Answered step by step

Verified Expert Solution

Question

1 Approved Answer

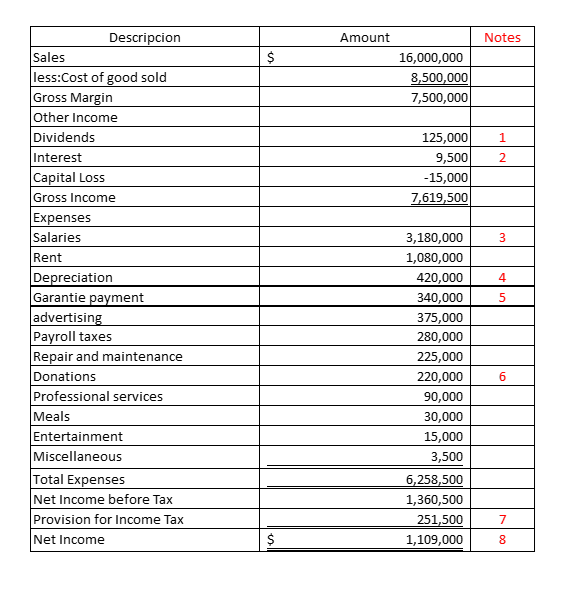

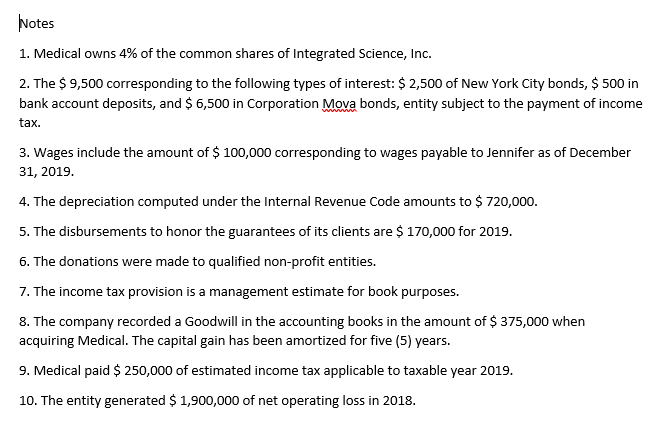

Determine the net income (loss) before the deduction for (a) donations, (b) net operating loss and (c) dividends received for medical expenses as of December

Determine the net income (loss) before the deduction for

(a) donations,

(b) net operating loss and

(c) dividends received for medical expenses as of December 31, 2019, using the table to reconcile the elements presented in the statement account income and expenses (accounting income) and its conversion to taxable base (tax numbers).

Amount Notes 16,000,000 8,500,000 7,500,000 125,000 9,500 - 15,000 7,619,500 Descripcion Sales less:Cost of good sold Gross Margin Other Income Dividends Interest Capital Loss Gross Income Expenses Salaries Rent Depreciation Garantie payment advertising Payroll taxes Repair and maintenance Donations Professional services Meals Entertainment Miscellaneous Total Expenses Net Income before Tax Provision for Income Tax Net Income 3,180,000 1,080,000 420,000 340,000 375,000 280,000 225,000 220,000 90,000 30,000 15,000 3,500 6,258,500 1,360,500 251,500 1,109,000 Notes 1. Medical owns 4% of the common shares of Integrated Science, Inc. 2. The $ 9,500 corresponding to the following types of interest: $ 2,500 of New York City bonds, $ 500 in bank account deposits, and $ 6,500 in Corporation Mova bonds, entity subject to the payment of income tax. 3. Wages include the amount of $ 100,000 corresponding to wages payable to Jennifer as of December 31, 2019. 4. The depreciation computed under the Internal Revenue Code amounts to $ 720,000. 5. The disbursements to honor the guarantees of its clients are $ 170,000 for 2019. 6. The donations were made to qualified non-profit entities. 7. The income tax provision is a management estimate for book purposes. 8. The company recorded a Goodwill in the accounting books in the amount of $375,000 when acquiring Medical. The capital gain has been amortized for five (5) years. 9. Medical paid $ 250,000 of estimated income tax applicable to taxable year 2019. 10. The entity generated $ 1,900,000 of net operating loss in 2018. Amount Notes 16,000,000 8,500,000 7,500,000 125,000 9,500 - 15,000 7,619,500 Descripcion Sales less:Cost of good sold Gross Margin Other Income Dividends Interest Capital Loss Gross Income Expenses Salaries Rent Depreciation Garantie payment advertising Payroll taxes Repair and maintenance Donations Professional services Meals Entertainment Miscellaneous Total Expenses Net Income before Tax Provision for Income Tax Net Income 3,180,000 1,080,000 420,000 340,000 375,000 280,000 225,000 220,000 90,000 30,000 15,000 3,500 6,258,500 1,360,500 251,500 1,109,000 Notes 1. Medical owns 4% of the common shares of Integrated Science, Inc. 2. The $ 9,500 corresponding to the following types of interest: $ 2,500 of New York City bonds, $ 500 in bank account deposits, and $ 6,500 in Corporation Mova bonds, entity subject to the payment of income tax. 3. Wages include the amount of $ 100,000 corresponding to wages payable to Jennifer as of December 31, 2019. 4. The depreciation computed under the Internal Revenue Code amounts to $ 720,000. 5. The disbursements to honor the guarantees of its clients are $ 170,000 for 2019. 6. The donations were made to qualified non-profit entities. 7. The income tax provision is a management estimate for book purposes. 8. The company recorded a Goodwill in the accounting books in the amount of $375,000 when acquiring Medical. The capital gain has been amortized for five (5) years. 9. Medical paid $ 250,000 of estimated income tax applicable to taxable year 2019. 10. The entity generated $ 1,900,000 of net operating loss in 2018Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started