Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Madison Corporation is authorized to issue $760,000 of 6-year bonds dated June 30, 2019, with a stated rate of interest of 11%. Interest on the

Madison Corporation is authorized to issue $760,000 of 6-year bonds dated June 30, 2019, with a stated rate of interest of 11%. Interest on the bonds is payable semiannually, and the bonds are sold on June 30, 2019.

Required:

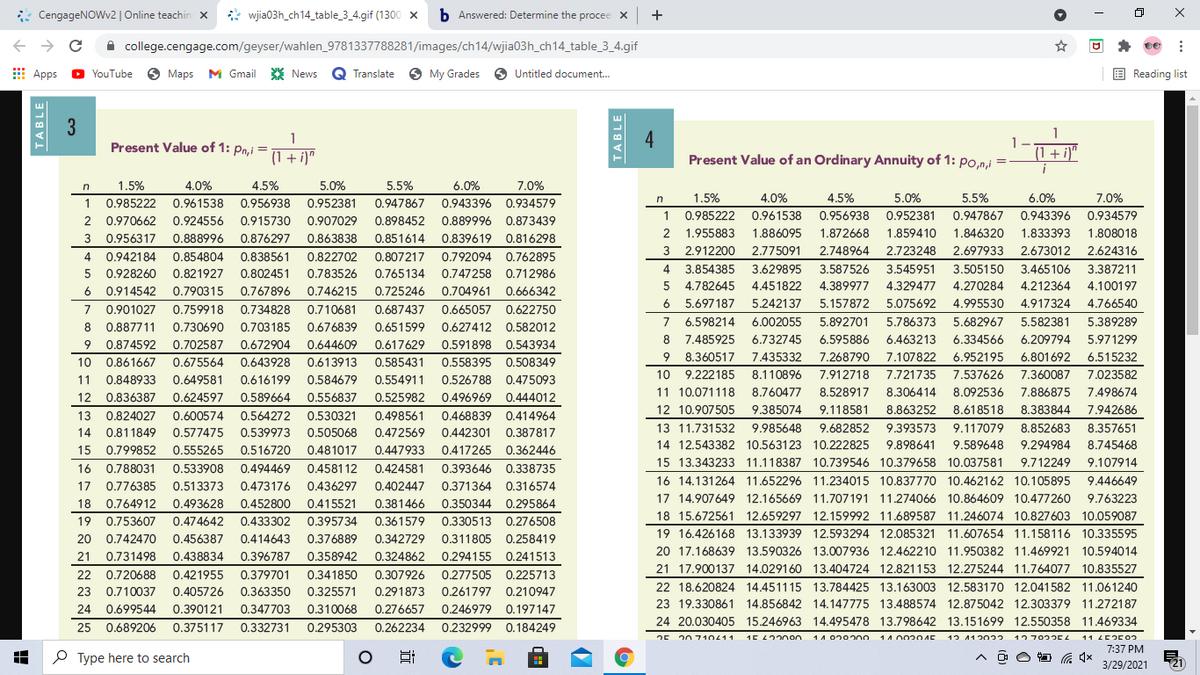

Determine the proceeds that the company will receive if it sells the following: (Click here to access the tables to use with this exercise and round your answers to two decimal places, if necessary.)

| 1. The bonds to yield 12% | $fill in the blank 1 |

| 2. The bonds to yield 10% | $fill in the blank 2 |

* CengageNOWv2 | Online teachir * wjia03h_ch 14_table_3_4.gif (1300 X b Answered: Determine the procee X i college.cengage.com/geyser/wahlen_9781337788281/images/ch14/wjia03h_ch14_table_3_4.gif E Apps YouTube O Maps M Gmail * News Q Translate 9 My Grades 9 Untitled document. E Reading list 1 1 Present Value of 1: Po.j = 4 Present Value of an Ordinary Annuity of 1: po,n,i 1 (1+ i)" (1+ i)" %3D 1.5% 4.0% 4.5% 5.0% 5.5% 6.0% 7.0% 1.5% 4.0% 4.5% 5.0% 5.5% 6.0% 7.0% 1 0.985222 0.961538 0.956938 0.952381 0.947867 0.943396 0.934579 1 0.985222 0.961538 0.956938 0.952381 0.947867 0.943396 0.934579 2 0.970662 0.924556 0.915730 0.907029 0.898452 0.889996 0.873439 2 1.955883 1.886095 1.872668 1.859410 1.846320 1.833393 1.808018 3 0.956317 0.888996 0.876297 0.863838 0.851614 0.839619 0.816298 3 2.912200 2.775091 2.748964 2.723248 2.697933 2.673012 2.624316 4 0.942184 0.854804 0.838561 0.822702 0.807217 0.792094 0.762895 4 3.854385 3.629895 3.587526 3.545951 3.505150 3.465106 3.387211 0.712986 0.666342 0.928260 0.821927 0.802451 0.783526 0.765134 0.747258 5 4.782645 4.451822 4.389977 4.329477 4.270284 4.212364 4.100197 6 0.914542 7 0.901027 6. 0.790315 0.767896 0.746215 0.725246 0.704961 5.697187 5.242137 5.157872 5.075692 4.995530 4.917324 4.766540 7 0.759918 0.734828 0.710681 0.687437 0.665057 0.622750 0.730690 7 6.598214 6.002055 5.892701 5.786373 5.682967 5.582381 5.389289 8 0.887711 0.703185 0.676839 0.651599 0.627412 0.582012 8 7.485925 6.732745 6.595886 6.463213 6.334566 6.209794 5.971299 9 0.874592 10 0.861667 0.702587 0.672904 0.644609 0.617629 0.591898 0.543934 9 9 8.360517 7.435332 7.268790 7.107822 6.952195 6.801692 6.515232 0.675564 0.643928 0.613913 0.585431 0.558395 0.508349 0.848933 0.584679 0.526788 0.475093 10 9.222185 8.110896 7.912718 7.721735 7.537626 7.360087 7.023582 11 0.649581 0.616199 0.554911 11 10.071118 8.760477 8.528917 8.306414 8.092536 7.886875 7.498674 12 0.836387 0.624597 0.589664 0.556837 0.525982 0.496969 0.444012 13 0.824027 0.600574 0.564272 0.530321 0.498561 0.468839 0.414964 12 10.907505 9.385074 9.118581 8.863252 8.618518 8.383844 7.942686 9.117079 9.589648 8.852683 9.294984 8.745468 13 11.731532 .985648 9.682852 9.393573 8.357651 14 0.811849 0.577475 0.539973 0.505068 0.472569 0.442301 0.387817 14 12.543382 10.563123 10.222825 9.898641 15 0.799852 0.555265 0.516720 0.481017 0.447933 0.417265 0.362446 15 13.343233 11.118387 10.739546 10.379658 10.037581 9.712249 9.107914 16 0.788031 0.533908 0.494469 0.458112 0.424581 0.393646 0.338735 16 14.131264 11.652296 11.234015 10.837770 10.462162 10.105895 9.446649 17 0.776385 0.513373 0.473176 0.436297 0.402447 0.371364 0.316574 17 14.907649 12.165669 11.707191 11.274066 10.864609 10.477260 9.763223 18 0.764912 0.493628 0.452800 0.415521 0.381466 0.350344 0.295864 18 15.672561 12.659297 12.159992 11.689587 11.246074 10.827603 10.059087 19 0.753607 0.474642 0.433302 0.395734 0.361579 0.330513 0.276508 19 16.426168 13.133939 12.593294 12.085321 11.607654 11.158116 10.335595 20 0.742470 0.456387 0.414643 0.376889 0.342729 0.311805 0.258419 20 17.168639 13.590326 13.007936 12.462210 11.950382 11.469921 10.594014 21 0.731498 0.438834 0.396787 0.358942 0.324862 0.294155 0.241513 21 17.900137 14.029160 13.404724 12.821153 12.275244 11.764077 10.835527 22 0.720688 0.421955 0.379701 0.341850 0.307926 0.277505 0.225713 23 0.710037 0.405726 0.363350 0.325571 0.291873 0.261797 0.210947 22 18.620824 14.451115 13.784425 13.163003 12.583170 12.041582 11.06124O 23 19.330861 14.856842 14.147775 13.488574 12.875042 12.303379 11.272187 24 0.699544 0.390121 0.347703 0.310068 0.276657 0.246979 0.197147 24 20.030405 15.246963 14.495478 13.798642 13.151699 12.550358 11.469334 25 0.689206 0.375117 0.332731 0.295303 0.262234 0.232999 0.184249 2E 20710411 14.929200 14002045 12 412022 11 LEOE o 14.002O45 127022EL 7:37 PM P Type here to search 3/29/2021 21

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 The bonds to yield 12 a Semiannual Interest Amount 4620000 840000112 b PV Annuity Fa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started