Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Determine the approximate annual percent cost of trade credit for providing a 3% discount for customers that pay in 30 days, given the expected number

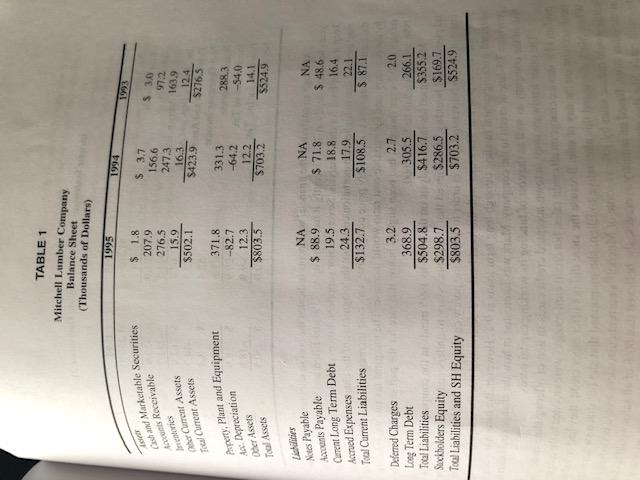

Determine the approximate annual percent cost of trade credit for providing a 3% discount for customers that pay in 30 days, given the expected number of days credit would be outstanding without the discount is 65 days. how does this compare with the companies cost of capital? how does the existing policy compare to the proposed policy of 5% COD net 30?

TABLE 1 Mitchell Lumber Company Balance Sheet (Thousands of Dollars) 1995 Grand Marketable Securities as Receivate $ 1.8 207.9 276.5 15.9 $502.1 $ 3.7 156,6 247.3 16.3 $423.9 her Current Assets ral Current Assets $ 3.0 97.2 1639 12.4 $276.5 Property, Plant and Equipment A. Depreciation her Assets Tal Assets 371.8 -82.7 12.3 $803.5 331.3 -64.2 12.2 $703.2 288.3 -54.0 14.1 $524.9 Listes Notes Payable Arants Payable Current Long Term Debt NA $ 88.9 19.5 24.3 $132.7 NA $ 71.8 18.8 17.9 $108.5 NA $48.6 16.4 22.1 $ 87.1 Accrued Expenses Toal Current Liabilities Deferred Charges Long Term Debt Total Liabilities Suckholders Equity Total Liabilities and SH Equity 3.2 368.9 $504.8 $298.7 $803,5 2.7 305.5 $416.7 $286.5 $703.2 2.0 266.1 $355,2 $169.7 $5249 TABLE 1 Mitchell Lumber Company Balance Sheet (Thousands of Dollars) 1995 Grand Marketable Securities as Receivate $ 1.8 207.9 276.5 15.9 $502.1 $ 3.7 156,6 247.3 16.3 $423.9 her Current Assets ral Current Assets $ 3.0 97.2 1639 12.4 $276.5 Property, Plant and Equipment A. Depreciation her Assets Tal Assets 371.8 -82.7 12.3 $803.5 331.3 -64.2 12.2 $703.2 288.3 -54.0 14.1 $524.9 Listes Notes Payable Arants Payable Current Long Term Debt NA $ 88.9 19.5 24.3 $132.7 NA $ 71.8 18.8 17.9 $108.5 NA $48.6 16.4 22.1 $ 87.1 Accrued Expenses Toal Current Liabilities Deferred Charges Long Term Debt Total Liabilities Suckholders Equity Total Liabilities and SH Equity 3.2 368.9 $504.8 $298.7 $803,5 2.7 305.5 $416.7 $286.5 $703.2 2.0 266.1 $355,2 $169.7 $5249Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started