Question

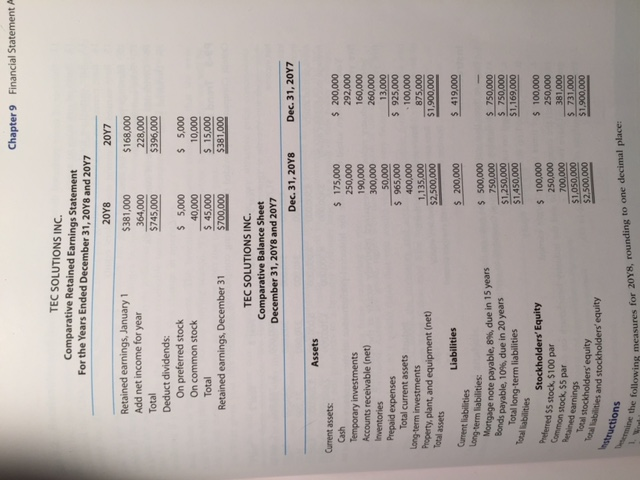

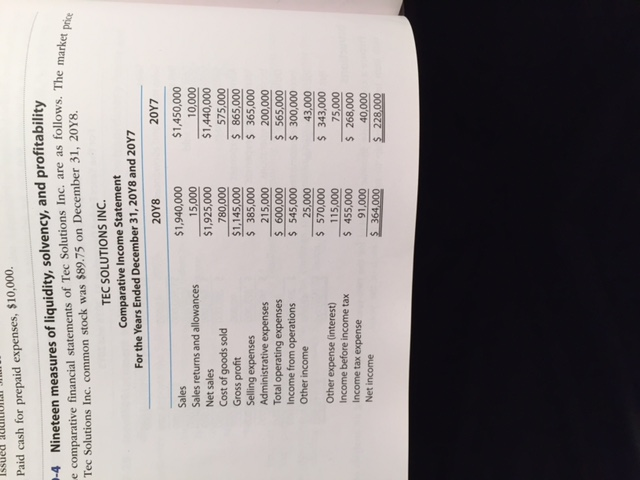

Determine the following measures for 20Y8, rounding to one decimal place: 1. Working capital 2. Current ratio 3. Quick ratio 4. Accounts receivable turnover 5.

Determine the following measures for 20Y8, rounding to one decimal place:

1. Working capital

2. Current ratio

3. Quick ratio

4. Accounts receivable turnover

5. Number of days sales in receivables

6. Inventory turnover

7. Number of days sales in inventory

8. Ratio of fixed assets to long-term liabilities

9. Ratio of liabilities to stockholders equity

10. Number of times interest charges earned

11. Number of times preferred dividends earned

12. Ratio of net sales to assets

13. Rate earned on total assets

14. Rate earned on stockholders equity

15. Rate earned on common stockholders equity

16. Earnings per share on common stock

17. Price-earnings ratio

18. Dividends per share of common stock

19. Dividend yield

| 1. | Working capital: | - | = | |||||

| Calculated | ||||||||

| Ratio | Numerator | Denominator | Value | |||||

| 2. | Current ratio | = | ||||||

| 3. | Quick ratio | = | ||||||

| 4. | Accounts receivable turnover | = | ||||||

| 5. | Number of days' sales in receivables | = | ||||||

| 6. | Inventory turnover | = | ||||||

| 7. | Number of days' sales in inventory | = | ||||||

| 8. | Ratio of fixed assets to long-term liabilities | = | ||||||

| 9. | Ratio of liabilities to stockholders' equity | = | ||||||

| 10. | Number of times interest charges earned | = | ||||||

| 11. | Number of times preferred dividends earned | = | ||||||

| 12. | Ratio of net sales to assets | = | ||||||

| 13. | Rate earned on total assets | = | ||||||

| 14. | Rate earned on stockholders' equity | = | ||||||

| 15. | Rate earned on common stockholders' equity | = | ||||||

| 16. | Earnings per share on common stock | = | ||||||

| 17. | Price-earnings ratio | = | ||||||

| 18. | Dividends per share of common stock | = | ||||||

| 19. | Dividend yield | = | ||||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started