Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Determine the amount of the Earned Income Credit in each of the following cases. Assume that the person or persons are eligible to take

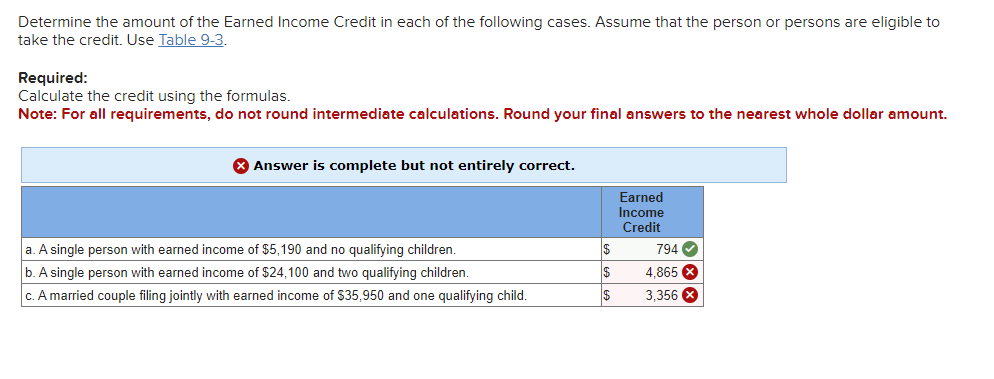

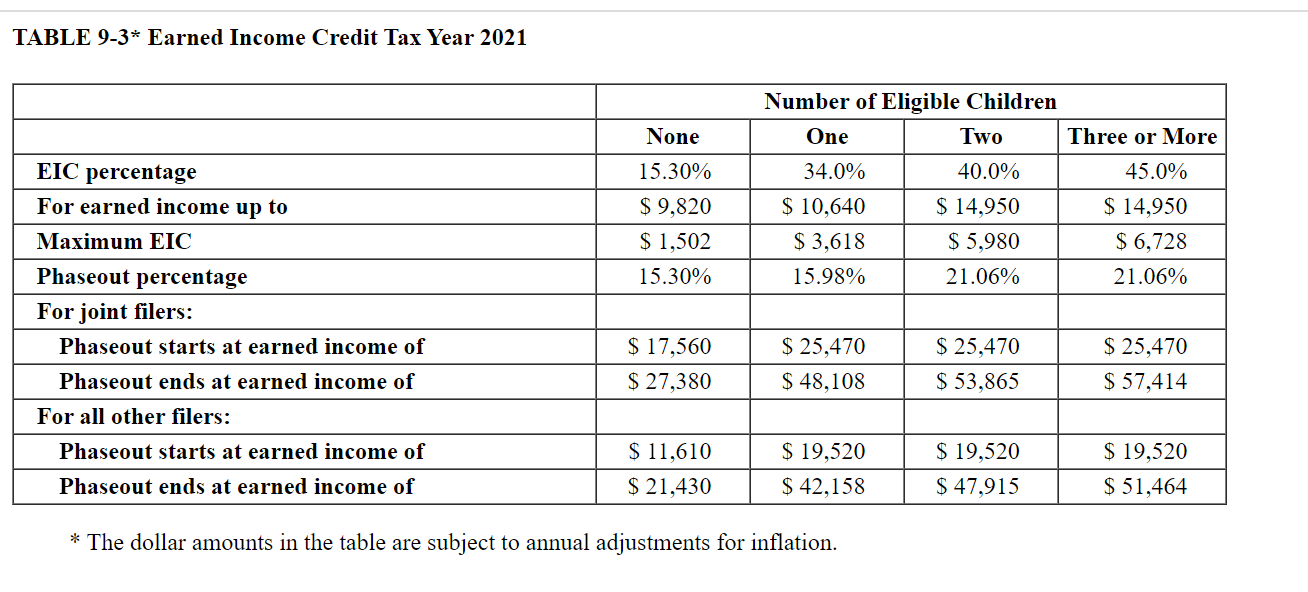

Determine the amount of the Earned Income Credit in each of the following cases. Assume that the person or persons are eligible to take the credit. Use Table 9-3. Required: Calculate the credit using the formulas. Note: For all requirements, do not round intermediate calculations. Round your final answers to the nearest whole dollar amount. Answer is complete but not entirely correct. Earned Income Credit a. A single person with earned income of $5,190 and no qualifying children. $ 794 b. A single person with earned income of $24,100 and two qualifying children. $ 4,865 c. A married couple filing jointly with earned income of $35,950 and one qualifying child. $ 3,356 X TABLE 9-3* Earned Income Credit Tax Year 2021 EIC percentage For earned income up to None 15.30% $ 9,820 Number of Eligible Children One 34.0% Two Three or More 40.0% $ 10,640 $ 14.950 $ 1,502 15.30% $ 3,618 15.98% $ 5,980 21.06% 45.0% $ 14,950 $ 6,728 21.06% Maximum EIC Phaseout percentage For joint filers: Phaseout starts at earned income of $ 17,560 $ 25,470 $ 25,470 $ 25,470 Phaseout ends at earned income of $ 27.380 $ 48,108 $ 53.865 $ 57,414 For all other filers: Phaseout starts at earned income of Phaseout ends at earned income of $ 11,610 $ 19.520 $ 19.520 $ 19.520 $ 21,430 $ 42,158 $ 47,915 $51,464 * The dollar amounts in the table are subject to annual adjustments for inflation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started