Answered step by step

Verified Expert Solution

Question

1 Approved Answer

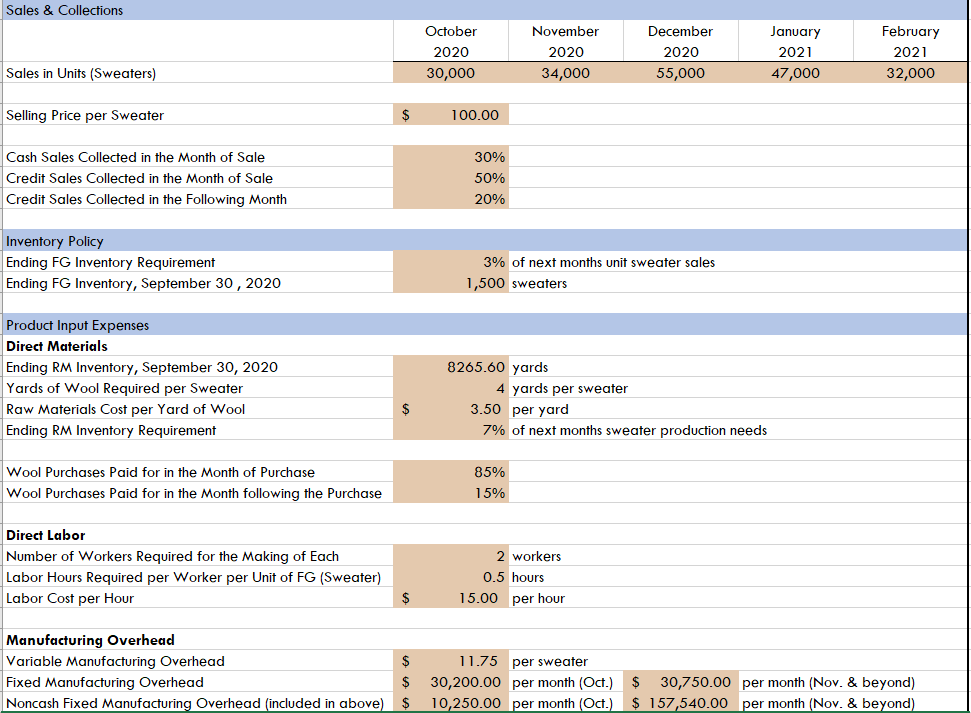

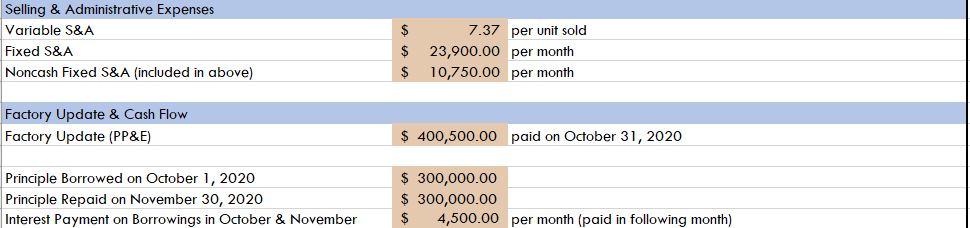

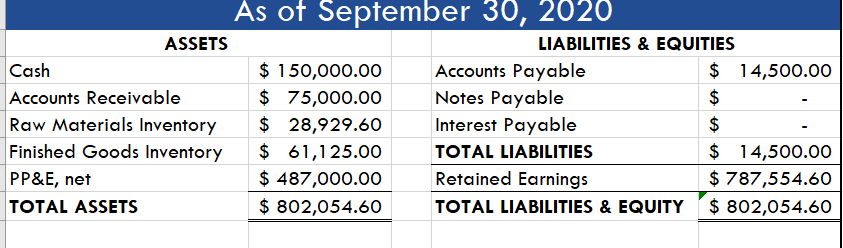

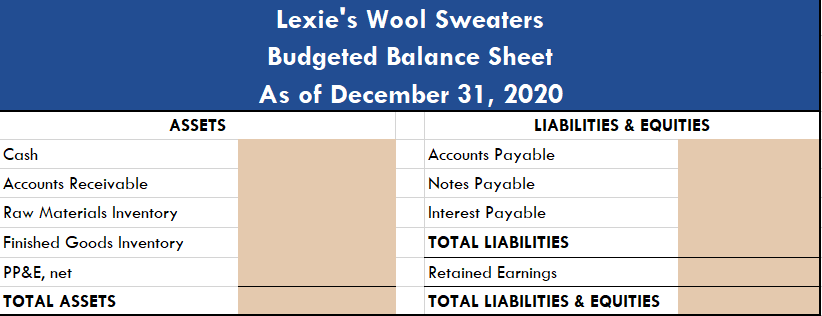

Determine the following balance sheet with the information provided **** NON CASH MANUFACTURING SHOULD BE $15,750 please show formulas used Sales & Collections October 2020

Determine the following balance sheet with the information provided

**** NON CASH MANUFACTURING SHOULD BE $15,750

please show formulas used

Sales & Collections October 2020 30,000 November 2020 34,000 December 2020 55,000 January 2021 47,000 February 2021 32,000 Sales in Units (Sweaters) Selling Price per Sweater $ 100.00 30% Cash Sales Collected in the Month of Sale Credit Sales Collected in the Month of Sale Credit Sales Collected in the following Month 50% 20% Inventory Policy Ending FG Inventory Requirement Ending FG Inventory, September 30, 2020 3% of next months unit sweater sales 1,500 sweaters Product Input Expenses Direct Materials Ending RM Inventory, September 30, 2020 Yards of Wool Required per Sweater Raw Materials Cost per Yard of Wool Ending RM Inventory Requirement 8265.60 yards 4 yards per sweater 3.50 per yard 7% of next months sweater production needs Wool Purchases Paid for in the Month of Purchase Wool Purchases Paid for in the Month following the Purchase 85% 15% Direct Labor Number of Workers Required for the Making of Each Labor Hours Required per Worker per Unit of FG (Sweater) Labor Cost per Hour 2 workers 0.5 hours 15.00 per hour Manufacturing Overhead Variable Manufacturing Overhead Fixed Manufacturing Overhead $ Noncash Fixed Manufacturing Overhead (included in above) $ 11.75 per sweater 30,200.00 per month (Oct.) $ 30,750.00 per month (Nov. & beyond) 10,250.00 per month (Oct.) $ 157,540.00 per month (Nov. & beyond) Selling & Administrative Expenses Variable S&A Fixed S&A Noncash Fixed S&A (included in above) $ $ $ 7.37 per unit sold 23,900.00 per month 10,750.00 per month Factory Update & Cash Flow Factory Update (PP&E) $ 400,500.00 paid on October 31, 2020 Principle Borrowed on October 1, 2020 Principle Repaid on November 30, 2020 Interest Payment on Borrowings in October & November $ 300,000.00 $ 300,000.00 $ 4,500.00 per month (paid in following month) As of September 30, 2020 ASSETS LIABILITIES & EQUITIES Cash $ 150,000.00 Accounts Payable $ 14,500.00 Accounts Receivable $ 75,000.00 Notes Payable Raw Materials Inventory $ 28,929.60 Interest Payable Finished Goods Inventory $ 61,125.00 TOTAL LIABILITIES $ 14,500.00 PP&E, net $ 487,000.00 Retained Earnings $ 787,554.60 TOTAL ASSETS $ 802,054.60 TOTAL LIABILITIES & EQUITY $ 802,054.60 Lexie's Wool Sweaters Budgeted Balance Sheet As of December 31, 2020 ASSETS Cash Accounts Receivable Raw Materials Inventory Finished Goods Inventory PP&E, net TOTAL ASSETS LIABILITIES & EQUITIES Accounts Payable Notes Payable Interest Payable TOTAL LIABILITIES Retained Earnings TOTAL LIABILITIES & EQUITIES Sales & Collections October 2020 30,000 November 2020 34,000 December 2020 55,000 January 2021 47,000 February 2021 32,000 Sales in Units (Sweaters) Selling Price per Sweater $ 100.00 30% Cash Sales Collected in the Month of Sale Credit Sales Collected in the Month of Sale Credit Sales Collected in the following Month 50% 20% Inventory Policy Ending FG Inventory Requirement Ending FG Inventory, September 30, 2020 3% of next months unit sweater sales 1,500 sweaters Product Input Expenses Direct Materials Ending RM Inventory, September 30, 2020 Yards of Wool Required per Sweater Raw Materials Cost per Yard of Wool Ending RM Inventory Requirement 8265.60 yards 4 yards per sweater 3.50 per yard 7% of next months sweater production needs Wool Purchases Paid for in the Month of Purchase Wool Purchases Paid for in the Month following the Purchase 85% 15% Direct Labor Number of Workers Required for the Making of Each Labor Hours Required per Worker per Unit of FG (Sweater) Labor Cost per Hour 2 workers 0.5 hours 15.00 per hour Manufacturing Overhead Variable Manufacturing Overhead Fixed Manufacturing Overhead $ Noncash Fixed Manufacturing Overhead (included in above) $ 11.75 per sweater 30,200.00 per month (Oct.) $ 30,750.00 per month (Nov. & beyond) 10,250.00 per month (Oct.) $ 157,540.00 per month (Nov. & beyond) Selling & Administrative Expenses Variable S&A Fixed S&A Noncash Fixed S&A (included in above) $ $ $ 7.37 per unit sold 23,900.00 per month 10,750.00 per month Factory Update & Cash Flow Factory Update (PP&E) $ 400,500.00 paid on October 31, 2020 Principle Borrowed on October 1, 2020 Principle Repaid on November 30, 2020 Interest Payment on Borrowings in October & November $ 300,000.00 $ 300,000.00 $ 4,500.00 per month (paid in following month) As of September 30, 2020 ASSETS LIABILITIES & EQUITIES Cash $ 150,000.00 Accounts Payable $ 14,500.00 Accounts Receivable $ 75,000.00 Notes Payable Raw Materials Inventory $ 28,929.60 Interest Payable Finished Goods Inventory $ 61,125.00 TOTAL LIABILITIES $ 14,500.00 PP&E, net $ 487,000.00 Retained Earnings $ 787,554.60 TOTAL ASSETS $ 802,054.60 TOTAL LIABILITIES & EQUITY $ 802,054.60 Lexie's Wool Sweaters Budgeted Balance Sheet As of December 31, 2020 ASSETS Cash Accounts Receivable Raw Materials Inventory Finished Goods Inventory PP&E, net TOTAL ASSETS LIABILITIES & EQUITIES Accounts Payable Notes Payable Interest Payable TOTAL LIABILITIES Retained Earnings TOTAL LIABILITIES & EQUITIESStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started