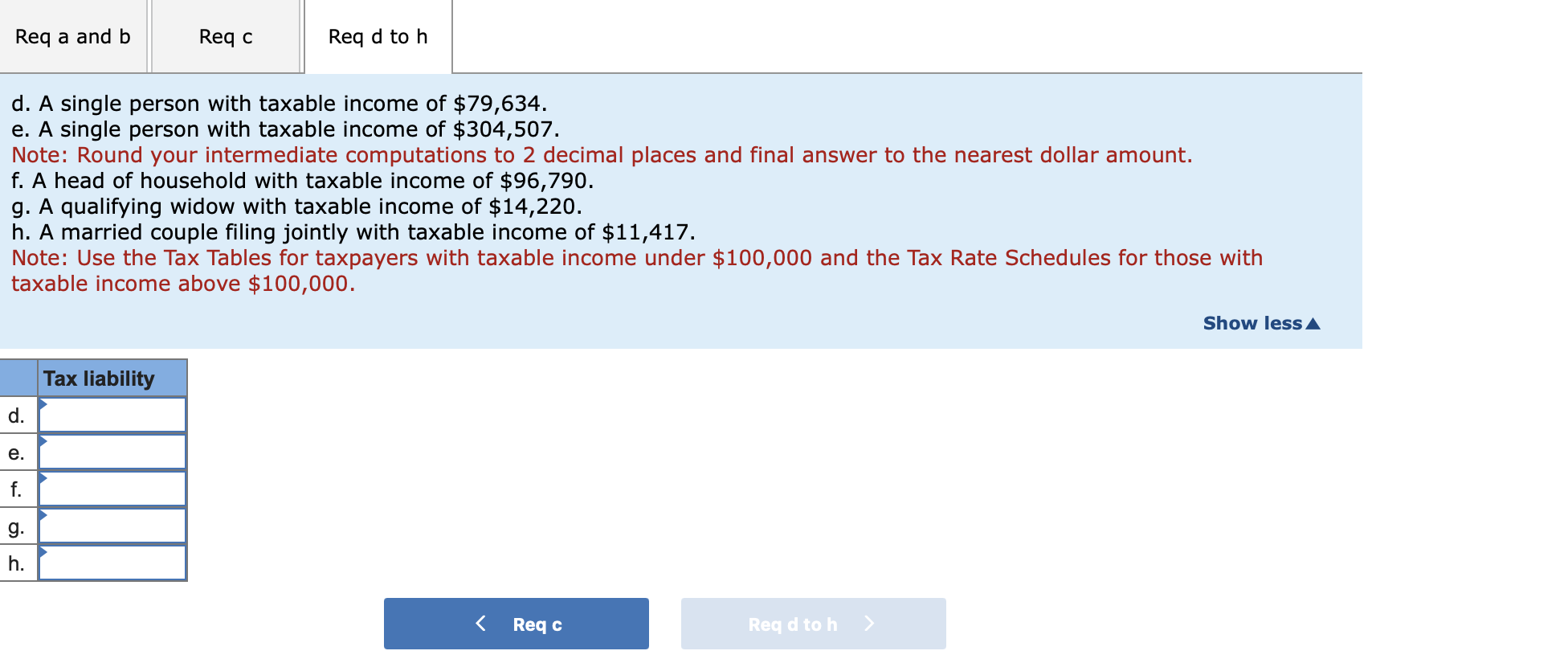

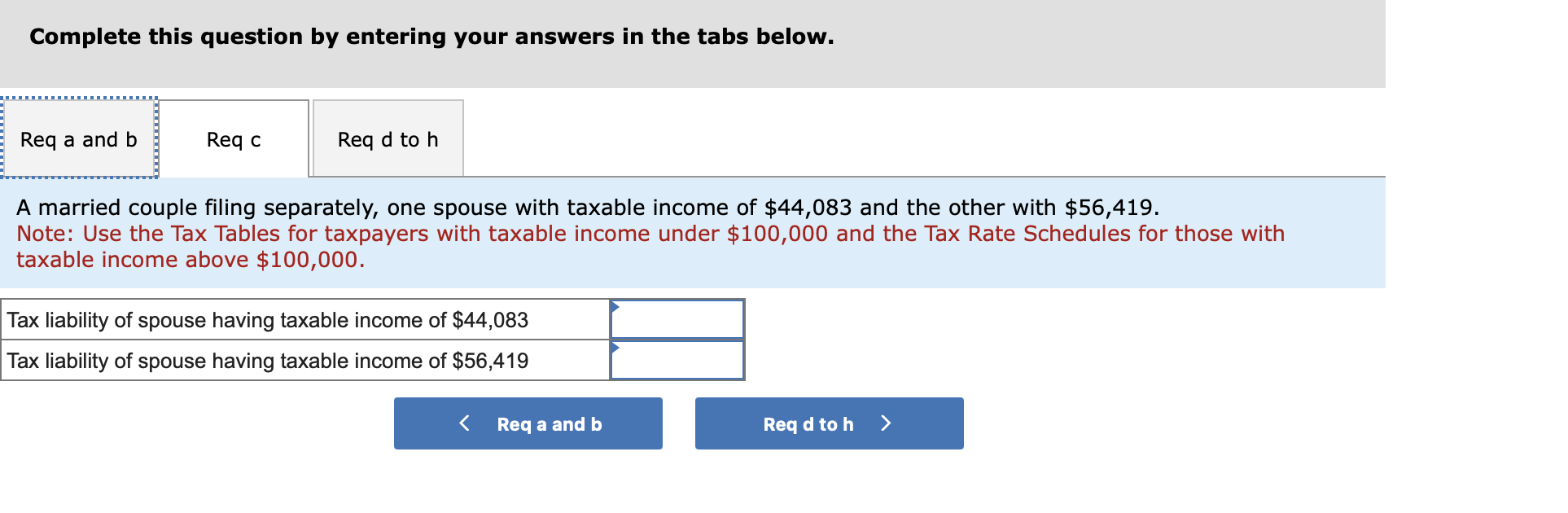

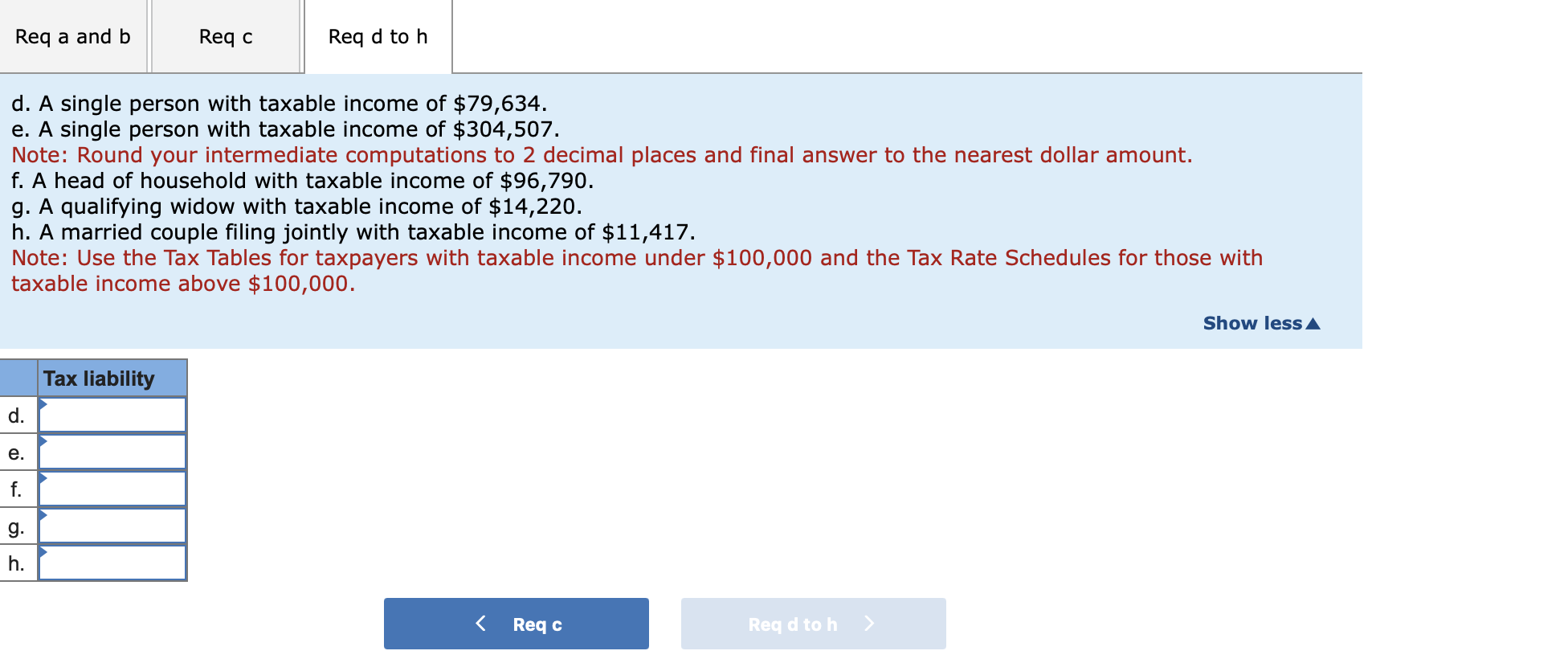

Determine the amount of tax liability in each of the following instances: Use the appropriate Tax Tables and Tax Rate Schedules. a. A married couple filing jointly with taxable income of $33,189. b. A married couple filing jointly with taxable income of $196,763. c. A married couple filing separately, one spouse with taxable income of $44,083 and the other with $56,419. d. A single person with taxable income of $79,634. e. A single person with taxable income of $304,507. f. A head of household with taxable income of $96,790. g. A qualifying widow with taxable income of $14,220. h. A married couple filing jointly with taxable income of $11,417. Complete this question by entering your answers in the tabs below. Req a and b Reqc Req d to h a. A married couple filing jointly with taxable income of $33,189. b. A married couple filing jointly with taxable income of $196,763. Note: Use the Tax Tables for taxpayers with taxable income under $100,000 and the Tax Rate Schedules for those with taxable income above $100,000. Round your intermediate computations to 2 decimal places and final answer to the nearest dollar amount. Show less Tax liability a. b. Complete this question by entering your answers in the tabs below. Req a and b Reqc Req d to h A married couple filing separately, one spouse with taxable income of $44,083 and the other with $56,419. Note: Use the Tax Tables for taxpayers with taxable income under $100,000 and the Tax Rate Schedules for those with taxable income above $100,000. Tax liability of spouse having taxable income of $44,083 Tax liability of spouse having taxable income of $56,419 Req a and b Req d to h > Req a and b Reqc Req d to h d. A single person with taxable income of $79,634. e. A single person with taxable income of $304,507. Note: Round your intermediate computations to 2 decimal places and final answer to the nearest dollar amount. f. A head of household with taxable income of $96,790. g. A qualifying widow with taxable income of $14,220. h. A married couple filing jointly with taxable income of $11,417. Note: Use the Tax Tables for taxpayers with taxable income under $100,000 and the Tax Rate Schedules for those with taxable income above $100,000. Show less A Tax liability d. e. f. g. h. Complete this question by entering your answers in the tabs below. Req a and b Reqc Req d to h A married couple filing separately, one spouse with taxable income of $44,083 and the other with $56,419. Note: Use the Tax Tables for taxpayers with taxable income under $100,000 and the Tax Rate Schedules for those with taxable income above $100,000. Tax liability of spouse having taxable income of $44,083 Tax liability of spouse having taxable income of $56,419 Req a and b Req d to h > Req a and b Reqc Req d to h d. A single person with taxable income of $79,634. e. A single person with taxable income of $304,507. Note: Round your intermediate computations to 2 decimal places and final answer to the nearest dollar amount. f. A head of household with taxable income of $96,790. g. A qualifying widow with taxable income of $14,220. h. A married couple filing jointly with taxable income of $11,417. Note: Use the Tax Tables for taxpayers with taxable income under $100,000 and the Tax Rate Schedules for those with taxable income above $100,000. Show less A Tax liability d. e. f. g. h.