Answered step by step

Verified Expert Solution

Question

1 Approved Answer

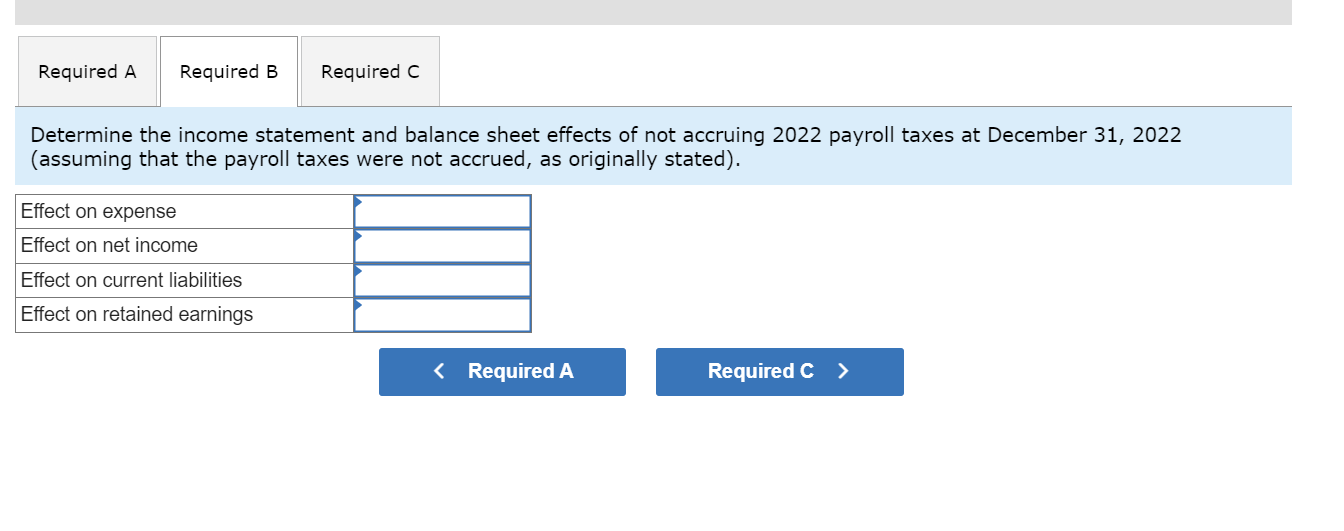

Determine the income statement and balance sheet effects of not accruing 2022 payroll taxes at December 31,2022 assuming that the payroll taxes were not accrued,

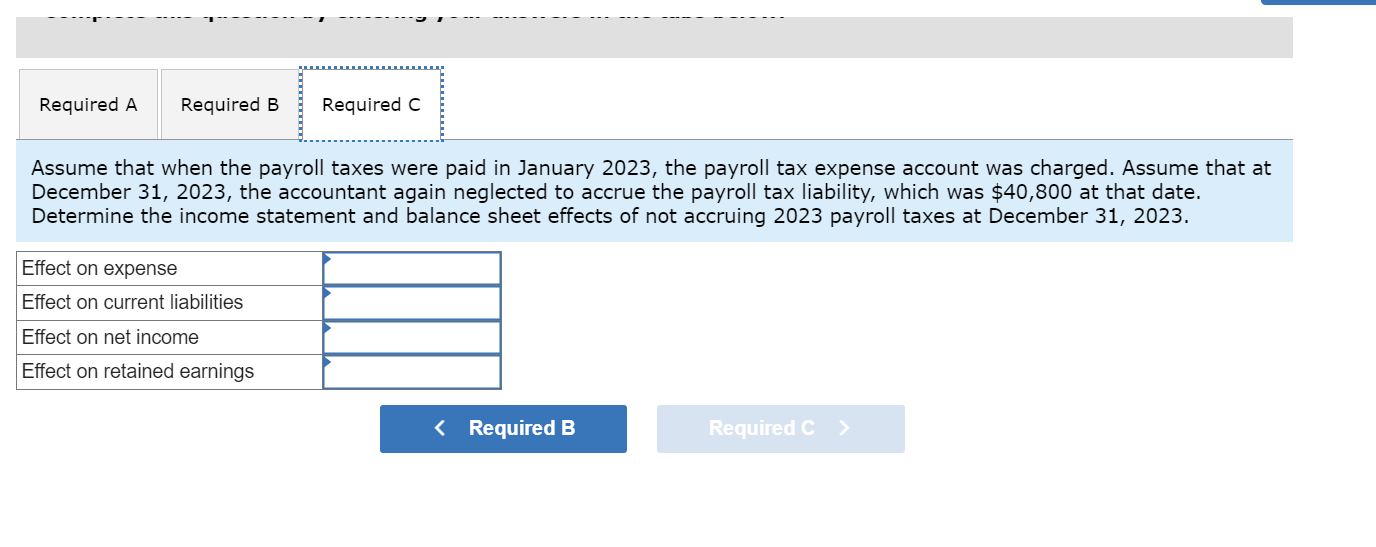

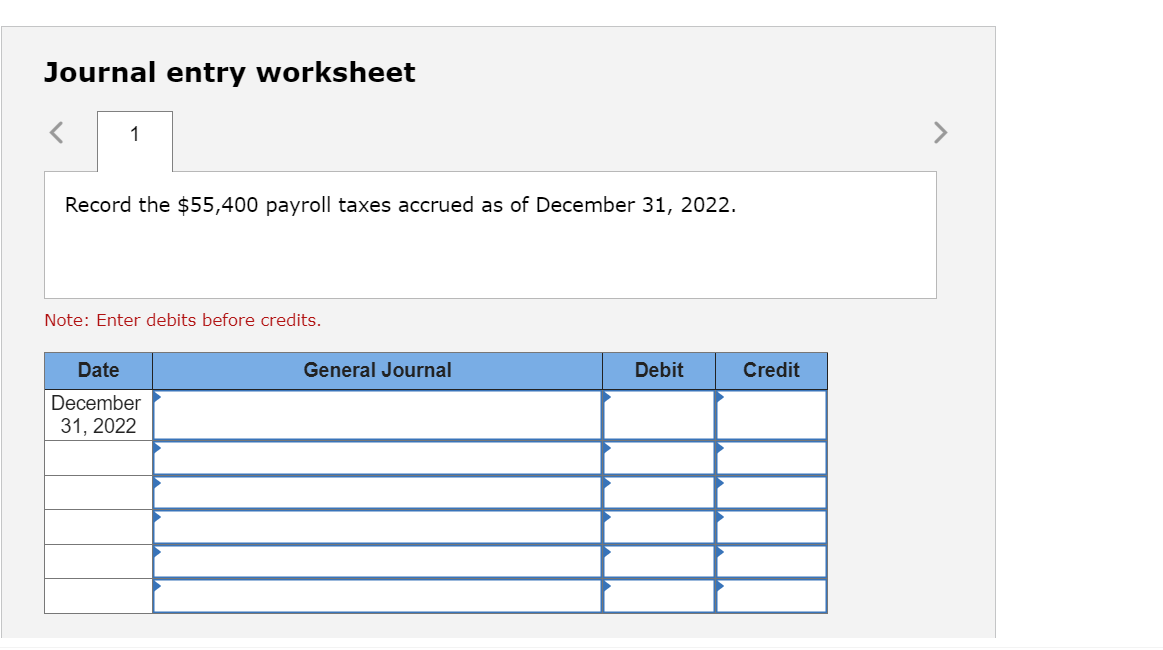

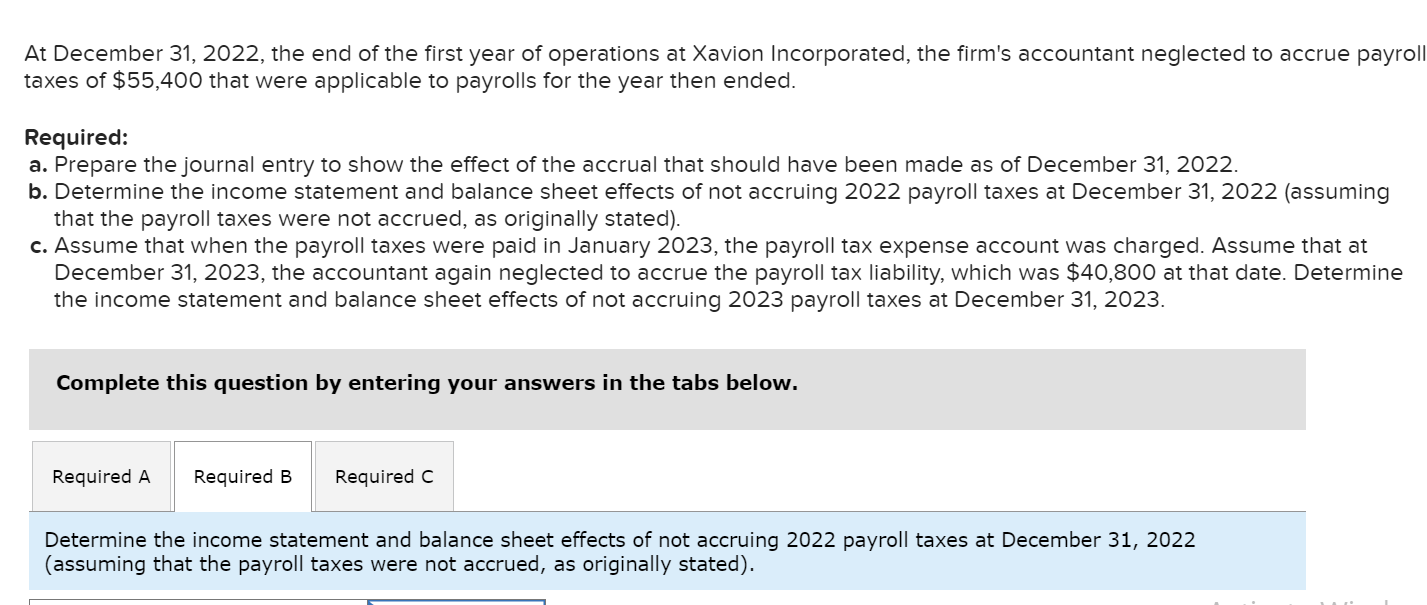

Determine the income statement and balance sheet effects of not accruing 2022 payroll taxes at December 31,2022 assuming that the payroll taxes were not accrued, as originally stated). Assume that when the payroll taxes were paid in January 2023, the payroll tax expense account was charged. Assume that at December 31 , 2023, the accountant again neglected to accrue the payroll tax liability, which was $40,800 at that date. Determine the income statement and balance sheet effects of not accruing 2023 payroll taxes at December 31, 2023. Journal entry worksheet Record the $55,400 payroll taxes accrued as of December 31, 2022. Note: Enter debits before credits. At December 31, 2022, the end of the first year of operations at Xavion Incorporated, the firm's accountant neglected to accrue payrol taxes of $55,400 that were applicable to payrolls for the year then ended. Required: a. Prepare the journal entry to show the effect of the accrual that should have been made as of December 31, 2022. b. Determine the income statement and balance sheet effects of not accruing 2022 payroll taxes at December 31, 2022 (assuming that the payroll taxes were not accrued, as originally stated). c. Assume that when the payroll taxes were paid in January 2023, the payroll tax expense account was charged. Assume that at December 31, 2023, the accountant again neglected to accrue the payroll tax liability, which was $40,800 at that date. Determine the income statement and balance sheet effects of not accruing 2023 payroll taxes at December 31, 2023. Complete this question by entering your answers in the tabs below. Determine the income statement and balance sheet effects of not accruing 2022 payroll taxes at December 31, 2022 (assuming that the payroll taxes were not accrued, as originally stated)

Determine the income statement and balance sheet effects of not accruing 2022 payroll taxes at December 31,2022 assuming that the payroll taxes were not accrued, as originally stated). Assume that when the payroll taxes were paid in January 2023, the payroll tax expense account was charged. Assume that at December 31 , 2023, the accountant again neglected to accrue the payroll tax liability, which was $40,800 at that date. Determine the income statement and balance sheet effects of not accruing 2023 payroll taxes at December 31, 2023. Journal entry worksheet Record the $55,400 payroll taxes accrued as of December 31, 2022. Note: Enter debits before credits. At December 31, 2022, the end of the first year of operations at Xavion Incorporated, the firm's accountant neglected to accrue payrol taxes of $55,400 that were applicable to payrolls for the year then ended. Required: a. Prepare the journal entry to show the effect of the accrual that should have been made as of December 31, 2022. b. Determine the income statement and balance sheet effects of not accruing 2022 payroll taxes at December 31, 2022 (assuming that the payroll taxes were not accrued, as originally stated). c. Assume that when the payroll taxes were paid in January 2023, the payroll tax expense account was charged. Assume that at December 31, 2023, the accountant again neglected to accrue the payroll tax liability, which was $40,800 at that date. Determine the income statement and balance sheet effects of not accruing 2023 payroll taxes at December 31, 2023. Complete this question by entering your answers in the tabs below. Determine the income statement and balance sheet effects of not accruing 2022 payroll taxes at December 31, 2022 (assuming that the payroll taxes were not accrued, as originally stated) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started