Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Startups in Pakistan have witnessed a sharp rise in investments in the first eight months of 2021. After a dry Covid-induced lockdown period, capital

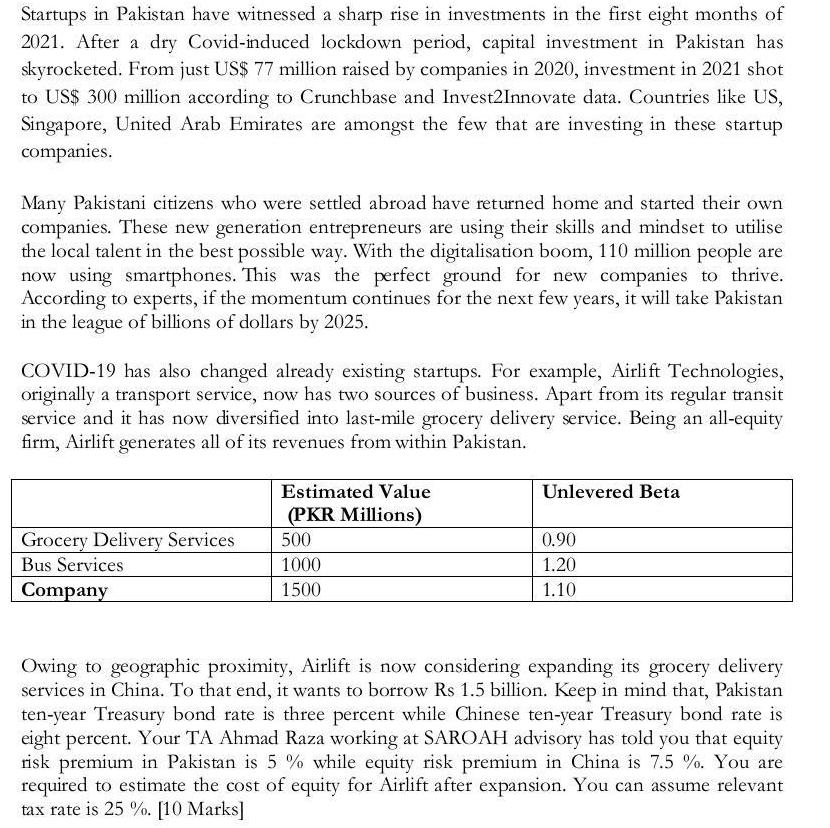

Startups in Pakistan have witnessed a sharp rise in investments in the first eight months of 2021. After a dry Covid-induced lockdown period, capital investment in Pakistan has skyrocketed. From just US$ 77 million raised by companies in 2020, investment in 2021 shot to US$ 300 million according to Crunchbase and Invest2Innovate data. Countries like US, Singapore, United Arab Emirates are amongst the few that are investing in these startup companies. Many Pakistani citizens who were settled abroad have returned home and started their own companies. These new generation entrepreneurs are using their skills and mindset to utilise the local talent in the best possible way. With the digitalisation boom, 110 million people are now using smartphones. This was the perfect ground for new companies to thrive. According to experts, if the momentum continues for the next few years, it will take Pakistan in the league of billions of dollars by 2025. COVID-19 has also changed already existing startups. For example, Airlift Technologies, originally a transport service, now has two sources of business. Apart from its regular transit service and it has now diversified into last-mile grocery delivery service. Being an all-equity firm, Airlift generates all of its revenues from within Pakistan. Grocery Delivery Services Bus Services Company Estimated Value (PKR Millions) 500 1000 1500 Unlevered Beta 0.90 1.20 1.10 Owing to geographic proximity, Airlift is now considering expanding its grocery delivery services in China. To that end, it wants to borrow Rs 1.5 billion. Keep in mind that, Pakistan ten-year Treasury bond rate is three percent while Chinese ten-year Treasury bond rate is eight percent. Your TA Ahmad Raza working at SAROAH advisory has told you that equity risk premium in Pakistan is 5% while equity risk premium in China is 7.5 %. You are required to estimate the cost of equity for Airlift after expansion. You can assume relevant tax rate is 25 %. [10 Marks]

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

The cost of equity for Airlift after expansion would be ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started