Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Determine the amount of tax liability in the following situations. In all cases, the taxpayer is using the filing status of married filing jointly.

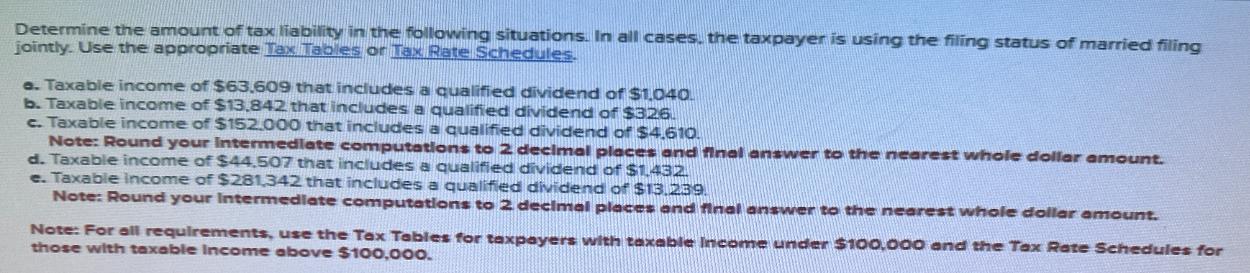

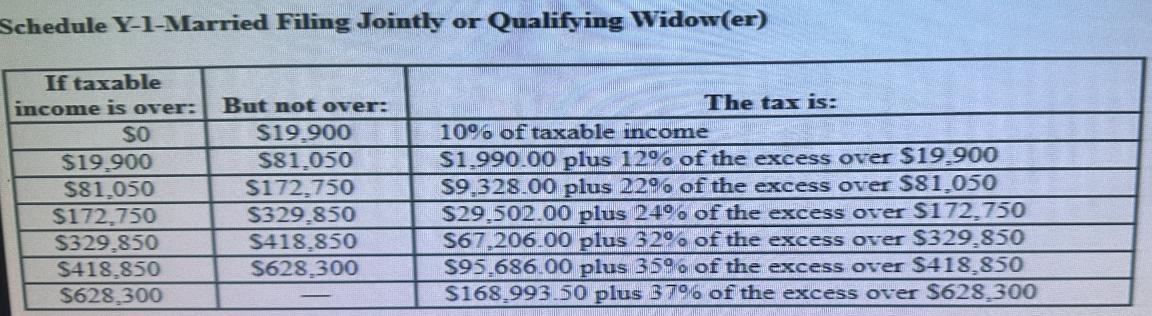

Determine the amount of tax liability in the following situations. In all cases, the taxpayer is using the filing status of married filing jointly. Use the appropriate Tax Tables or Tax Rate Schedules. a. Taxable income of $63.609 that includes a qualified dividend of $1,040. b. Taxable income of $13,842 that includes a qualified dividend of $326. c. Taxable income of $152.000 that includes a qualified dividend of $4.610. Note: Round your Intermediate computations to 2 decimal places and final answer to the nearest whole dollar amount. d. Taxable income of $44.507 that includes a qualified dividend of $1,432. e. Taxable income of $281,342 that includes a qualified dividend of $13.239. Note: Round your Intermediate computations to 2 decimal places and final answer to the nearest whole dollar amount. Note: For all requirements, use the Tax Tables for taxpayers with taxable Income under $100,000 and the Tax Rate Schedules for those with taxable income above $100,000. Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: $19.900 SO $81,050 $172,750 $329,850 $418,850 $628,300 $19,900 $81,050 $172,750 $329,850 $418.850 $628,300 The tax is: 10% of taxable income $1.990.00 plus 12% of the excess over $19,900 $9,328.00 plus 22% of the excess over $81,050 $29,502.00 plus 24% of the excess over $172,750 $67,206.00 plus 52% of the excess over $329,850 $95.686.00 plus 35% of the excess over $418,850 $168.993.50 plus 37% of the excess over $628,300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here is how you can calculate the tax liability a Taxable income of 63609 that includes a qualified ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started