Question

Determine the following: a. Foreign exchange gain or loss on: i. December 1, 20x4 ii. December 31, 20x4 iii. March 1, 20x5 b. On December

Determine the following:

a. Foreign exchange gain or loss on:

i. December 1, 20x4

ii. December 31, 20x4

iii. March 1, 20x5

b. On December 31, 20x4:

i. Accounts payable

ii. Inventory

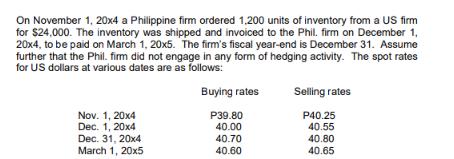

On November 1, 20x4 a Philippine firm ordered 1,200 units of inventory from a US firm for $24,000. The inventory was shipped and invoiced to the Phil. firm on December 1, 20x4, to be paid on March 1, 20x5. The firm's fiscal year-end is December 31. Assume further that the Phil. firm did not engage in any form of hedging activity. The spot rates for US dollars at various dates are as follows: Nov. 1, 20x4 Dec. 1, 20x4 Dec. 31, 20x4 March 1, 20x5 Buying rates P39.80 40.00 40.70 40.60 Selling rates P40.25 40.55 40.80 40.65

Step by Step Solution

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To determine the foreign exchange gain or loss and the accounts payable and inventory on various dat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Financial Accounting

Authors: Thomas Beechy, Umashanker Trivedi, Kenneth MacAulay

6th edition

013703038X, 978-0137030385

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App