Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Determine the following as a result of your audit: 1. How much is the total interest expense in 2021? 2. How much is the non

Determine the following as a result of your audit:

1. How much is the total interest expense in 2021?

2. How much is the non current portion of all notes payable at the end of 2021?

3. How much is reported as trade notes payable in 2021

4. How much is the total interest expense in 2022?

5. How much is the total current liabilities in 2022?

How much is the total noncurrent liabilities in 2022?

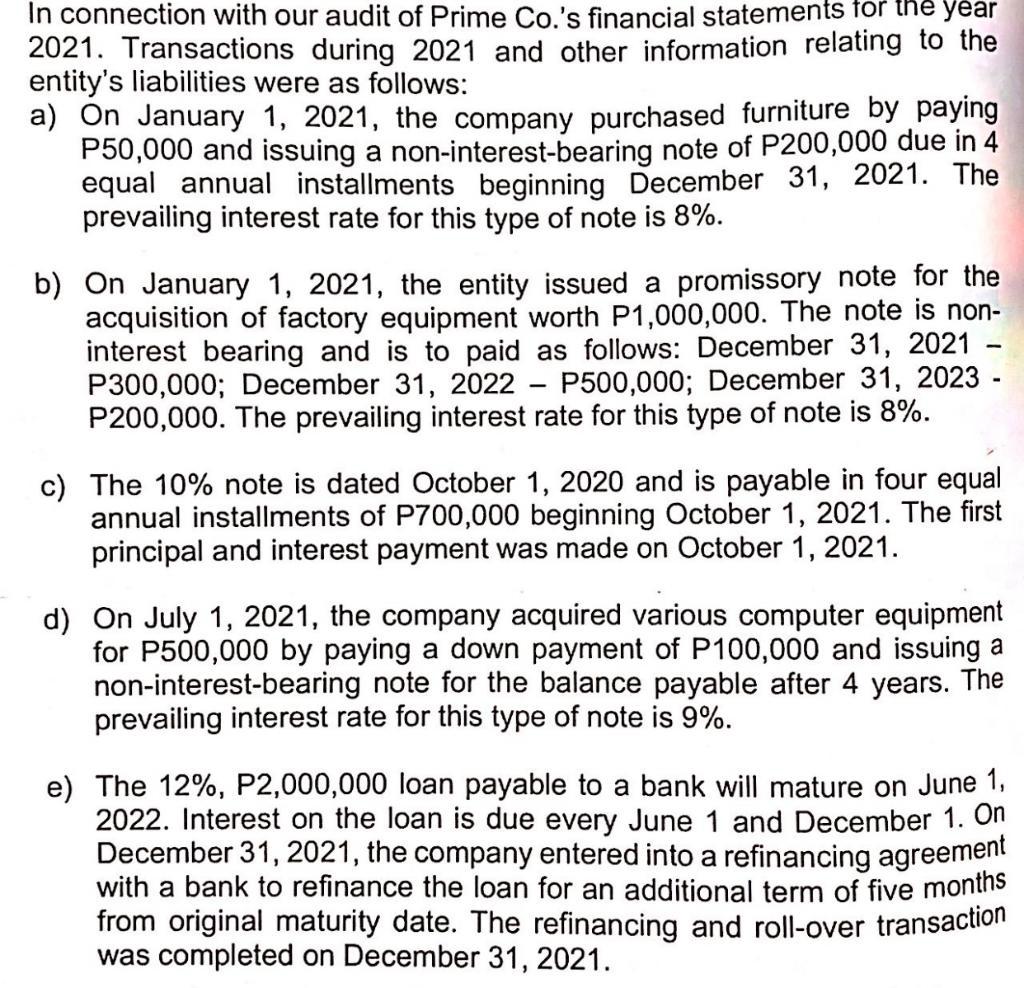

In connection with our audit of Prime Co.'s financial statements for the year 2021. Transactions during 2021 and other information relating to the entity's liabilities were as follows: a) On January 1, 2021, the company purchased furniture by paying P50,000 and issuing a non-interest-bearing note of P200,000 due in 4 equal annual installments beginning December 31, 2021. The prevailing interest rate for this type of note is 8%. b) On January 1, 2021, the entity issued a promissory note for the acquisition of factory equipment worth P1,000,000. The note is non- interest bearing and is to paid as follows: December 31, 2021 P300,000; December 31, 2022 P500,000; December 31, 2023 P200,000. The prevailing interest rate for this type of note is 8%. - - c) The 10% note is dated October 1, 2020 and is payable in four equal annual installments of P700,000 beginning October 1, 2021. The first principal and interest payment was made on October 1, 2021. d) On July 1, 2021, the company acquired various computer equipment for P500,000 by paying a down payment of P100,000 and issuing a non-interest-bearing note for the balance payable after 4 years. The prevailing interest rate for this type of note is 9%. e) The 12%, P2,000,000 loan payable to a bank will mature on June 1, 2022. Interest on the loan is due every June 1 and December 1. On December 31, 2021, the company entered into a refinancing agreement with a bank to refinance the loan for an additional term of five months from original maturity date. The refinancing and roll-over transaction was completed on December 31, 2021.

Step by Step Solution

★★★★★

3.51 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

1 The total interest expense in 2021 is P40000 This includes the interest expense on the furniture p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started