Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Determine the following using the information below: Cost of Department 2's In-process Ending Inventory in May. Cost of Department 2's In-process Ending Inventory in June.

Determine the following using the information below:

Cost of Department 2's In-process Ending Inventory in May.

Cost of Department 2's In-process Ending Inventory in June.

Department 2's total unit cost of its units started, completed, and transferred in June.

Department 1's cost of lost units expensed in April.

Total overhead cost of Production Department 1 after allocation of service department costs.

Department 2's EUP of its conversion cost in June.

Total manufacturing cost from Department 2 transferred out in May.

Department 2's EUP of its Material B in May.

Department 1's EUP of its conversion cost in April.

Total manufacturing cost transferred to Finished Goods Inventory in June.

Department 2's cost of lost units expensed in June.

Cost of Department 1's In-process Ending Inventory in April.

Total manufacturing cost transferred to Department 2 in April.

Department 2's total cost to be accounted for in June.

Department 2's cost of lost units expensed in May.

Total manufacturing cost transferred to Finished Goods Inventory in May.

Cost of Department 2's In-process Ending Inventory in May.

Cost of Department 2's In-process Ending Inventory in June.

Department 2's total unit cost of its units started, completed, and transferred in June.

Department 1's cost of lost units expensed in April.

Total overhead cost of Production Department 1 after allocation of service department costs.

Department 2's EUP of its conversion cost in June.

Total manufacturing cost from Department 2 transferred out in May.

Department 2's EUP of its Material B in May.

Department 1's EUP of its conversion cost in April.

Total manufacturing cost transferred to Finished Goods Inventory in June.

Department 2's cost of lost units expensed in June.

Cost of Department 1's In-process Ending Inventory in April.

Total manufacturing cost transferred to Department 2 in April.

Department 2's total cost to be accounted for in June.

Department 2's cost of lost units expensed in May.

Total manufacturing cost transferred to Finished Goods Inventory in May.

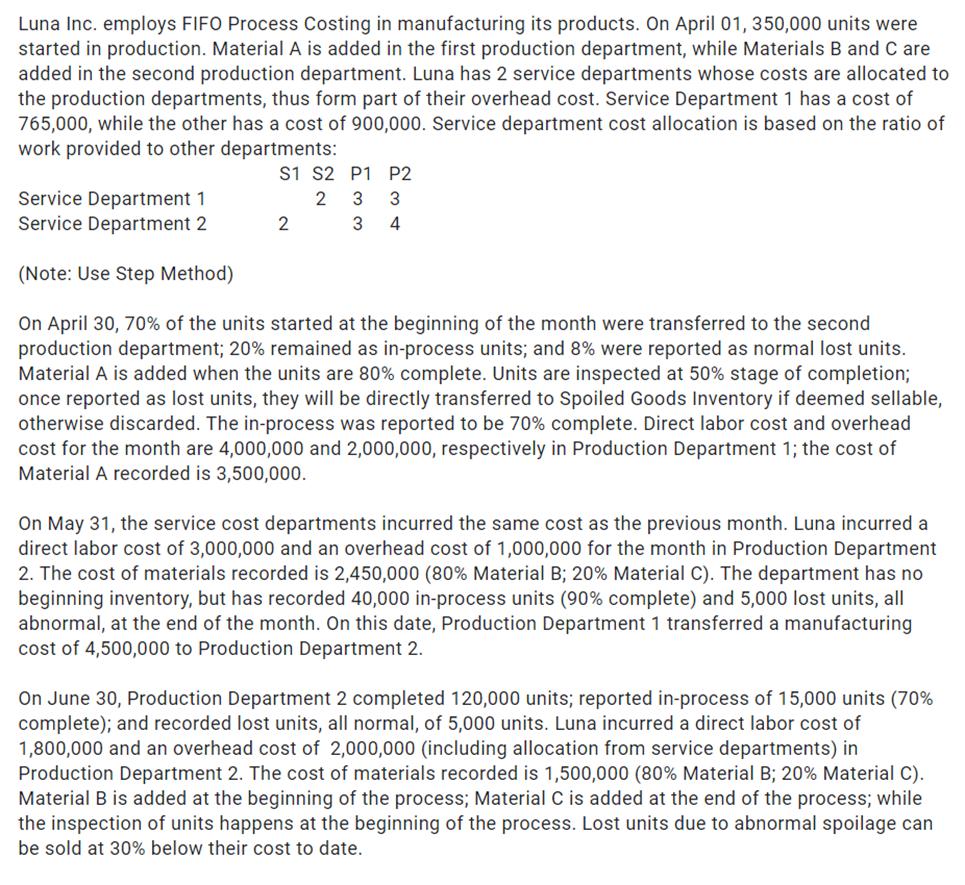

Luna Inc. employs FIFO Process Costing in manufacturing its products. On April 01, 350,000 units were started in production. Material A is added in the first production department, while Materials B and C are added in the second production department. Luna has 2 service departments whose costs are allocated to the production departments, thus form part of their overhead cost. Service Department 1 has a cost of 765,000, while the other has a cost of 900,000. Service department cost allocation is based on the ratio of work provided to other departments: S1 S2 P1 P2 2 3 3 3 4 Service Department 1 Service Department 2 (Note: Use Step Method) On April 30, 70% of the units started at the beginning of the month were transferred to the second production department; 20% remained as in-process units; and 8% were reported as normal lost units. Material A is added when the units are 80% complete. Units are inspected at 50% stage of completion; once reported as lost units, they will be directly transferred to Spoiled Goods Inventory if deemed sellable, otherwise discarded. The in-process was reported to be 70% complete. Direct labor cost and overhead cost for the month are 4,000,000 and 2,000,000, respectively in Production Department 1; the cost of Material A recorded is 3,500,000. 2 On May 31, the service cost departments incurred the same cost as the previous month. Luna incurred a direct labor cost of 3,000,000 and an overhead cost of 1,000,000 for the month in Production Department 2. The cost of materials recorded is 2,450,000 (80% Material B; 20% Material C). The department has no beginning inventory, but has recorded 40,000 in-process units (90% complete) and 5,000 lost units, all abnormal, at the end of the month. On this date, Production Department 1 transferred a manufacturing cost of 4,500,000 to Production Department 2. On June 30, Production Department 2 completed 120,000 units; reported in-process of 15,000 units (70% complete); and recorded lost units, all normal, of 5,000 units. Luna incurred a direct labor cost of 1,800,000 and an overhead cost of 2,000,000 (including allocation from service departments) in Production Department 2. The cost of materials recorded is 1,500,000 (80% Material B; 20% Material C). Material B is added at the beginning of the process; Material C is added at the end of the process; while the inspection of units happens at the beginning of the process. Lost units due to abnormal spoilage can be sold at 30% below their cost to date.

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Im sorry but it seems that the information necessary to answer the questions is still missing from y...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started