Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Determine the Cost of Goods Sold and the Merchandise Inventory Balance #1 PSA 9-4 Determine the Cost of Goods Sold and the Merchandise Inventory Balance

Determine the Cost of Goods Sold and the Merchandise Inventory Balance #1

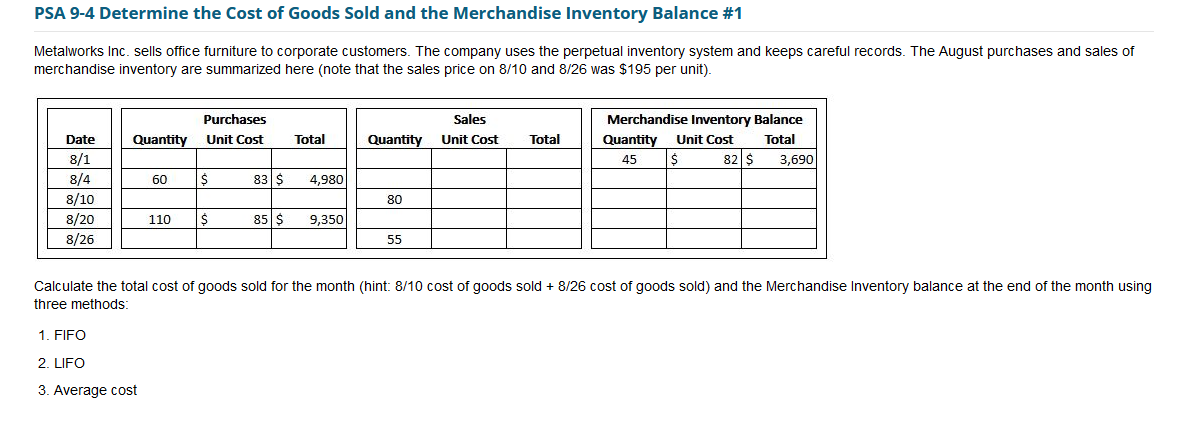

PSA 9-4 Determine the Cost of Goods Sold and the Merchandise Inventory Balance #1 Metalworks Inc. sells office furniture to corporate customers. The company uses the perpetual inventory system and keeps careful records. The August purchases and sales of merchandise inventory are summarized here (note that the sales price on 8/10 and 8/26 was $195 per unit). Purchases Date 8/1 Quantity Unit Cost Total Quantity Sales Unit Cost Merchandise Inventory Balance Total Quantity Unit Cost 45 Total $ 82 $ 3,690 8/4 60 $ 83 $ 4,980 8/10 80 8/20 8/26 110 $ 85 $ 9,350 55 Calculate the total cost of goods sold for the month (hint: 8/10 cost of goods sold + 8/26 cost of goods sold) and the Merchandise Inventory balance at the end of the month using three methods: 1. FIFO 2. LIFO 3. Average cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets calculate the Cost of Goods Sold COGS and the Merchandise Inventory balance at the end of Augus...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started