Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Determine the initial cash needs to start the business. 2. Once uMunch starts operating, determine the expenses that will be fixed costs and variable

1. Determine the initial cash needs to start the business.

2. Once uMunch starts operating, determine the expenses that will be fixed costs and

variable costs.

3. Project uMunch’s sales on a monthly basis for 2019, 2020 and 2021.

4. Prepare a monthly cash budget for 2019, 2020, and 2021. Hint: If u Munch ends any month with a negative cash balance, then use the line of credit and factor in the resulting interest expense.

5. Prepare 2019, 2020, and 2021, Income statements and balance sheets.

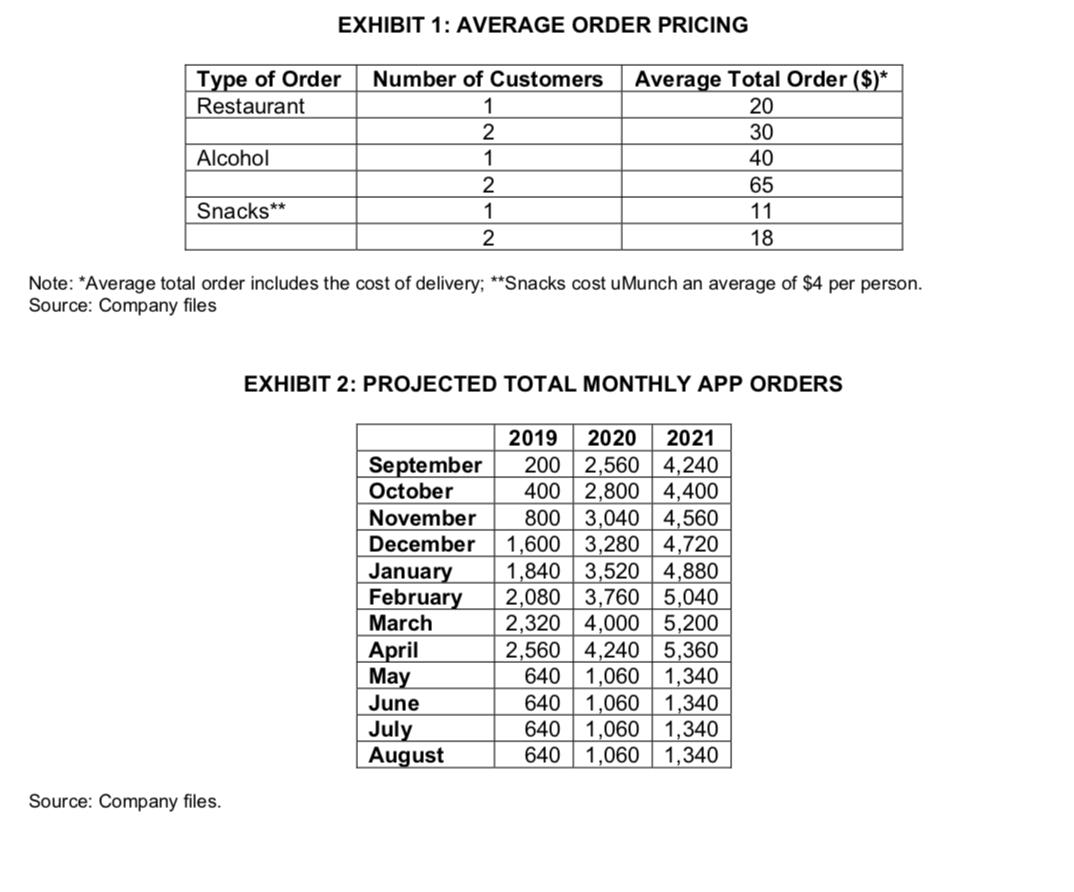

locally owned, student-oriented restaurants first, believing that these restaurants were more likely than chain restaurants to try something new. PROJECTIONS Sales After surveying the student body, Rezvani and Rajah determined early on that it was most likely that students would order either by themselves or with only one other individual. Of the total projected orders, it was estimated that 50 per cent would be attributed to restaurant sales, 10 per cent to alcohol, and 40 per cent to snacks. In each of these categories, half of the orders would be for one person and the other half would be for two (see Exhibit 1). Due to the re-order nature of the app and the expectations for growth, the pair understood that during the first three years of operations, sales would likely vary considerably from month to month. After speaking with several small-business owners in the area regarding their early sales and researching the experiences of other app-based delivery services, they concluded that they would likely experience more growth during the months when students were in school compared to the summer months (see Exhibit 2). All transactions were paid by credit card. In order to process these transactions, uMunch contracted Stripe, a third-party credit-card processing company. All consumer payments would be managed by Stripe, which would then deposit the funds directly to uMunch on a semi-monthly basis. All restaurants featured on the app would be paid directly by Stripe on the same day as uMunch. Stripe charged 30 cents per credit card used in each transaction plus 2.9 per cent of every sale. All transaction fees would be covered by uMunch in full. The app's semi-monthly inflows would be net of these transaction fees. To complete these deliveries, another third-party company, Debb Delivery (Debb), would be contracted. In order to allow for the legal delivery of alcohol, Debb's drivers would be Smart Serve Certified. When a delivery driver picked up a restaurant order, the driver would be paid immediately for the delivery charge by the restaurant. Restaurant delivery fees of $6 were included in the total transaction paid by the customer. The delivery fee and 75 per cent of the food order would be paid directly to the restaurant through Stripe. When the delivery driver delivered an alcohol or snack order, the driver would first need to travel to the LCBO or partner convenience store and purchase the item(s) with his own money. Since the delivery driver would not have to wait for food to be prepared in these instances, the delivery fee was lower, at $5 per delivery. Both the delivery fee and the cost of the alcohol and/or snacks would be paid to Debb on the first of the following month. Debb would then distribute the funds accordingly to the delivery drivers. Advertising Marketing would play a critical role in the growth of uMunch. Over the course of the first three years of operations, the founders intended to advertise using Facebook and Instagram, and by distributing information about the app on postcards through a direct-mail campaign. In year one, $3,000 was budgeted toward marketing. Of the total advertising budget, Facebook and Instagram would represent 90 per cent, and postcards would represent the remaining 10 per cent. In years two and three, the budget would increase to $6,000 and $9,000, respectively. Advertising expenses were expected to be incurred evenly between the months of August and March each year, and would be paid in the same month.

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Cash is a required element in starting a business and a lack of it can be fatal The first step to determining the cash needs is to look at the current situation of the company This will help determine ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started