Answered step by step

Verified Expert Solution

Question

1 Approved Answer

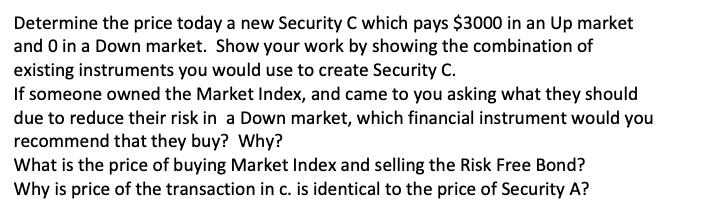

Determine the price today a new Security C which pays $3000 in an Up market and 0 in a Down market. Show your work

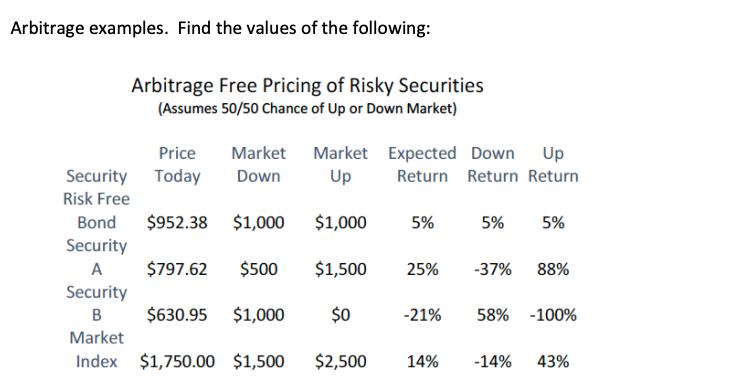

Determine the price today a new Security C which pays $3000 in an Up market and 0 in a Down market. Show your work by showing the combination of existing instruments you would use to create Security C. If someone owned the Market Index, and came to you asking what they should due to reduce their risk in a Down market, which financial instrument would you recommend that they buy? Why? What is the price of buying Market Index and selling the Risk Free Bond? Why is price of the transaction in c. is identical to the price of Security A? Arbitrage examples. Find the values of the following: Arbitrage Free Pricing of Risky Securities (Assumes 50/50 Chance of Up or Down Market) Price Today $952.38 $1,000 $797.62 $500 Security B $630.95 $1,000 Market Index $1,750.00 $1,500 $2,500 Market Market Down Up $1,000 Security Risk Free Bond Security A Expected Down Up Return Return Return 5% 5% $1,500 25% -37% $0 5% 88% -21% 58% -100% 14% -14% 43%

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To determine the price of Security C which pays 3000 in an Up market and 0 in a Down market we need to create a portfolio that replicates this payoff ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started