Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Determine the depreciation expense of the printing press for the year ending 30 June 2021. Show your calculations. The following information relates to questions 15

Determine the depreciation expense of the printing press for the year ending 30 June 2021. Show your calculations.

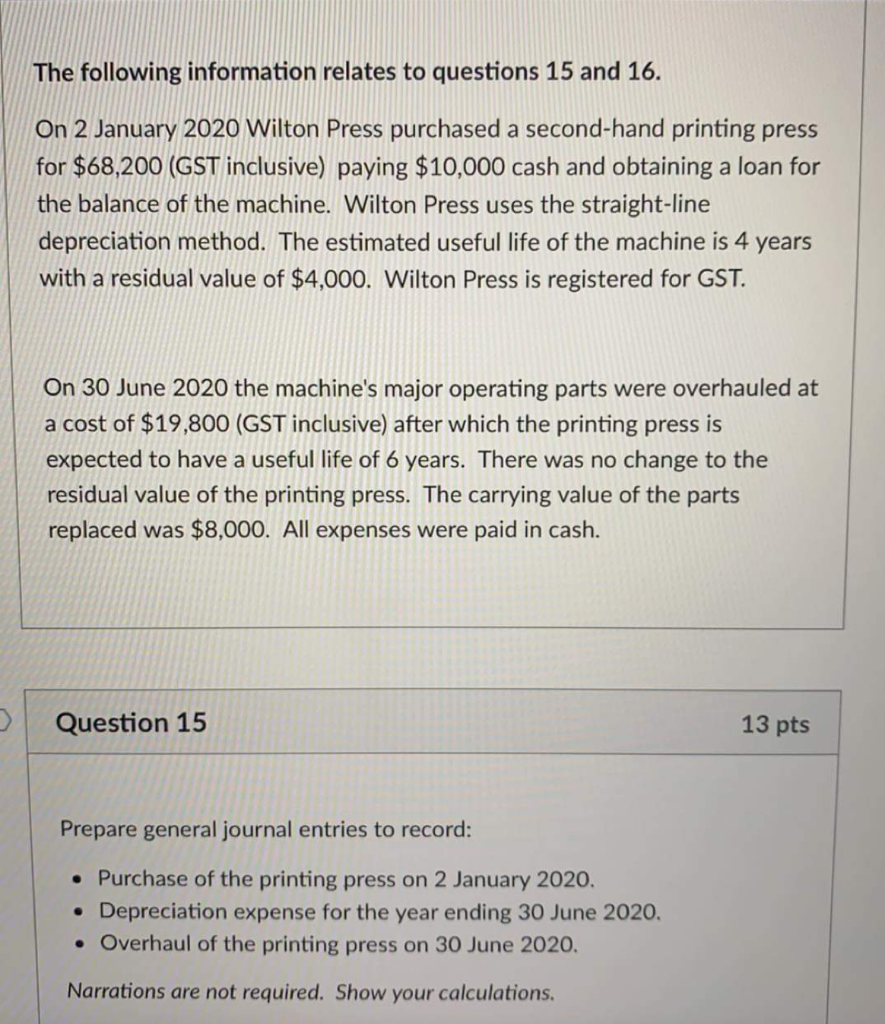

The following information relates to questions 15 and 16. On 2 January 2020 Wilton Press purchased a second-hand printing press for $68,200 (GST inclusive) paying $10,000 cash and obtaining a loan for the balance of the machine. Wilton Press uses the straight-line depreciation method. The estimated useful life of the machine is 4 years with a residual value of $4,000. Wilton Press is registered for GST. On 30 June 2020 the machine's major operating parts were overhauled at a cost of $19,800 (GST inclusive) after which the printing press is expected to have a useful life of 6 years. There was no change to the residual value of the printing press. The carrying value of the parts replaced was $8,000. All expenses were paid in cash. > Question 15 13 pts Prepare general journal entries to record: Purchase of the printing press on 2 January 2020. Depreciation expense for the year ending 30 June 2020, Overhaul of the printing press on 30 June 2020. Narrations are not required. Show your calculationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started