Answered step by step

Verified Expert Solution

Question

1 Approved Answer

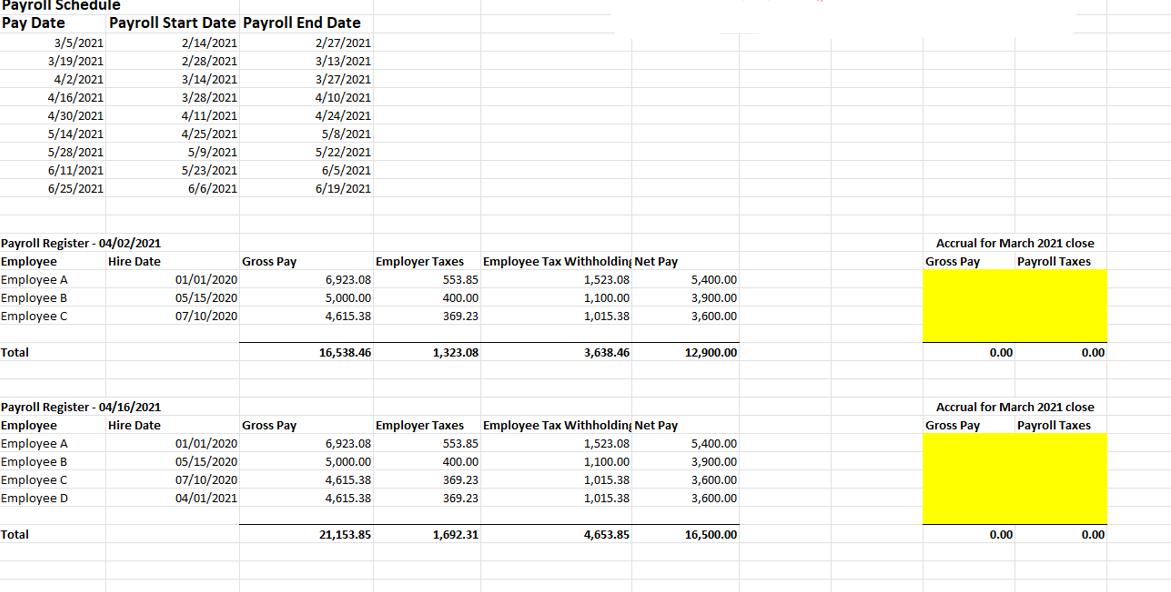

Determine the payroll accrual Amounts for closing March 2021. Prepare payroll accrual JE(s) to close March 2021. Payroll Schedule Pay Date 3/5/2021 3/19/2021 4/2/2021 Total

Determine the payroll accrual Amounts for closing March 2021.

Prepare payroll accrual JE(s) to close March 2021.

Payroll Schedule Pay Date 3/5/2021 3/19/2021 4/2/2021 Total 4/16/2021 4/30/2021 5/14/2021 5/28/2021 6/11/2021 6/25/2021 Payroll Register - 04/02/2021 Hire Date Employee Employee A Employee B Employee C Total Payroll Start Date Payroll End Date 2/27/2021 3/13/2021 3/27/2021 4/10/2021 4/24/2021 5/8/2021 5/22/2021 6/5/2021 6/19/2021 Payroll Register - 04/16/2021 Employee Hire Date Employee A Employee B Employee C Employee D 2/14/2021 2/28/2021 3/14/2021 3/28/2021 4/11/2021 4/25/2021 5/9/2021 5/23/2021 6/6/2021 01/01/2020 05/15/2020 07/10/2020 01/01/2020 05/15/2020 07/10/2020 04/01/2021 Gross Pay Gross Pay 6,923.08 5,000.00 4,615.38 16,538.46 6,923.08 5,000.00 4,615.38 4,615.38 21,153.85 Employer Taxes 553.85 400.00 369.23 1,323.08 553.85 400.00 369.23 369.23 Employee Tax Withholding Net Pay 1,523.08 1,100.00 1,015.38 Employer Taxes Employee Tax Withholding Net Pay 1,523.08 1,100.00 1,015.38 1,015.38 1,692.31 3,638.46 4,653.85 5,400.00 3,900.00 3,600.00 12,900.00 5,400.00 3,900.00 3,600.00 3,600.00 16,500.00 Accrual for March 2021 close Payroll Taxes Gross Pay 0.00 0.00 Accrual for March 2021 close Payroll Taxes. Gross Pay 0.00 0.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the payroll accrual amounts for closing March 2021 we need to look at the number of days in March that are covered by each payroll and have not yet been paid as of the end of March We nee...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started