Answered step by step

Verified Expert Solution

Question

1 Approved Answer

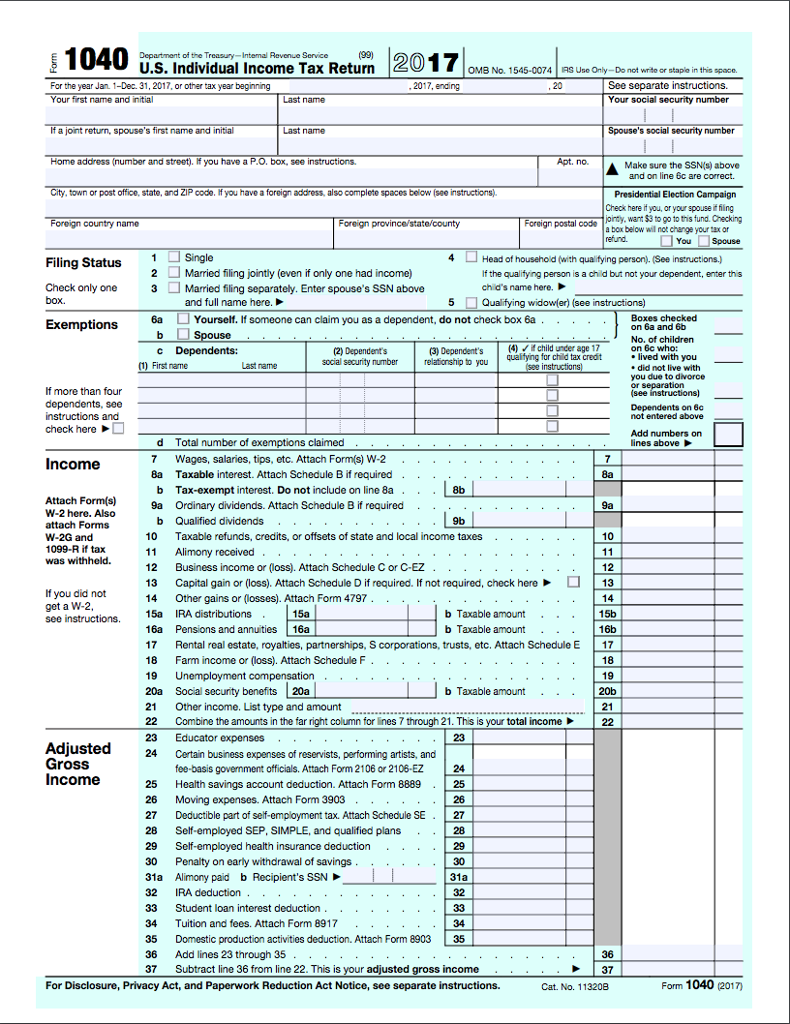

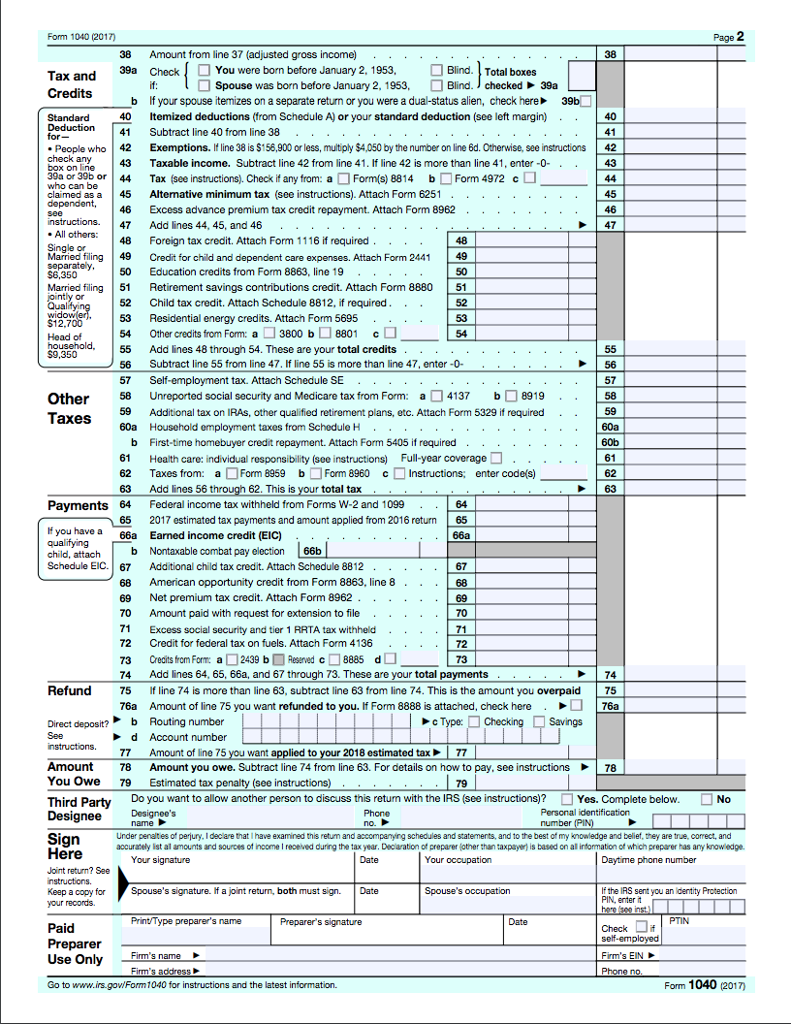

Determine the federal income tax for 2016 for the Deans on a joint return by completing a 1040 form. They do not want to contribute

Determine the federal income tax for 2016 for the Deans on a joint return by completing a 1040 form. They do not want to contribute to the Presidential Election Campaign Fund. All members of the family had health care coverage for all of 2016. If any overpayment results, it is to be refunded to them.

Use only one side of the sheet, if something doesn't belong in a space leave it blank (no commas, no zeros, no cents), ignore qualified dividends only use ordinary dividends.

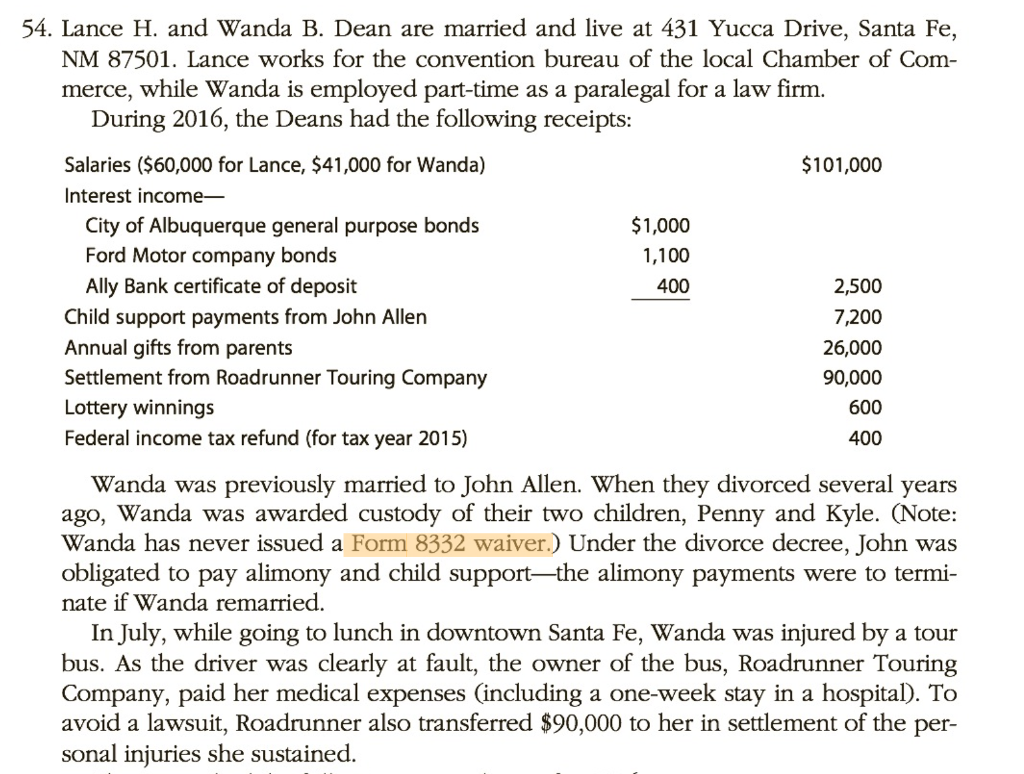

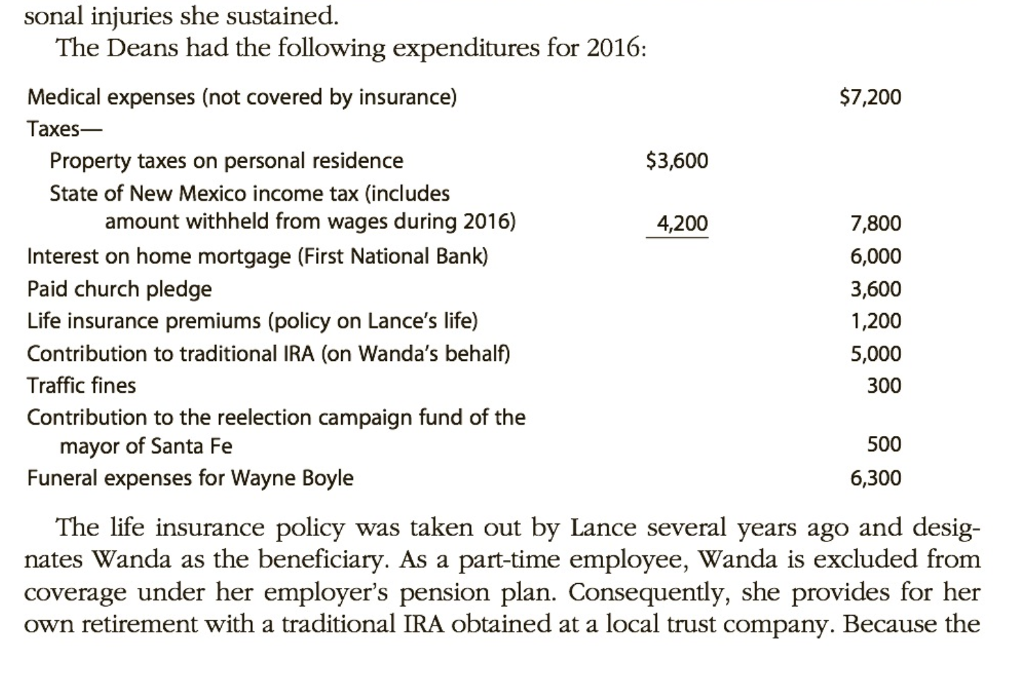

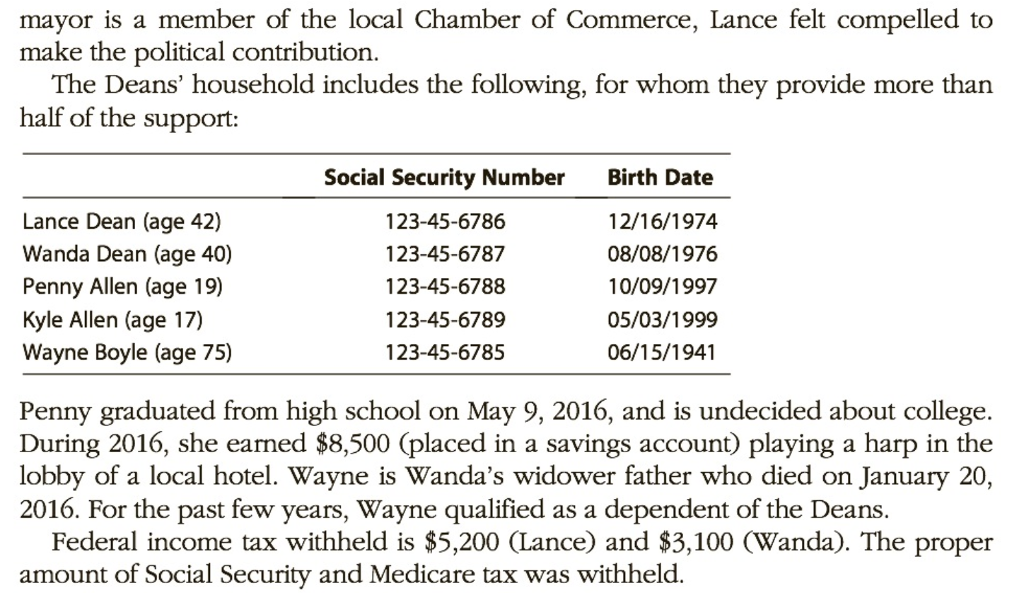

54. Lance H. and Wanda B. Dean are married and live at 431 Yucca Drive, Santa Fe, NM 87501. Lance works for the convention bureau of the local Chamber of Com merce, while Wanda is employed part-time as a paralegal for a law firnm During 2016, the Deans had the following receipts: Salaries ($60,000 for Lance, $41,000 for Wanda) Interest income_ $101,000 $1,000 1,100 400 City of Albuquerque general purpose bonds Ford Motor company bonds Ally Bank certificate of deposit Child support payments from John Allen Annual gifts from parents Settlement from Roadrunner Touring Company Lottery winnings Federal income tax refund (for tax year 2015) 2,500 7,200 26,000 90,000 600 400 Wanda was previously married to John Allen. When they divorced several years ago, Wanda was awarded custody of their two children, Penny and Kyle. (Note: Wanda has never issued a Form 8332 waiver.) Under the divorce decree, John was obligated to pay alimony and child support-the alimony payments were to termi- nate if Wanda remarried In July, while going to lunch in downtown Santa Fe, Wanda was injured by a tour bus. As the driver was clearly at fault, the owner of the bus, Roadrunner Touring Company, paid her medical expenses (including a one-week stay in a hospital). To avoid a lawsuit, Roadrunner also transferred $90,000 to her in settlement of the per- sonal iniuries she sustainedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started